News (740)

Gécamines plans to sell part of the copper output from Tenke Fungurume Mining (TFM) to the United States through its new trading subsidiary, Gécamines Trading. TFM is 80% controlled by China’s CMOC.

The Congolese state miner said it has decided, for the first time, to exercise its contractual right to buy the share of production linked to its 20% stake in the mine and resell it to U.S. buyers. It put the volume at 100,000 tonnes for 2026.

“This first marketing operation represents an expansion of the competitive bidding system for output from Gécamines’ partnerships, a system introduced in 2023 and successfully implemented since then,” Guy-Robert Lukama, chairman of Gécamines’ board, said in a statement.

Gécamines said the decision to market the production share from its joint ventures is intended to address transfer-pricing practices used by some operators. Under such practices, output is sold at below-market prices to related entities, reducing dividends paid to Gécamines and mining revenues for the state.

The company said the strategy should lead to better pricing of Congolese minerals, higher tax revenues and a broader base of buyers, strengthening the country’s commercial independence.

“We welcome this first operation, which follows more than a year of work to strengthen the Democratic Republic of Congo’s position in global raw materials markets and to assert the state’s sovereignty over its mineral resources,” said Placide Nkala Basadilua, Gécamines’ chief executive, in the statement.

In the longer term, the state-owned company aims to secure sales rights of up to 500,000 tonnes of copper and 40,000 tonnes of cobalt, underlining its ambition to re-establish itself as a global player in critical minerals.

Strategic agreement

Before exercising its purchase right, Gécamines said it carried out a market consultation in late 2025. Several U.S. buyers agreed to purchase the 100,000 tonnes of copper at the end of the process under terms the company described as favourable.

Copper prices surged in 2025, rising 44% to a record $12,960 per tonne on the London Metal Exchange. Analysts expect momentum to remain strong in 2026.

The transaction also allows the DRC to implement commitments under a strategic agreement signed with the United States in Washington on Dec. 4, 2025. Under the agreement, “the DRC and its public enterprises will use their marketing rights linked to participation and contracts to provide offtake access to American and allied persons.”

The mechanism requires Gécamines, or any other state-owned company, to offer its marketable volumes to U.S. companies before other buyers, provided commercial terms are comparable and aligned with international prices.

The deal is being carried out by Gécamines Trading, a joint venture with Geneva-based Mercuria Energy Trading. The venture markets copper, cobalt and other critical minerals, including germanium and gallium, produced in the DRC.

The project is backed by the U.S. International Development Finance Corp (DFC). The agency said it has issued a letter of intent for an equity investment in the joint venture, aimed at securing U.S. supply chains for strategic minerals.

Pierre Mukoko

The Regulatory Authority for Subcontracting in the Private Sector (ARSP) has issued a decision that directly affects mining supply chains in the Democratic Republic of Congo.

In a decision published on Jan. 7, 2026, the regulator ruled that the supply of sulfuric acid, chemical reagents and similar inputs will be restricted exclusively to licensed subcontracting companies, in line with Law No. 17/001 governing private-sector subcontracting.

According to the decision, the supply of sulfuric acid, lime, flotation reagents, extractants and other chemicals used in ore processing is classified as a subcontracting activity in its own right. As a result, these supplies may no longer be provided directly by mining companies or by firms that are not listed in the ARSP’s official register.

The ARSP said the move was prompted by ongoing attempts to bypass subcontracting rules, which have allowed ineligible operators to dominate a strategic segment of the mining industry. Such practices, the regulator said, run counter to the law’s objective of ensuring meaningful participation by Congolese companies in markets generated by mining activity.

Under the new rules, mining companies must source acid and processing reagents exclusively from ARSP-approved subcontractors or face administrative sanctions under existing regulations.

The authority said it focused on the acid and reagents market because of the central role these products play in ore processing, particularly in copper and cobalt production. They are essential to leaching techniques used to extract metals from ore.

Until now, these inputs were largely supplied by foreign firms or entities integrated into major mining groups, limiting access for local suppliers. This, the regulator said, justified targeting the segment for stricter enforcement of subcontracting rules.

The decision forms part of the government’s broader strategy to promote local content and strengthen Congolese small and medium-sized enterprises. It aims to deepen the integration of national companies into the mining value chain and support job creation.

Boaz Kabeya

Hydrocarbons Minister Acacia Bandubola Mbongo has announced a series of projects to improve the supply of petroleum products in the provinces of Grand Equateur, Kasai and Sankuru. The projects were presented to executives from petroleum logistics and distribution companies during a meeting held on Jan. 8, 2026.

During the meeting, the minister outlined priorities for 2026, including the construction of new pipelines, the installation of additional storage facilities, and the rehabilitation of existing infrastructure to improve supply in underserved provinces of the Democratic Republic of Congo.

According to Olivier Okunda, deputy director general of Cobil, the meeting aimed to identify projects that could improve fuel supply in Grand Equateur, Kasai and Sankuru. He said technical and quantitative data would be submitted to the minister for government approval.

A 2022 roundtable involving the government and oil operators recommended the development of a dedicated roadmap to improve supply in Grand Equateur and Grand Kasai. Proposed measures included waterway dredging and marking, maintenance and rehabilitation of national roads, and the construction of fuel stations in each territory. Other recommendations included expanding the fuel molecular-marking programme and strengthening logistics capacity, notably through the provision of firefighting equipment to the provinces.

Oil operators also called for subsidies for the national railway operator SNCC to increase transport volumes and the number of tank wagons. They further urged the government to ensure regular fuel supply to the provinces and to enforce the existing price structure.

Ronsard Luabeya

Mobile operators in the Democratic Republic of Congo (DRC) face possible sanctions for failing to meet service-quality standards, authorities said.

At a cabinet meeting on Jan. 9, 2026, President Felix Tshisekedi instructed telecommunications regulators to take action to curb recurring disruptions affecting networks and systems nationwide.

The president ordered the strict enforcement of penalties предусмотрed by law against any operator found in breach of obligations relating to service quality, continuity, coverage, or consumer protection. He also called for stronger regulatory oversight, enhanced controls, and continuous monitoring of network and service performance, alongside improved coordination between line ministries, regulators, and technical agencies. A detailed report is due within 30 days.

The disruptions affect mobile and fixed telephony, internet access, data transmission, digital services, network interconnection, and radio and digital television broadcasting.

“These persistent failures seriously disrupt citizens’ daily lives, government operations, and the functioning of the national economy, leading to communication breakdowns, interruptions in banking and commercial transactions, and a marked deterioration in radio and digital television services,” the cabinet statement said.

In late December, Posts, Telecommunications and Digital Affairs Minister Jose Mpanda Kabangu called out operators Orange, Airtel, and Vodacom following user complaints over unstable networks, dropped calls, and limited internet access in Sankuru province.

Earlier, in September, shortly after taking office, the minister highlighted nationwide malfunctions, including frequent outages, network congestion, unjustified airtime deductions, and failed mobile money transactions that were nonetheless billed. Consumers regularly raise these issues on social media.

Pressure on telecom operators comes as Congolese authorities seek to position the digital sector as a key driver of socio-economic development. Officials say reliable, high-performance, resilient, and continuous networks are essential in a competitive environment that ensures fair territorial coverage and strong consumer protection.

Such infrastructure is also critical to support access to digital public services rolled out by the government.

The sanctions under consideration have not yet been specified. However, the 2020 telecommunications and ICT law provides that any breach of license conditions or associated specifications not warranting suspension or withdrawal may be punished by a fine of up to one-quarter of the license value.

Isaac K. Kassouwi

DR Congo’s state-owned airport authority, Régie des Voies Aériennes (RVA), plans to automate the collection of the Infrastructure Development Fund (Idef), commonly known as the Go-Pass after the payment system used in the Democratic Republic of Congo. The plan is outlined in an international call for tenders issued by the RVA on Sept. 23, 2025.

According to the tender document, the company intends to acquire machines, equipment and software to digitize the collection of the fee. Companies were invited to submit bids by Nov. 25, 2025. At this stage, the outcome of the tender is not known. A similar process was launched in June, but no information has been made public on its outcome.

The initiative comes amid recurring criticism over the collection and management of these revenues. In a report published in 2021, the Congo Research Group (CRG) said it was impossible to accurately track all revenue generated by the fee.

The report noted that travellers receive paper coupons upon payment, a system that has enabled parallel networks to emerge, led to the circulation of booklets bearing identical serial numbers, and resulted in weak controls. The GEC also said RVA executives deliberately avoided bank reconciliation to conceal funds.

These findings echo those of a 2012 report by the Court of Auditors on the recovery and use of the fee, which already pointed to obsolete airport infrastructure and governance weaknesses surrounding the Idef.

Created on March 19, 2009, to finance airport modernization and equipment purchases, the fee is set at $50 for passengers on international flights and $10 for domestic flights. For freight, the rate ranges from $0.005 to $0.070 depending on the type of traffic and the direction of the goods.

During hearings at the National Assembly in May 2025, the RVA’s director general, Léonard Ngoma Mbaki, who is currently suspended, said the Idef had generated about $363 million between its creation in 2009 and Dec. 31, 2024.

He said the funds are used as guarantees for loans contracted by the company and as counterpart funding for projects financed by the African Development Bank, including the Priority Air Safety Project in the DRC (PPSA 1 and 2).

Ngoma added that the revenue is also used to finance infrastructure work that is often invisible to passengers but essential to civil aviation operations, such as fire stations, power plants and erosion control at the country’s airports. He was responding to concerns raised by lawmakers and users, who regularly question the tangible impact of the fee.

Timothée Manoke

The Democratic Republic of the Congo has expanded its public-private partnership with German firm Dermalog Identification Systems to $133.2 million, according to a decision signed on June 10, 2025, by Foreign Affairs Minister Thérèse Kayikwamba Wagner that went largely unnoticed.

Under the decision, Dermalog is not only responsible for the $48.8 million contract covering the production of biometric passports, but has also been awarded an additional $84.4 million contract to build a national printing facility dedicated to passport production.

The initial contract, which runs for five years, is already being implemented. Dermalog officially began operations on June 5, 2025, the launch date of the new biometric passport. The document is now priced at $75, representing a 24.2% reduction from the previous fee of $99.

However, available documents do not specify how this fee is shared. It remains unclear how much the private partner earns for each passport produced.

Printing plant planned “in the medium term”

During an interview on Top Congo FM in August 2025, the minister confirmed the existence of the second contract, intended to give the country greater autonomy in passport production. She said implementation would take place in the medium term, within three to four years.

“The second contract will come into force, if I am not mistaken, within three or four years,” she said, noting that the delay would allow authorities to assess the service provider and, if necessary, adjust certain aspects of the first contract currently in force. She also stated that the printing facility to be installed in the DRC would be operated by Congolese staff.

As in the official decision, the minister provided no further details on the second contract. At this stage, no information is available on the technical specifications of the printing plant, the duration of the agreement, or how Dermalog will be compensated for the $84.4 million investment.

A long-standing objective

The goal of achieving autonomy in passport production is not new. It has been a stated priority of the Congolese government for several years. In 2015, the state signed a contract worth more than $200 million with Belgian company Semlex for the production of biometric passports, with the objective of enabling the country to print the documents locally within five years.

That project never materialized. It was widely criticized as excessively costly and was marred by multiple allegations of corruption, while the official passport price at the time stood at $185, one of the highest on the continent.

According to information provided by Dermalog, the current rollout is based on an end-to-end solution, covering online pre-registration, biometric capture, and centralized production.

The company says it has installed 100 fixed and mobile enrollment stations across the DRC, as well as 50 mobile units in embassies and consulates. Production capacity was announced on June 5, 2025, at 2,400 passports per day.

Timothée Manoke

- DR Congo launched validation talks on a national strategy for critical minerals on January 7 in Lubumbashi.

- The draft prioritizes local processing, ESG standards, clean energy use, and improved sector governance.

- Experts urge a coherent framework to turn mineral wealth into inclusive, sustainable development.

The Democratic Republic of Congo moved closer to validating its national strategy for critical minerals and metals as the Ministry of Mines launched validation sessions on January 7, 2026, in Lubumbashi, in the Haut-Katanga province.

The sessions, scheduled to conclude on January 8, will review policy directions on promoting local processing, developing sustainable industrialization, complying with environmental, social and governance (ESG) standards, mobilizing clean energy, strengthening human and technological capacities, improving sector governance, and sharing benefits with local communities.

The Ministry of Mines said Congolese and African experts drafted the strategy with support from Southern Africa Resources Watch (SARW), which has acted as a technical and financial partner to the Congolese mining sector for nearly two decades.

The document aims to provide the country with a consensual and operational framework focused on economic diversification, industrialization, job creation and enhanced value addition from national mineral resources.

The ministry added that this step forms part of a broader process to design a roadmap to reposition DR Congo as a major industrial player in the global value chain for critical minerals and metals, which underpin the energy transition and green industrialization.

In a report published on March 20, the Natural Resource Governance Institute (NRGI) said DR Congo needs a coherent strategic framework to ensure that the energy transition delivers tangible benefits to the population. The report, titled “The Democratic Republic of Congo and the Energy Transition Challenge: Turning Mineral Wealth into a Lever for Sustainable Development,” highlighted structural weaknesses.

NRGI identified gaps in inter-institutional coordination, conflicts of interest, politicization of public action and weak stakeholder inclusion as key factors that have hindered the emergence of a harmonized framework between the mining and energy sectors.

Meanwhile, DR Congo continues to face challenges in locally processing its mineral resources. According to a report by the Publish What You Pay (PWYP) network, the country holds significant potential to capture greater value added as global demand for strategic minerals accelerates amid the transition toward low-carbon economies.

This article was initially published in French by Ronsard Luabeya

Adapted in English by Ange Jason Quenum

- Kinshasa authorities said the city is negotiating a new waste management partnership with Averda.

- Technical studies are set to begin on Jan. 7 ahead of work expected in coming weeks.

- The move revives a failed 2017 contract that stalled over financial guarantees and equipment delivery.

Lebanese waste management company Averda is moving toward a partnership with the city-province of Kinshasa to improve waste management in the Congolese capital, which has faced chronic sanitation problems for decades.

Kinshasa Governor Daniel Bumba met Averda executives on Jan. 6, 2026, alongside provincial sanitation officials.

The governor’s office said the meeting aimed to lay the groundwork for a partnership designed to reduce persistent urban waste and improve living conditions for residents.

The governor’s office said technical studies are due to begin on Jan. 7, 2026, ahead of the effective launch of works in the coming weeks.

The initiative forms part of the “Kinshasa Ezo Bonga” (“Kinshasa Is Changing”) program, which the provincial executive is implementing to modernize urban services and strengthen local governance.

Return after failed 2017 contract

The project marks a renewed attempt at cooperation between Kinshasa and Averda following an earlier contract signed in 2017 that produced no tangible results.

The previous partnership collapsed over an administrative dispute.

Averda requested financial guarantees and an advance payment, while the provincial government awaited the delivery of equipment promised to start operations.

Averda, which was founded in 1964 and is headquartered in Dubai, presents itself as one of the leading waste management and recycling companies in emerging markets.

The group said it serves more than 60,000 public- and private-sector clients, ranging from small and medium-sized enterprises to large institutions.

Averda said its activities include household waste collection, street cleaning, waste sorting and recycling, composting, and the secure disposal of hazardous waste, including strictly regulated medical and chemical waste.

The company operates across Gulf countries and several African markets, including the Republic of Congo, Gabon, Angola, South Africa, and Morocco.

This article was initially published in French by Ronsard Luabeya

Adapted in English by Ange Jason Quenum

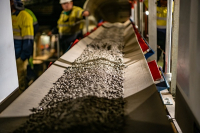

- Ivanhoe Mines said total investment in the Kamoa-Kakula copper smelter reached $1.1 billion.

- The figure exceeded the $700 million estimate announced in 2021.

- Power infrastructure, including Inga II rehabilitation, accounted for a significant share of costs.

Ivanhoe Mines said total investment in the new smelter at the Kamoa-Kakula copper complex reached $1.1 billion, as the company announced the first production of copper anodes.

The company linked the start-up of the smelter to the full capital deployment in a statement accompanying the production milestone.

Robert Friedland, founder and executive co-chairman of Ivanhoe Mines, said the event marked “the culmination of a $1.1 billion investment.”

The $1.1 billion figure exceeded the capital cost estimate Ivanhoe Mines disclosed during the project’s early development stages.

In a statement dated Nov. 18, 2021, Ivanhoe Mines said expected capital expenditure for the smelter stood “in the region of $700 million,” and the company said operating cash flows from Kamoa-Kakula would fund the project.

Ivanhoe Mines did not explicitly state the reasons for the gap between the 2021 estimate and the 2026 investment figure.

However, the $1.1 billion total appeared to include ancillary infrastructure costs, even though the company built the smelter according to the same design outlined in 2021.

Ivanhoe Mines constructed a direct-to-blister smelter with nominal capacity of 500,000 tonnes per year of blister copper, alongside sulfuric acid by-product production and emissions standards aligned with those of the International Finance Corporation, part of the World Bank Group.

To enable initial anode production, Ivanhoe Mines not only built the smelter but also installed an uninterruptible power supply system.

The company said the 60-megawatt system could provide up to two hours of instant backup power, protecting the smelter from voltage fluctuations on the Democratic Republic of Congo’s national grid.

In parallel, the company required 50 megawatts of clean electricity to commission the smelter.

To secure that supply, Ivanhoe Mines rehabilitated turbine five at the Inga II hydroelectric dam, which has total installed capacity of 178 megawatts.

Kamoa Copper, owner of the Kamoa-Kakula complex, estimated the investment at $450 million, including ongoing grid modernization works.

This article was initially published in French by Boaz Kabeya

Adapted in English by Ange Jason Quenum

- DR Congo awarded a $7.46 million contract to Belgian firm Castillo Valere to supply 100,000 pairs of license plates.

- The government set vehicle registration fees at up to $115, with a 50% surcharge for corporate entities.

- Authorities plan to roll out the plate change nationwide from late December 2026.

On January 6, 2026, the Democratic Republic of Congo implemented a new vehicle license plate system. Belgian company Castillo Valere will manufacture the plates.

Documents reviewed by Bankable showed that authorities awarded the supply contract to Castillo Valere in August 2025. The contract totaled $7,456,416 for 100,000 pairs of plates, implying a unit cost of $74.5 per pair.

Authorities awarded the contract following a public tender process that sparked debate over procedural compliance and transparency.

However, market participants described Castillo Valere as a reference supplier in Belgium’s license plate market. The company already operates in Africa, including in Côte d’Ivoire and Mauritania.

Officials from the Ministry of Finance, cited by Top Congo FM, said the Prime Minister must still validate the full technical specifications of the new plates by decree before they carry full legal effect.

Meanwhile, the General Directorate of Taxes (DGI) said the new plate was “designed in line with international standards.”

In 2023, the Public Expenditure Observatory (ODEP) and the Congolese League Against Corruption (LICOCO) accused the previous plate supplier of producing plates using Congo-Brazzaville’s country code “CGO.”

The organizations said the correct code for the Democratic Republic of Congo was “COD.”

Controversies

Tax authorities said the reform aimed to improve driver security, standardize the national vehicle registration system, and strengthen police road controls. Authorities also said the reform would increase state revenue.

A Finance Ministry decree signed in November 2025 set registration-related fees at $115 for a first registration, $72 for a plate change, $24 for vehicle ownership transfer, $54 for a duplicate pair of plates, $30 for a duplicate half-pair, $24 for a duplicate registration certificate, and $24 for an address change on the certificate. The decree increased all fees by 50% when operations involved legal entities.

The launch of the new plates triggered strong reactions among Congolese citizens. Critics questioned the administration’s capacity to deliver the new plates, as authorities still struggled to fulfill previous orders.

Observers said Castillo Valere now faced pressure to demonstrate its ability to produce and deliver plates quickly.

Owners of existing plates also challenged the legality of the operation. They cited the Congolese Highway Code, which prohibits re-registration of vehicles already in circulation.

However, Finance Ministry officials said the process involved only a plate replacement, not a re-registration, and did not alter the original vehicle registration data. Authorities said this phase would begin from late December 2026.

This article was initially published in French by Timothée Manoke

Adapted in English by Ange Jason Quenum

More...

- DR Congo signed a ministerial declaration on Dec. 19, 2025, to extend the Nacala rail corridor toward its borders.

- The project targets an integrated rail network of about 2,400 kilometers linking Zambia, Malawi, Mozambique, and potentially southern DR Congo.

- The initiative aims to cut transport costs, shorten transit times, and boost regional trade competitiveness.

The Democratic Republic of Congo signed a ministerial declaration on Dec. 19, 2025, with Mozambique, Malawi, and Zambia to extend the Nacala railway corridor toward Congolese borders. The extension would give DR Congo rail access to the Indian Ocean through Mozambique’s port of Nacala.

The project plans to create an integrated rail network of about 2,400 kilometers linking Chipata in eastern Zambia to Malawi and Mozambique. The plan also includes a potential extension into southern DR Congo.

Transport and infrastructure ministers from the four countries said the corridor will reduce transport costs, shorten transit times, and strengthen export competitiveness. They also said the project should stimulate industrial growth, improve food security, and consolidate regional value chains.

The ministerial declaration confirms the commitment of the signatory countries to mobilize joint financing and attract strategic partners. It also provides for the harmonization of policies, technical standards, and regulatory frameworks to ensure smooth cross-border rail operations.

The governments plan to finalize an implementation framework in early 2026. The framework will define governance structures, financing models, and construction phases.

Mozambique’s Minister of Transport and Logistics João Matlombe said the next step will involve signing an agreement to appoint a strategic partner for the construction of the railway line and logistics infrastructure. He said authorities plan this step for the first quarter of 2026.

The port of Nacala, located in northern Mozambique, serves as a strategic maritime trade hub in eastern and southern Africa. The port handled 1.4 million tonnes of cargo in 2024, equivalent to 100,000 twenty-foot equivalent units. Mozambican authorities projected traffic of 1.8 million tonnes, or 115,100 TEUs, for 2025.

This article was initially published in French by Ronsard Luabeya

Afdapted in English by Ange Jason Quenum

- NIU Invest granted Critical Metals a £2.1 million ($2.84 million) convertible loan.

- The funding will support operations at the Molulu copper-cobalt project in the DRC.

- Critical Metals targets first mineral sales from Molulu by mid-2026.

NIU Invest SE, the majority shareholder of Critical Metals, has granted the company a loan of £2.1 million, equivalent to about $2.84 million, to finance its activities, notably at the Molulu copper and cobalt project in the Haut-Katanga province of the Democratic Republic of Congo.

The company announced the financing on December 31, 2025. The loan has an 18-month maturity and carries an annual interest rate of 10%, payable at the end of the term.

According to the disclosed terms, the loan takes the form of a convertible bond. This structure allows NIU Invest SE to convert the loan into equity in Critical Metals at any time and under certain conditions.

NIU Invest has used similar instruments to gradually increase its stake in the company. Its participation has now reached 69.62%, giving it effective control over Critical Metals.

The financing provides short-term relief for Critical Metals, whose Molulu project—70% owned by the company—has yet to generate commercial sales. The company remains loss-making.

For the financial year ended June 30, 2025, Critical Metals reported losses of about £2.4 million. This marked a reduction of roughly 13% compared with the previous financial year, when losses stood near £2.8 million.

According to the financial report, the improvement primarily reflects a reduction of about 25% in salary expenses. The company also implemented significant workforce cuts in the Democratic Republic of Congo, particularly among technical staff.

Cost-cutting measures extended to senior management. Since January 1, 2025, remuneration for the chief executive position has been reduced by as much as 30%.

First Sales Expected in 2026

Alongside its financial restructuring, Critical Metals has undergone several leadership changes. Russell Fryer stepped down as chief executive on September 4, 2025, and Ali Farid Khwaja replaced him. Khwaja subsequently resigned on December 16, 2025.

Since then, Danilo Lange has served as interim chief executive.

In its announcement, the company described Lange as an internationally experienced executive with more than 25 years of experience across the mining, consumer goods and marketing sectors. He previously held senior roles at companies including Yahoo and Red Bull and served as chief executive of Auriant Mining AB, a Swedish mining company listed on Nasdaq in the United States.

Critical Metals said his profile suits the company’s transition phase, as the board continues its search for a permanent chief executive.

The loan from NIU Invest again signals the majority shareholder’s confidence in the Molulu project, despite the company’s continued financial losses since launch.

The funding secures short-term operational financing while the company prepares for a ramp-up in activity.

According to Critical Metals’ most recent report, the first mineral sales from the Molulu mine are now expected by mid-2026.

This article was initially published in French by Timothée Manoke

Adapted in English by Ange Jason Quenum

- The mines minister partially and temporarily lifted the suspension on artisanal copper-cobalt processing entities in Lualaba.

- A compliance review found all processing entities in violation of the Mining Code and regulations.

- Authorities will condition any permanent lifting on full regulatory compliance.

The Democratic Republic of Congo partially eased restrictions on artisanal copper-cobalt processing in Lualaba, the country’s main hub for artisanal activity in the sector.

Mines Minister Louis Watum Kabamba lifted “partially and temporarily” the suspension of mining and commercial activities for artisanal mineral processing entities in the copper-cobalt value chain operating in Lualaba. The ministry announced the decision in a statement published on January 5, 2026, following compliance inspections conducted in Kolwezi.

“At the end of the commission’s work (established on December 26), organized into three sub-commissions (administrative and legal, technical, and traceability and compliance), the commission found violations of the Mining Code and Mining Regulations by all processing entities,” the statement said.

The minister framed the decision as a transitional measure, allowing operators time to regularize their status. “The maintenance or definitive lifting of the suspension will remain conditional on the effective regularization of each processing entity,” the document added.

#RDC_MINES | COMMUNIQUÉ DE PRESSE pic.twitter.com/06YGkQgwcv

— Ministère des Mines - RDC (@MinMinesRDC) January 5, 2026

According to the statement, authorities will notify each processing entity within 72 hours of publication. The individual notices will detail corrective measures required to address administrative, technical, and traceability breaches and will specify, where applicable, financial penalties payable under current mining law.

However, the partial lifting does not apply to Luilu Resources. The ministry said the company failed to present credible documentation on technical operations and mineral traceability during the review. Authorities ordered the company to appear again before the commission in Lubumbashi within three days, with the required documents, or face sanctions proportionate to the seriousness of the violations.

Transitional Measure for Haut-Katanga

Authorities also adopted a transitional measure for Haut-Katanga, another province with significant artisanal copper-cobalt activity. Pending inspection results, authorities authorized processing entities on a temporary basis to receive minerals already present at legal or tolerated artisanal sites.

Provincial services will supervise the operation, including the provincial mining division, the provincial directorate of SAEMAPE, the provincial ministry of Mines, and representatives of cooperatives and traders.

Since December 19, 2025, authorities have suspended activities of all artisanal mineral processing entities in the copper-cobalt sector nationwide. The mines minister said the suspension forms part of the implementation of the roadmap of the National Commission to Combat Mining Fraud.

The measure aims to clean up the artisanal mineral supply chain and ensure compliance with OECD due diligence principles and the national traceability manual.

This article was initially published in French by Ronsard Luabeya

Adapted in English by Ange Jason Quenum

The Democratic Republic of Congo’s regulator has extended the deadline for using cobalt export quotas to March 31, 2026, from the last quarter of 2025, according to a statement reported by Reuters on Wednesday.

The move eases uncertainty caused by bottlenecks in DRC’s new cobalt export process. After imposing an embargo on shipments of the battery metal in February, Kinshasa introduced an export quota system in October. Under that system, 18,125 metric tons of cobalt were allocated for export between October and December 2025.

Several companies were unable to use their quotas because the regulatory framework does not allow the transfer or deferral of shipments. Finance Minister Doudou Fwamba said recently that cobalt exports had “resumed,” without providing details on volumes or companies involved.

CMOC, a major cobalt producer in DRC with a fourth-quarter 2025 export quota of 6,650 tons, said the first shipments were unlikely to depart before January. Administrative procedures extended into the final weeks of 2025, including sampling under the new quota system and customs payments.

While the extension removes uncertainty over unused 2025 quotas, other challenges remain for the Congolese government, which must show it can implement the new framework sustainably. The February embargo, imposed amid a surplus market that had weighed on prices, coincided with a surge in cobalt prices in 2025.

Even if the policy succeeds in supporting prices, Kinshasa must manage the risk of substitution. Some analysts warn that restrictions on Congolese supply could prompt manufacturers to accelerate efforts to reduce cobalt use in electric vehicle batteries.

Emiliano Tossou