Equipe Publication

AGOA : la RDC reste éligible, ses exportations explosent à près de 2 milliards $ en 2025

Les États-Unis ont acté la reconduction de l’African Growth and Opportunity Act (AGOA). Selon un communiqué du Bureau du représentant américain au commerce (USTR), le président Donald Trump a promulgué, le 3 février dernier, une loi prolongeant le programme jusqu’au 31 décembre 2026, avec effet rétroactif à partir du 30 septembre 2025, date d’expiration du précédent cycle. Cette reconduction assure la continuité des échanges préférentiels entre les pays africains éligibles, dont la République démocratique du Congo (RDC), et le marché américain.

Cette reconduction intervient alors que les exportations congolaises vers les États-Unis ont explosé en 2025. Entre janvier et juillet, elles ont atteint 1,3 milliard de dollars, dépassant le total cumulé des huit années précédentes. Plus d’un milliard de dollars de marchandises ont été expédiés entre avril et juillet, avec un pic mensuel de près de 400 millions de dollars en juin.

Mais cette dynamique a commencé à ralentir dès septembre. Ce mois-là, les exportations se sont établies à 86,9 millions de dollars, avant de tomber à 12,3 millions en octobre, puis de se redresser modérément à 38,2 millions en novembre. Les données de décembre ne sont pas encore disponibles.

Quoi qu’il en soit, 2025 s’annonce comme une année exceptionnelle dans l’histoire des échanges commerciaux entre la RDC et les États-Unis, avec des exportations congolaises approchant 2 milliards de dollars et un excédent commercial autour de 1,6 milliard de dollars.

Détournement du commerce ?

En juillet 2024, le gouvernement congolais a adopté une stratégie nationale visant à promouvoir les exportations vers les États-Unis dans le cadre de l’AGOA, avec pour objectif de porter le volume des échanges commerciaux entre la RDC et les États-Unis à 3, voire 5 milliards de dollars à l’horizon 2025-2030. Elle s’articule autour de 26 filières : 21 filières non minières (dont le café, le cacao, l’huile de palme et l’ananas) et cinq filières minières (cuivre, diamants, or, cobalt et les « 3T » : cassitérite, wolframite et coltan).

Mais l’existence de cette stratégie, à elle seule, ne suffirait pas à justifier une telle hausse. Pour la Commission économique des Nations unies pour l’Afrique (CEA), qui a également constaté la hausse des exportations d’autres pays africains vers les États-Unis, cette situation résulterait d’une demande américaine soutenue pour les matières premières africaines et des « effets de détournement du commerce ». La coïncidence de ces hausses avec l’escalade de la guerre commerciale entre les États-Unis et la Chine tend à conforter cette analyse.

Pour maintenir la dynamique, le ministère du Commerce extérieur rappelle aux opérateurs économiques les conditions à remplir pour accéder effectivement au marché américain : conformité aux normes de qualité et de certification — notamment celles de la Food and Drug Administration —, respect des standards de l’Office congolais de contrôle, exigences liées à l’emballage. Il conseille aussi le recours à la diaspora congolaise aux États-Unis comme relais commerciaux.

Boaz Kabeya

Lire aussi :

Commerce RDC–États-Unis : les exportations explosent à 1,3 milliard $ en sept mois

Exportations vers les États-Unis : la RDC avantagée par les décisions de Trump

Rio Tinto Merger Failure Raises Profile of Glencore-Orion CMC Talks

Rio Tinto formally ended discussions with Glencore on Feb. 5, 2026 over a potential merger or other combination after the parties failed to reach an agreement. The Anglo-Swiss group confirmed the decision shortly afterwards. Under the UK Takeover Code, Rio Tinto is now restricted from making a new offer in the near term, except under limited circumstances.

Glencore said it is now focusing on executing its 2026 priorities, including meeting operational targets, de-risking its portfolio and pursuing organic growth.

Democratic Republic of Congo

In the Democratic Republic of Congo (DRC), where Glencore controls the Mutanda Mining (Mumi) and Kamoto Copper Company (KCC) copper and cobalt mines, this strategic focus has increased the relevance of a proposed partnership with the Orion Critical Mineral Consortium (Orion CMC). Based on details disclosed so far, the proposed transaction aligns with Glencore’s 2026 priorities and would involve neither a change of control nor operational disruption. Instead, it would provide a capital injection and risk-sharing to support the development of existing assets and potentially fund new acquisitions.

The Orion option is outlined in a non-binding memorandum of understanding announced on Feb. 3, 2026. It envisages the acquisition by the U.S.-backed consortium of 40% of Glencore’s interests in Mumi and KCC, based on a combined enterprise value of about $9 billion, including debt.

Capital structure

Under the proposed capital reconfiguration, Glencore would remain the majority shareholder, with a 57% stake in Mumi and 42% in KCC, alongside Orion CMC with 38% and 28%, the Congolese state with 5% of Mumi, and state miner Gécamines with 30% of KCC.

The framework would allow Orion CMC to appoint non-executive directors and to direct the sale of its share of production to designated buyers, in line with the strategic partnership between the United States and the DRC. Glencore would retain operational control of the mines.

The transaction remains subject to due diligence, the signing of binding documentation and the receipt of regulatory approvals. Completion would also depend on governance arrangements and approvals from Congolese shareholders. Glencore and Orion said they intend to work with the government and Gécamines.

Pierre Mukoko

Échec de la fusion avec Rio Tinto : le deal Glencore-Orion gagne en importance

Rio Tinto a officiellement mis fin, le 5 février 2026, aux discussions engagées avec Glencore autour d’une fusion ou d’une autre combinaison possible, faute d’être parvenu à un accord. Dans la foulée, le groupe anglo-suisse a confirmé l’information. Selon les deux parties, en vertu du Code britannique sur les offres publiques d’achat (OPA), Rio Tinto ne peut plus, à court terme, formuler une nouvelle offre, sauf exceptions.

Dans son communiqué, Glencore affirme désormais se concentrer sur la mise en œuvre de ses priorités pour 2026 : atteinte des objectifs opérationnels, dérisquage (réduction des risques) et croissance organique.

En République démocratique du Congo (RDC), où Glencore contrôle les mines de cuivre et de cobalt Mutanda Mining (Mumi) et Kamoto Copper Company (KCC), cette orientation confère un intérêt accru au partenariat envisagé avec le consortium Orion Critical Mineral Consortium (Orion CMC). D’après les informations communiquées jusqu’ici, ce deal en discussion est cohérence avec les priorités de 2026 de Glencore. Il ne prévoit ni changement de contrôle ni rupture opérationnelle, mais plutôt un apport de capitaux et un partage des risques, afin de développer les actifs existants et, éventuellement, d’acquérir de nouveaux actifs.

L’option Orion est, pour l’instant, structurée autour d’un protocole d’accord non contraignant annoncé le 3 février 2026. Il envisage l’acquisition, par ce consortium soutenu par les États-Unis, de 40 % des intérêts détenus par Glencore dans Mumi et KCC, pour une valeur d’entreprise combinée « d’environ 9 milliards de dollars », dette incluse.

La reconfiguration du capital qu’impliquerait l’opération maintiendrait Glencore en position d’actionnaire majoritaire, avec respectivement 57 % et 42 %, aux côtés d’Orion CMC (38 % et 28 %), de l’État (5 % de Mumi) et de Gécamines (30 % de KCC).

Conformément à cette répartition, le schéma prévoit qu’Orion CMC puisse nommer des administrateurs non exécutifs et diriger la vente de sa quote-part de production à des « acheteurs désignés », conformément au partenariat stratégique entre les États-Unis et la RDC, tout en laissant la gestion des mines au groupe anglo-suisse.

Plusieurs étapes restent néanmoins à franchir. Le communiqué Glencore–Orion précise que la transaction demeure conditionnée à la due diligence, à la signature d’une documentation juridiquement contraignante et à l’obtention des autorisations réglementaires applicables. Dans les faits, sa matérialisation dépendra aussi des équilibres de gouvernance et des validations des actionnaires congolais, Glencore et Orion indiquant vouloir travailler avec le gouvernement et Gécamines.

Pierre Mukoko

Lire aussi :

Cuivre-cobalt : ce que peut changer le tandem Glencore–Orion en RDC

Egypt’s Safrimex set to begin rehabilitation of Bandundu Airport

Egyptian civil engineering firm Safrimex is set to begin rehabilitation work at Bandundu Airport in Kwilu Province.

Company representative Glody Asani announced the move on Feb. 2, 2026, during a meeting with Governor Philippe Akamituna Ndolo. The project involves rehabilitating the airport’s runway and apron to improve landing and take-off safety for the presidential aircraft and other planes.

The project is part of preparations for the 13th Provincial Governors’ Conference and a planned visit by President Félix-Antoine Tshisekedi to Bandundu, the provincial capital. Originally scheduled for Dec. 9 to 13, the conference was postponed indefinitely by order of the president.

The airport had not received the repairs needed to ensure the safety and smooth operation of flights. According to the Prime Minister’s office, this followed the termination of a contract between the Office of Roads and the Régie des Voies Aériennes (RVA), as the Office of Roads lacked the technical and financial capacity to complete the work within the required timeframe. The project was subsequently awarded to Safrimex.

During a Council of Ministers meeting on Jan. 23, 2026, Prime Minister Judith Suminwa instructed the ministers of Transport and Finance to finalize the contracting process without delay and ensure the rapid execution of the work.

According to Fiston Mwemu, commander of Bandundu Airport, the project will begin with a preliminary study, considered essential before the start of the rehabilitation works. He said work would begin shortly.

Separately, a new airport is planned for Bandundu with support from the African Development Bank (AfDB). It is expected to be built on a site further from the city centre and is seen as a way to open up the region and stimulate investment.

Ronsard Luabeya

Aéroport de Bandundu : Safrimex prépare le démarrage des travaux de réhabilitation

La société égyptienne Safrimex, spécialisée dans les travaux de génie civil, s’apprête à lancer les travaux de réhabilitation de l’aéroport de Bandundu, dans la province du Kwilu. L’annonce a été faite le 2 février 2026 par Glody Asani, représentant de l’entreprise, lors d’une rencontre avec le gouverneur Philippe Akamituna Ndolo. Il est question de réhabiliter la piste et le tarmac de cet aéroport afin de garantir des conditions optimales d’atterrissage et de décollage pour l’avion présidentiel et d’autres aéronefs.

Le projet s’inscrit dans le cadre des préparatifs de la treizième Conférence des gouverneurs des provinces et de l’itinérance du chef de l’État, Félix-Antoine Tshisekedi, programmée à Bandundu, chef-lieu de la province. Prévue initialement du 9 au 13 décembre, la conférence a été reportée sine die sur instruction présidentielle.

L’aéroport n’avait pas bénéficié des réfections nécessaires pour garantir la sécurité et la fluidité des opérations aériennes. Selon la Primature, cette situation résulte de la résiliation du contrat entre l’Office des routes et la Régie des voies aériennes (RVA), l’Office des routes n’ayant pas démontré une capacité technique et financière suffisante pour achever les travaux dans les délais requis. Les travaux ont ensuite été confiés à Safrimex.

Lors du Conseil des ministres du 23 janvier 2026, la Première ministre Judith Suminwa avait instruit les ministres des Transports et des Finances de finaliser sans délai le processus de contractualisation des travaux et de prendre toutes les mesures nécessaires à leur réalisation rapide et efficace.

Selon Fiston Mwemu, commandant de l’aéroport de Bandundu, les travaux débuteront par une étude préliminaire, jugée essentielle avant le lancement des opérations de réhabilitation proprement dites. Il annonce un démarrage imminent.

Par ailleurs, la construction d’un nouvel aéroport à Bandundu est en maturation avec le soutien de la Banque africaine de développement (BAD). Il devrait être érigé sur un site plus éloigné du centre urbain. Le projet est présenté comme un levier stratégique pour « désenclaver la région et stimuler les investissements ».

Ronsard Luabeya

DRC plans to enforce law reserving 5% of telecom capital for workers

The government of the Democratic Republic of Congo (DRC) plans to allow Congolese employees in the telecommunications sector to benefit from profits generated by their companies. According to the minutes of a Council of Ministers meeting held on Jan. 30, 2025, the executive branch plans to enforce a legal provision requiring telecom operators to reserve 5% of their capital for Congolese workers. The measure has been included in successive laws governing the sector since 2002 but has never been enforced.

The minutes state that the Minister of Posts, Telecommunications and the Regulatory Authority of the Post and Telecommunications of Congo (ARPTC) have been tasked with holding talks with telecommunications companies. The discussions are intended to define the procedures, including the financial arrangements, under which Congolese employees can take a 5% stake in the companies where they work. The move is in line with Article 40 of Law No. 20/017 of Nov. 25, 2020, on telecommunications and information and communication technologies.

The law stipulates that any telecommunications company operating in the DRC must reserve at least 30% of its share capital for Congolese ownership. Of this total, 25% is reserved for Congolese individuals or Congolese-owned companies, while 5% is expressly set aside for the company’s Congolese employees. The text further states that even if the full 30% is not immediately taken up, the company may still be established provided that the participation reserved for Congolese workers is guaranteed.

Prospect of additional income

To date, telecommunications companies operating in the DRC are largely owned by foreign parent companies and shareholders. Vodacom Congo, for example, is 51% owned by the Vodacom Group and 49% by Congo Wireless Network (CWN), a company controlled by Gambian businessman Allieu Conteh. Orange RDC is wholly owned by the French group Orange, while Airtel Congo RDC belongs to the Airtel Africa group, a subsidiary of Indian multinational Bharti Airtel. Africell RDC is owned by the U.S.-based group Africell Holding.

According to the minutes of the Council of Ministers, President Felix Tshisekedi considers the continued failure to enforce the provision to be a legal and social irregularity. He said the situation deprives workers of a legally recognised right, perpetuates imbalances in corporate governance in the sector and weakens social dialogue.

Authorities say the situation prevents Congolese workers from benefiting from the economic returns generated by companies to which they contribute directly. Enforcement of the provision would allow Congolese employees, as shareholders, to receive a share of the profits generated by their employers at the end of each financial year, in addition to their salaries.

Turnover in the telecommunications sector has been rising in the DRC for several years. It increased by nearly 9% to $2.09 billion in 2024 compared with the previous year. It is unclear whether profits have followed the same trend, as operators do not publish their financial statements.

Timothée Manoke

Télécoms : la RDC veut appliquer la règle des 5 % du capital réservés aux salariés congolais

Le gouvernement veut désormais que les employés congolais travaillant dans les entreprises de télécommunications bénéficient des profits réalisés par ces sociétés en République démocratique du Congo (RDC). C’est ce qu’il ressort du compte rendu du Conseil des ministres du 30 janvier 2026. Pour ce faire, l’exécutif souhaite rendre effective une disposition légale qui réserve 5% du capital des opérateurs télécom aux travailleurs congolais ; prévue dans les lois successives qui régissent le secteur depuis 2002, elle est jusque-là restée inappliquée.

D’après le compte rendu du Conseil des ministres, le ministre des Postes, Télécommunications et l’Autorité de régulation de la poste et des télécommunications du Congo (ARPTC) ont été instruits d’engager des échanges avec les entreprises de télécommunications du pays en vue de définir les modalités notamment financières par lesquels les employés congolais pourront entrer en possession de 5 % du capital des entreprises dans lesquelles ils travaillent, conformément à l’article 40 de la loi n°20/017 du 25 novembre 2020 relative aux télécommunications et aux technologies de l’information et de la communication.

Cette loi prévoit que toute entreprise de télécommunications opérant en RDC doit réserver au moins 30 % de son capital social à des intérêts congolais. Dans cette proportion, 25 % sont destinés à des personnes physiques congolaises ou à des sociétés détenues par des Congolais, tandis que 5 % sont expressément réservés aux travailleurs congolais de l’entreprise. Le texte précise en outre que, même lorsque l’ensemble des 30 % n’est pas immédiatement souscrit, la société peut être constituée à condition que la participation réservée aux travailleurs congolais soit garantie.

Espoir d’un revenu supplémentaire

Mais, à ce jour, les entreprises de télécommunications opérant en RDC sont majoritairement détenues par des maisons mères et des actionnaires de nationalité étrangère. Vodacom Congo est, par exemple, détenue à 51 % par le groupe Vodacom et à 49 % par Congo Wireless Network (CWN), une société contrôlée par l’homme d’affaires gambien Allieu Conteh. Orange RDC appartient à 100 % au groupe français Orange, tandis qu’Airtel Congo RDC relève du groupe Airtel Africa, filiale de la multinationale indienne Bharti Airtel et Africell RDC du groupe américain Africell Holding.

Selon le compte rendu du Conseil des ministres, le président Félix Tshisekedi, estime que la non-application persistante de cette disposition constitue une anomalie à la fois juridique et sociale, « ayant pour effets la privation d’un droit légalement reconnu aux travailleurs, le maintien des déséquilibres dans la gouvernance des entreprises du secteur et l’affaiblissement du dialogue social ».

Pour les autorités, cette situation empêche les travailleurs congolais de bénéficier des retombées économiques générées par des entreprises dans lesquelles ils contribuent pourtant directement à la création de valeur. Elle permettrait ainsi aux travailleurs congolais, en leur qualité d’actionnaires, à la clôture des exercices financiers, de percevoir une part des bénéfices réalisés par leurs employeurs, en plus de leurs salaires.

Depuis plusieurs années le chiffre d’affaires global du secteur des télécoms est en hausse en RDC. Il a par exemple augmenté de près de 9% à 2,09 milliards de dollars en 2024 par rapport à l’année précédente. Mais, on ignore si les bénéfices suivent la même trajectoire ; les opérateurs ne publiant pas leurs états financiers.

Timothée Manoke

Lire aussi :

Télécoms : la licence unifiée redistribue les cartes entre les opérateurs en RDC

Télécoms : Airtel reste leader en RDC avec 741 millions $ de revenus en 2024

ACGT begins modernization studies for DRC's Bumba port

The Congolese Agency for Large Works (ACGT) announced the launch of modernization studies for the port of Bumba in Mongala province on Feb. 3, 2025. ACGT Director General Nico Nzau Nzau disclosed the information to Prime Minister Judith Suminwa during her official visit to the province.

According to the ACGT director general, the modernization project is expected to move into its implementation phase in the coming days. It includes the replacement of two dilapidated cranes, installed in 1955 and out of service since 1992, with modern equipment. The port platform will be entirely redeveloped to accommodate around ten boats, with the construction of a wider quay suited to current requirements. The rehabilitation of Avenue du Port, which is 1,700 meters long, as well as erosion control works along several affected sections of the riverbank, are also planned.

The cost of the project has not yet been disclosed, but financing will be provided under the Sino-Congolese program.

The port of Bumba, which measures 410 by 110 meters, is currently in an advanced state of decay, significantly constraining its operations. The infrastructure is managed by the public company CFU-F (Uélés-River Railway). It is connected to the Vicicongo railway line (Bumba–Isiro), which is used to transport agricultural products, including coffee and rice, to the river for shipment to other provinces.

A modernization plan had already been announced in 2019. It included the rehabilitation of the administrative building, the development of the docking quay, the construction of a boundary wall, and the reconstruction of five warehouses. These works were to be financed by the Congolese state, according to theSteering Committee for the Reform of Enterprises of the State Portfolio (COPIREP). However, the project has yet to materialize.

Ronsard Luabeya

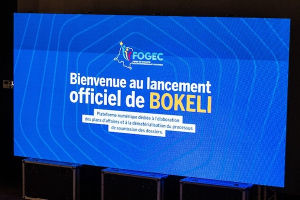

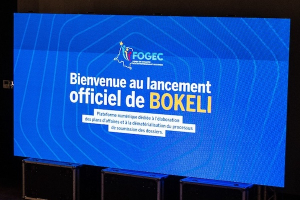

FOGEC Launches 'Bokeli' Digital Platform to Streamline SME Financing Requests

The Fonds de Garantie de l’Entrepreneuriat au Congo (FOGEC), a state-backed guarantee fund, on Tuesday launched a digital platform in Kinshasa aimed at helping entrepreneurs develop business plans and streamline the financing application process.

The platform, called Bokeli, forms part of government efforts to strengthen support for entrepreneurs and improve access to credit for small and medium-sized enterprises (SMEs), startups and artisans.

Accessible at bokeli.fogec.cd, the platform enables entrepreneurs to structure their projects using digital tools for business plan development, financial documentation and submission to relevant institutions. The aim is to produce clearer, bank-ready applications that meet financial institutions’ requirements, while reducing administrative hurdles in financing procedures.

The initiative addresses a recurring challenge in Congo’s entrepreneurial ecosystem: the poor technical quality of many loan applications submitted to banks and guarantee schemes. FOGEC’s mandate is to facilitate access to financing for viable SME, startup and artisan projects by providing guarantees, in an environment where bank collateral requirements remain a major constraint.

The launch comes as entrepreneurship continues to expand, driven in part by a young population increasingly engaged in business creation. However, this momentum has yet to translate into structured financing. According to Partech Africa, funding raised by Congolese startups remains limited relative to the country’s market potential, highlighting persistent barriers to capital access for early-stage companies.

Since its creation five years ago, FOGEC has supported nearly 300 projects worth a total of about $3.2 million. Against this backdrop, challenges related to project formalisation, business plan quality and procedural complexity remain central. By offering a digital tool focused on these steps, FOGEC aims to improve project bankability and facilitate exchanges between entrepreneurs, guarantee bodies and financial institutions, in order to better support the development of the domestic productive sector.

Samira Njoya

PME : le Fogec lance Bokeli pour dématérialiser les demandes de financement

Le Fonds de garantie de l’entrepreneuriat au Congo (Fogec) a lancé, le mardi 3 février 2026 à Kinshasa, une plateforme numérique dédiée à l’élaboration des plans d’affaires et à la dématérialisation du processus de soumission des dossiers de financement. Baptisée Bokeli, l’initiative s’inscrit dans les efforts des autorités congolaises visant à renforcer l’accompagnement des porteurs de projets et à améliorer l’accès des petites et moyennes entreprises (PME), des start-up et des artisans au crédit.

Accessible à l’adresse bokeli.fogec.cd, la plateforme permet aux entrepreneurs de structurer leurs projets grâce à des outils numériques dédiés à la conception de business plans, à la préparation des dossiers financiers et à leur transmission aux structures concernées. L’objectif est de faciliter la constitution de dossiers plus lisibles et conformes aux exigences des institutions financières, tout en allégeant les contraintes administratives liées aux procédures de financement.

À travers ce dispositif, le Fogec entend répondre à une difficulté régulièrement relevée dans l’écosystème entrepreneurial congolais : la faiblesse technique de nombreux dossiers présentés aux banques et aux mécanismes de garantie. L’institution rappelle que sa mission consiste à faciliter l’accès au financement des PME, des start-up et des artisans, en apportant des garanties aux projets jugés viables, dans un contexte marqué par l’insuffisance de garanties exigées par le système bancaire.

Cette initiative intervient dans un environnement caractérisé par une montée progressive de l’entrepreneuriat, portée notamment par une population jeune de plus en plus engagée dans la création d’activités économiques. Toutefois, ce dynamisme peine encore à se traduire par des financements structurés. Selon les analyses de Partech Africa, les montants levés par les start-up congolaises restent limités au regard du potentiel du marché national, confirmant les difficultés d’accès au capital pour les jeunes entreprises innovantes.

De son côté, le Fogec indique avoir accompagné près de 300 projets pour un montant global avoisinant 3,2 millions de dollars depuis sa création, il y a cinq ans. Dans ce contexte, les enjeux liés à la formalisation des projets, à la qualité des plans d’affaires et à la complexité des procédures demeurent centraux. En mettant à disposition un outil numérique dédié à ces étapes clés, le Fogec ambitionne de renforcer la bancabilité des projets et de fluidifier les échanges entre entrepreneurs, structures de garantie et institutions financières, afin de soutenir plus efficacement le développement du tissu productif national.

Samira Njoya, We Are Tech

Lire aussi :

Femmes rurales : le FOGEC s’apprête à garantir pour 2 millions $ les prêts de Bisou Bisou

Sous-traitance : Rawbank, l’ARSP et le FOGEC lancent des prêts jusqu’à 1 million $