News (739)

The Democratic Republic of Congo (DRC) is among six African countries selected for pilot projects aimed at developing affordable 4G smartphones. The initiative is led by the GSMA, the global association representing mobile network operators and industry players, and organizer of the Mobile World Congress (MWC) in Barcelona.

Announced during MWC 2026, the project also involves Ethiopia, Nigeria, Rwanda, Tanzania and Uganda. These countries will serve as test markets for entry-level smartphones priced between $30 and $40, with the aim of reducing one of the main barriers to digital adoption in Africa: the cost of devices.

The initiative was discussed during a roundtable held on March 2 at MWC 2026. The Congolese Minister of Digital Economy, Augustin Kibassa Maliba, said he attended the meeting. According to a statement from the ministry, the GSMA is advocating for a coalition of governments, telecom operators and manufacturers to lower smartphone prices.

The ministry also mentioned a proposal to reduce taxes on entry-level smartphones, potentially shifting part of the tax burden toward higher-end devices.

Bridging the digital gap

According to the Regulatory Authority of the Post and Telecommunications of Congo (ARPTC), mobile penetration in the DRC reached about 65% at the end of September 2025, while mobile internet penetration stood at just over 32%. The gap suggests that network coverage is expanding faster than smartphone adoption, largely due to low purchasing power.

The Minister of Digital Economy said lower device prices could expand the user base, boost data consumption and ultimately increase revenue from digital services.

ARPTC data show that mobile internet is gaining weight in the telecom sector. In the third quarter of 2025, the segment generated more than $335 million and accounted for nearly 55% of total mobile market revenue.

However, the initiative’s impact remains uncertain. Its success will depend on several factors, including the level of taxes applied to devices, manufacturers’ ability to meet price targets amid rising component costs, and the speed of commercial rollout in pilot countries.

Augustin Kibassa Maliba said the government plans to work with relevant ministries and telecom operators to develop a balanced fiscal framework aimed at expanding digital access without reducing government revenue.

For the DRC, the challenge will now be to translate its inclusion in the African pilot program into concrete measures on pricing, distribution and effective access to mobile internet.

Timothée Manoke

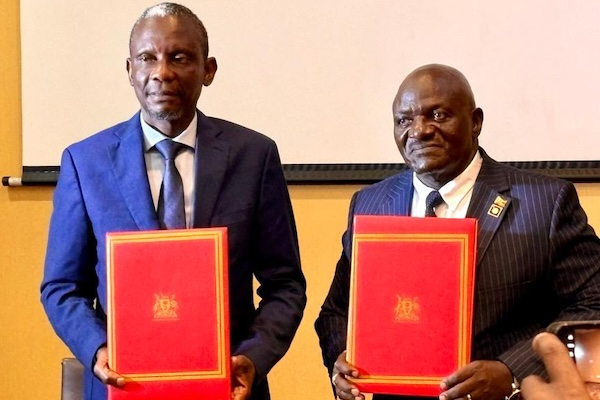

The Democratic Republic of Congo (DRC) and Uganda plan to accelerate the modernization of their cross-border road corridor. According to a statement issued by the Congolese Ministry of Infrastructure and Public Works on March 5, 2026, Congolese Minister John Banza Lunda and his Ugandan counterpart Katumba Wamala agreed to begin paving the first 15 kilometers of the 80-km Kasindi–Beni road.

The statement said both sides decided to remove administrative and technical bottlenecks that had slowed the project. The Congolese and Ugandan governments, together with contractor Dott Services Ltd, committed to accelerating construction.

The announcement follows the timeline presented in July 2025, which projected paving works on the Kasindi-Beni (80 km) and Beni-Butembo (54 km) roads in the first quarter of 2026.

The Congolese minister of infrastructure had previously acknowledged several challenges delaying the project while reaffirming the commitment of stakeholders to overcome them and meet the agreed timetable. In December 2025, John Banza Lunda visited the Beni-Kasindi section to assess progress. During the visit, he noted the installation and commissioning of several crushing units intended to supply construction materials for the works.

Preparatory work has also widened and secured the existing road, reducing travel time between Beni and Kasindi to about one and a half hours, according to project information.

The project is part of a broader cross-border road program officially launched in June 2021 by the presidents of the DRC and Uganda. It covers three sections: Kasindi-Beni (80 km), Beni-Butembo (54 km), and Bunagana-Rutshuru-Goma (89 km), for a total of 223 kilometers.

The total cost is estimated at $551.6 million. Under the financing structure, Dott Services Ltd covers 60% of the funding, while the Congolese and Ugandan governments each contribute 20%.

Investments will be repaid through a toll system, with reduced rates due to the participation of the two governments. According to previously published project information, the concession is expected to last at least 15 years, while the initial construction phase was planned over three years. The project has both economic and security implications. It aims to improve connectivity between the DRC and Uganda, facilitate trade flows, and support stabilization efforts in eastern Congo.

Ronsard Luabeya

The industrial transformation of the Rubaya coltan mine in Masisi territory, North Kivu, would require an investment of between $50 million and $150 million. Reuters reported that this estimate appears in an initial list of 25 assets offered to American investors as part of a strategic critical minerals partnership signed between the Democratic Republic of Congo (DRC) and the United States on Dec. 4.

The document says the investments would accelerate commercial-scale production. A rapid return on investment is expected due to strong global demand for tantalum, a strategic metal extracted from coltan.

Congolese authorities say the Rubaya mine is of particular interest to Washington, reflecting U.S. efforts to secure Western supply chains for critical materials used in electronics, energy and defense industries. The site is widely described as one of the world’s most important coltan deposits.

It accounts for roughly 15% of global coltan production, with tantalum grades ranging between 20% and 40%.

Under the agreement between Kinshasa and Washington, American companies have a right of first offer on the selected assets. Even before the agreement was signed, Western groups had already expressed interest in the site.

Bloomberg reported that Swiss trader Mercuria Energy Group and investment firm TechMet are considering plans to develop and modernize the tantalum deposit near Rubaya. TechMet is backed by the U.S. International Development Finance Corporation (DFC).

The Financial Times has also reported interest from Texan businessman Gentry Beach through his company America First Global. Beach is described as being close to Donald Trump.

Zone under occupation

Despite its strategic importance, mining at the site remains largely artisanal and informal. These conditions frequently lead to deadly accidents.

In a statement published on March 4, 2026, the Congolese Ministry of Mines reported that a landslide occurred on March 3 at the Rubaya mining sites following heavy rains. Authorities said the provisional death toll exceeded 200 people, including around 70 children. Many injured were evacuated to health facilities in Goma.

Similar casualty figures had already been reported after landslides at the mine in late January.

In this context, industrializing the site is seen as a way to improve safety and reduce human risks by gradually replacing artisanal mining with more regulated operations. However, the project depends on improvements in the security situation.

Since April 2024, the Rubaya area has been under the control of the AFC/M23 rebel movement, which is supported by Rwanda. United Nations experts say some minerals extracted in the region are smuggled into Rwanda. The armed group reportedly earns around $800,000 per month by taxing mining activities.

“The development of sites located in occupied zones depends on the withdrawal of Rwandan troops, as provided for in the DRC-Rwanda peace agreement concluded in June 2025,” Daniel Mukoko Samba told Jeune Afrique in February.

Mukoko Samba is the Congolese vice-prime minister in charge of the economy and a signatory to the strategic agreement with the United States.

Aware of the situation, Washington has increased pressure on Kigali. The U.S. Treasury announced a new series of sanctions on March 2, 2026 targeting the Rwanda Defence Force (RDF) and four senior military officials.

In 2025, the United States had already sanctioned the armed group PARECO-FF, the Cooperative of Mining Artisans of Congo (CDMC), and the Chinese companies East Rise Corporation and Star Dragon Corporation for alleged involvement in the illegal trade of minerals from the Rubaya sites.

Dispute over the permit

“We are not the perpetrators, but the primary victims,” the CDMC said in response. The company also accused certain Congolese officials of leading a coordinated effort to undermine its ownership of the Rubaya mining permit with support from opaque diplomatic and financial channels.

Congolese mining registries indicate that the state-owned company Société Aurifère du Kivu et du Maniema (SAKIMA) holds the permit covering the Rubaya area. However, these rights are contested by the CDMC.

The company argues that the concession belongs to its subsidiary Congo Fair Mining (CFM), a joint venture formed with SAKIMA in which the state firm holds a 30% stake.

This claim is supported by rulings issued on April 30 and September 4, 2025 by the Council of State, the country’s highest administrative court.

The joint venture creating CFM was signed in 2020 between SAKIMA and the CDMC. It provided for the transfer of the Rubaya exploitation permit from the public enterprise to CFM. The transfer agreement was reportedly signed on March 11, 2021, leading to the registration of the permit transfer in the Mining Registry on May 20, 2022.

Mining Minister Louis Watum Kabamba told Bloomberg in October 2025 that he planned to bring the parties together to discuss the dispute. It remains unclear whether the meeting has taken place.

However, Kinshasa has already included the Rubaya coltan deposit among the strategic mining assets offered to American investors. The government now faces two key challenges: securing the site and resolving legal disputes to enable industrial development.

Pierre Mukoko & Timothée Manoke

Traffic on the Mweha-Mukwija section of National Road 2 (RN2), which links North and South Kivu through Kalehe territory, has been severely disrupted.

According to Actualité.cd, several muddy stretches have formed along the road, making parts of it impassable for vehicles and motorcycles. Drivers and motorcyclists face a high risk of accidents and long delays, even though the road remains a key corridor for the movement of people and goods.

The RN2 plays a key role in the regional economy, allowing agricultural produce from rural areas of Kalehe to reach the cities of Bukavu and Goma.

Local officials warn that the road’s deterioration is already affecting trade. Farmers are struggling to get their produce to urban markets, causing significant financial losses and potentially pushing prices higher. The most affected areas include Mweha, Makengere, Chez les Français and Lukera in Mukwija. The heavily damaged Mweha and Lukera bridges are further complicating traffic.

BK

Construction of Provincial Road 231 linking Batshamba to Kakobola via Gungu was launched on March 3 in Kwilu province by Infrastructure and Public Works Minister John Banza Lunda.

The 69-kilometre road connects the towns of Batshamba, Gungu and Kakobola, all located in Gungu territory.

Chinese company CISC-SA is carrying out the works under the Sino-Congolese cooperation programme for infrastructure development. The Congolese Agency for Major Works (ACGT) is overseeing the project.

According to ACGT Director General Nico Nzau Nzau, the works include clearing the road corridor, laying the different pavement layers, building drainage structures and reinforcing existing crossings. Road signage and safety equipment will also be installed along the route.

The project will be implemented in two phases. The first phase will reopen the road along its entire length to restore traffic between the three towns. The second phase will involve paving the road to transform the current dirt track into a developed road.

The poor condition of the road currently hampers the movement of people and the transport of agricultural products to markets. Modernising the Batshamba-Gungu-Kakobola section should therefore improve mobility in this part of Kwilu province and strengthen connections between rural areas and the region’s main transport corridors.

Boaz Kabeya

Democratic Republic of Congo's state water utility, Regideso, plans to launch a bottled water production plant in Kinshasa.

Speaking on Top Congo radio on March 4, 2026, Director General David Tshilumba Mutombo said the company is preparing a tender for the project.

According to him, construction of the plant could begin within three to four months. The project will include a bottle recycling system designed to collect used packaging across the city of Kinshasa. In the longer term, Regideso plans to replicate the model in several cities across the country.

The public utility also plans to develop payment service provider (PSP) technology. Tshilumba said the activity could become an additional revenue stream for the company. Regideso has also created a subsidiary dedicated to electricity production, RégiEnergies.

These initiatives form part of a diversification strategy aimed at reducing the company's financial dependence on payments from the State, which Tshilumba described as a "bad payer."

"When the State does not pay, it disrupts our business plan, our annual budget and our performance," he said, noting that government payments can sometimes be delayed by 10 to 12 months.

To better manage water consumption by public institutions, Regideso also plans to install smart meters, mostly prepaid. The company is awaiting the delivery of 80,000 to 90,000 units within three to four months.

These meters will be installed mainly in government offices and at certain institutional clients. The system will operate on a prepaid basis, meaning access to water will depend on the credit available on the meter.

"As with a telephone: if there are no units, the meter does not work. No units, no water," Tshilumba said.

Ronsard Luabeya

An audit of the teacher payroll system aimed at eliminating ghost workers saved the public treasury 11 billion Congolese francs (CDF) in 2025, according to the annual activity report of the Ministry of National Education and New Citizenship.

The report says the amount concerns only the city of Kinshasa, where the first campaign to verify and clean up payroll records was carried out.

The operation involved the biometric identification of employees, allowing the administration to remove ineligible individuals from the payroll. Following the initial results, the ministry said the payroll clean-up operation has been extended to all provinces to strengthen long-term workforce management and prevent the reappearance of ghost workers.

The initiative comes as part of broader reforms aimed at improving control of the size of the public workforce and the wage bill. In a report published in 2026, the International Monetary Fund (IMF) noted that the public wage bill more than doubled in nominal terms between 2021 and 2025 and rose by 46% in real terms, now exceeding 50% of tax revenue.

Within this context, authorities are seeking to strengthen payroll control mechanisms and transparency. In August 2025, the Ministry of Public Service announced plans for a biometric identification exercise targeting employees paid through the central government’s auxiliary budget. The objective is to interconnect the cleaned records with payroll databases in order to eliminate duplicates and ineligible employees.

Timothée Manoke

Rawbank said on March 4, 2026 it has secured $265 million in financing to support small and medium-sized enterprises (SMEs) in the Democratic Republic of Congo. The International Finance Corporation (IFC) led the deal, with participation from Proparco, British International Investment (BII), the eco.business Fund and the OPEC Fund for International Development.

The financing aims to expand access to credit for SMEs, support private sector growth and create jobs in the country, Rawbank said. The IFC added that the program could provide financing to at least 1,500 additional SMEs over the next four years, particularly in sectors such as telecommunications and fast-moving consumer goods.

“This operation represents a strategic allocation of international capital to a local financial intermediary able to channel these resources into productive financing,” said Mustafa Rawji, chief executive of Rawbank. “Our goal is to finance more Congolese SMEs, strengthen local production and support sustainable job creation across the country.”

A two-part financing structure

The deal has two components. The first is a $165 million senior credit facility arranged by the IFC, including $50 million provided directly by the institution. The remaining $115 million was mobilized from financial partners: Proparco ($50 million), eco.business Fund ($20 million), the OPEC Fund ($20 million) and British International Investment ($25 million).

The second component is a $100 million risk-sharing agreement between the IFC and Rawbank. Under this arrangement, the IFC covers 50% of the exposure, equivalent to $50 million, allowing Rawbank to extend credit to a larger number of SMEs. The mechanism is supported by the European Commission and the International Development Association (IDA) through the Small Loan Guarantee Program.

In addition to financing, the IFC will provide advisory services to strengthen Rawbank’s capacity in several areas, including climate finance, agricultural financing and support for women entrepreneurs.

Additional support for SME financing

According to Rawbank, the deal is “the largest transaction ever arranged by the IFC for a financial institution in the DRC.”

The financing forms part of the bank’s broader strategy to expand access to credit for Congolese SMEs. Rawbank participates in the “20,000 SMEs” program, a $200 million initiative designed to help integrate local companies into the value chains of large firms operating in the DRC.

Under this program, Rawbank works with the Regulatory Authority for Subcontracting in the Private Sector (ARSP) and the Guarantee Fund for Entrepreneurship in Congo (FOGEC) to expand access to financing for local businesses.

Ronsard Luabeya

Protests by health workers in Gbadolite over unpaid wages and bonuses have drawn attention to the worsening financial situation at Afriland First Bank DRC, which has been under provisional administration since June 20, 2022.

Data from the Central Bank of the Congo (BCC) for December 2025 shows a sharp deterioration in the bank’s financial position. Afriland reported a negative net banking income (NBI) of $4.68 million, while the country’s banking sector generated $2.241 billion in positive NBI.

NBI reflects the core revenue generated by banking activity and is equivalent to turnover. It includes interest margins on loans, commissions and trading income.

“When it turns negative, it means the bank’s core activity no longer generates income,” a banker said.

In practice, the bank’s financial costs, mainly interest expenses on deposits, now exceed the revenue generated from lending and financial services.

At the end of 2025, Afriland held $124.9 million in customer deposits and $175 million in gross loans. However, a large share of these loans no longer produces income. Loans to private companies account for 70% of the portfolio, but performing loans total only $37.8 million, or 21.6% of outstanding credit.

As a result, the bank has set aside $131.9 million in provisions for non-performing loans.

Rising recapitalization needs

Afriland is also losing market share in payments to public sector employees, reducing commission income and further weakening NBI.

In 2025, the bank was accused of delays and irregularities in public salary payments. It subsequently lost the contract for paying teachers and school operating expenses in five regions to other financial institutions. The lost portfolio covered 29,513 employees, 2,039 schools and a monthly payment volume of about 12 billion Congolese francs.

Afriland ended 2025 with losses of $50.4 million and negative equity of $116.9 million. This situation significantly increases recapitalization needs. Banks operating in the Democratic Republic of Congo have been required to maintain a minimum capital of $50 million since January 2025.

As early as March 2022, the BCC estimated Afriland’s recapitalization needs at $90 million. The estimate was challenged by the majority shareholder, Afriland First Group (AFG), controlled by Cameroonian businessman Paul Kammogne Fokam. The group, which said it held 95.6% of the bank’s capital, argued the assessment was conducted while the bank was already under reinforced BCC supervision.

The central bank deployed a close monitoring team in August 2021 after a governance crisis triggered by the board chairman’s suspension of the chief executive. Before the crisis, the bank’s equity was $48.05 million.

AFG conditioned any recapitalization on a contradictory audit, a request the BCC reportedly rejected before placing Afriland First Bank RDC under provisional administration in June 2022. A seven-member team led by Mudiay Mpinga was appointed to manage the bank. Its mandate was to coordinate with stakeholders, resolve the crisis and prepare a recovery plan within 180 days.

Risk of AFG losing its stake

On Dec. 27, 2022, one week after the end of the first mandate, a new law governing credit institutions was enacted. On Jan. 20, 2023, the same team was reappointed with a new mandate, placing Afriland under a resolution regime.

Under Congolese law, resolution is the final stage of banking supervision. It applies when a bank’s financial condition threatens its solvency and the interests of depositors and creditors.

The mechanism allows authorities to restructure failing institutions quickly. However, by the end of 2025, the two key objectives, restoring profitability and solvency, had still not been achieved. Financial indicators suggest the bank’s situation has deteriorated since the crisis began in July 2021.

The law grants broad powers to the resolution commissioner, who can replace corporate bodies such as the general assembly, the board of directors and executive management. The commissioner may also decide on capital restructuring or asset sales.

Given the bank’s financial position, the risk that the historical majority shareholder could lose its stake appears high.

AFG has acknowledged the severity of the situation. In a statement issued on Feb. 12, 2026, following the protests by health workers in Gbadolite, the holding company said it had been “ousted” from the capital of Afriland First Bank RDC by the Congolese state and its central bank.

According to the group, arbitration proceedings have been filed with the International Centre for Settlement of Investment Disputes (ICSID) to challenge what it described as an “expropriation” and seek compensation.

Pierre Mukoko

Micropolis Robotics, a United Arab Emirates-based company specializing in autonomous ground platforms, said on Tuesday it had signed a development and multi-year distribution agreement with AfricAI to expand the deployment of its unmanned ground vehicles across Africa, with a particular focus on the Democratic Republic of Congo (DRC).

According to the statement, the program involves a total investment of $9.3 million over an estimated 18-month period. The funding will support the development of three models designed for specific applications: police and public security, agricultural operations, and border surveillance and control.

The platforms will be adapted to operational constraints common across several African environments, including mobility over difficult terrain, operation in high-heat conditions, and the need for long-range communications and AI-assisted surveillance capabilities.

The distribution agreement spans three years. Micropolis said AfricAI would manage the purchase, marketing and distribution of the vehicles through its subsidiary, AfricaAI Technology FZ LLC. The markets listed include the DRC, South Africa, Tanzania and member states of the Economic Community of West African States (ECOWAS).

The statement also said real-world pilot tests must be conducted at sites in Africa before any large-scale commercial deployment.

A separate communication released in late January 2026, attributed to AfricAI, also referred to a partnership aimed at deploying Micropolis robotic platforms across the African continent. As the two announcements appear to be distinct, the scope of exclusivity, whether continental or limited to specific markets, would depend on the contractual terms defined in each agreement.

At this stage, the published statements do not detail the financial conditions of the distribution agreement, such as purchase prices, volumes, delivery schedules or performance clauses. The specific sites selected for the African pilot projects were also not disclosed. In addition, the exact legal identity of the entity "AfricAI Limited" was not clarified in the March 3 announcement beyond the reference to its subsidiary, AfricaAI Technology FZ LLC.

Ronsard Luabeya

More...

State Minister and Justice Minister Guillaume Ngefa Atondoko Andali has called on judicial authorities to ensure effective prosecution of offenses committed online.

In a statement dated March 3, 2026, the ministry said Congolese cyberspace is fully subject to national law and cannot be a lawless zone.

The document said the use of digital platforms such as TikTok, Facebook, X and WhatsApp must comply strictly with the laws of the Republic, particularly the Digital Code and the Penal Code.

While noting that freedom of expression, guaranteed by the Constitution, protects criticism and public debate, including when they are “lively or controversial,” the communiqué stressed that this freedom does not extend to acts that constitute criminal offenses or abuse the rights of others, threaten public order, or undermine human dignity.

The minister instructed prosecutors general at the courts of appeal, public prosecutors and senior auditors of military jurisdictions to ensure that digital offenses are effectively prosecuted. He said any action must be based on a clear legal foundation, be legally justified and remain strictly proportionate to the alleged facts. Measures taken must also respect the right to a fair trial and the Democratic Republic of Congo’s international human rights obligations.

The communiqué listed criminal offenses including defamation, spreading false information, harassment, threats, insults, incitement to hatred, and violations of privacy and human dignity.

It also said that, when legal requirements are met, authorities may order the removal, blocking or suspension of clearly illegal content. Such measures must remain subject to judicial oversight and must not infringe fundamental freedoms.

Judicial authorities were also urged to activate international cooperation mechanisms when alleged perpetrators are outside national territory, in accordance with conventions ratified by the DRC. They were further asked to ensure effective protection of victims by conducting investigations promptly, guaranteeing confidentiality where required and preventing further victimization.

The statement comes as President Félix Tshisekedi recently called for stronger oversight of social networks, including better public awareness of laws governing the digital space.

Boaz Kabeya

Agriculture Minister Muhindo Nzangi plans to appoint a new operator to restart activities at the Lubondai agricultural site in Dibaya territory, Kasai-Central. He announced the move on February 27, 2026, during a review of agricultural programs in the wider Kasai region. The restart will be phased, beginning with the assembly of processing units and the retrieval of tractors previously deployed to the site.

Operations were initially entrusted to Bio Agro Business (BAB). The company withdrew several months ago after both sides failed to meet contractual commitments. Equipment remains at the site, which the Ministry of Agriculture says it owns, having acquired it under the Voluntary Agricultural Program (PVA). The program aims to boost food production and strengthen food self-sufficiency through a partnership between the Congolese state, equipment supplier DEM, and site operator BAB.

The minister said the restart would also extend to the Nkuadi site in Kasai-Oriental and the Mongata site in Kwango, both previously managed by BAB. In Lubondai, authorities plan to bring back tractors left in Kananga and repair feeder roads to ease operations and transport of produce.

Local media report that implementation stalled after DEM failed to meet key contractual obligations, including completing storage warehouses and fully installing processing units such as dryers, silos, and flour mills. The facilities were financed through a $139 million supplier credit granted to the PVA.

Bio Agro Business said it had received no public funding to acquire equipment and could not operate the sites without completed infrastructure. Under the contract, the company was to manage sites once fully equipped. The state was responsible for delivering installations for the production and processing of corn, cassava, and rice, as well as providing technical support to local farmers.

The Voluntary Agricultural Program covers six pilot sites: Mongata (Kwango), Nkundi (Kongo-Central), Nkuadi (Kasai-Oriental), Sakadi (Haut-Lomami), Lubondai (Kasai-Central), and Ruzizi (South Kivu).

Ronsard Luabeya

The Democratic Republic of Congo faces a potential double supply shock in its beef market, following the suspension of livestock imports from South Africa and disruptions along the Kasumbalesa corridor, a key transit route between Zambia and southeastern Congo.

The Congolese Ministry of Fisheries and Livestock announced on Feb. 26, 2026, that it was suspending imports of cattle and other cloven-hoofed livestock, as well as certain related products, citing a resurgence of foot-and-mouth disease in South Africa. Import permits have been canceled or suspended, and veterinary checks tightened at border posts. The ministry said it is monitoring developments in South Africa.

At the same time, Zambia has begun exporting beef to the Congolese market. President Hakainde Hichilema announced the first shipment to the DRC on Oct. 14, 2025. According to the Daily Mail, the initial consignment, valued at $62,635, forms part of a national strategy to raise beef exports to $1 billion by 2030. The DRC and Angola have been identified as priority markets. Farmers are expected to receive about $4.5 per kilogram, with final market prices estimated at around $9 per kilogram.

To ensure exports meet health standards, the Zambian presidency said small-scale farmers have been integrated into a system aligned with export requirements. Cattle undergo at least one month of quarantine before being slaughtered in licensed abattoirs. The veterinary department certifies that animals are disease-free through Animal Disease-Free Compartments (ADFC), supported by accredited laboratories including the National Livestock Epidemiology and Information Centre (NALEIC), as well as private partners overseeing pre-export health surveillance.

However, the main transport route used for these shipments is currently disrupted. ZNBC reported that the first consignment, slaughtered in Kalomo in October 2025, was transported to the DRC via the Kasumbalesa border post. Traffic along this route has been affected since the night of Feb. 28, 2026, after the Kakoso bridge collapsed following heavy rains, according to the Road Development Agency. The agency said work is underway to build a temporary bypass and restore traffic.

Timothée Manoke

The U.S. Department of the Treasury on Monday imposed sanctions on the Rwanda Defence Force (RDF) and four senior military officials, accusing them of supporting the March 23 Movement (M23) rebel group in eastern Democratic Republic of Congo.

The sanctions were announced by the Treasury’s Office of Foreign Assets Control (OFAC) as part of U.S. measures targeting those Washington says are undermining peace and stability in eastern Congo.

The Treasury said the Rwandan army provides direct military, logistical and technological support to M23, a rebel group under U.S. sanctions since 2013 and also subject to United Nations sanctions. It said the support had enabled M23 offensives and helped the group consolidate control in several parts of eastern Congo, including Goma and Bukavu, as well as Rubaya, a strategic mining hub.

U.S. authorities cited the deployment of advanced military equipment, including GPS jamming systems, air defence equipment and drones, and said Rwandan troops were present on the ground.

The Treasury said the operations were linked to serious human rights abuses committed by M23, including summary executions and violence against civilians.

The sanctions come after the Dec. 4, 2025 signing in Washington of the Washington Accords for Peace and Prosperity between Congo and Rwanda under U.S. mediation. The United States views continued offensives as inconsistent with commitments made under that agreement, according to the Associated Press.

In addition to the RDF, the Treasury designated four senior officers: Vincent Nyakarundi, identified as army chief of staff; Ruki Karusisi, a major general; Mubarakh Muganga, chief of defence staff; and Stanislas Gashugi, described as a special forces commander.

Under the sanctions, all property and interests in property of the designated individuals and entities in the United States or in the possession or control of U.S. persons are blocked. U.S. persons are generally prohibited from engaging in transactions with them, and entities owned 50% or more by designated persons are also subject to the measures.

The Treasury said financial institutions and other businesses, including non-U.S. entities, could face sanctions if they engage in or facilitate transactions that violate or evade the restrictions. It said the measures are intended to change behaviour and that removal from the sanctions list is possible if conditions are met.

Rwanda’s government condemned the sanctions as “unjust” and accused Washington of taking a biased view of the conflict.

Boaz Kabeya