News (739)

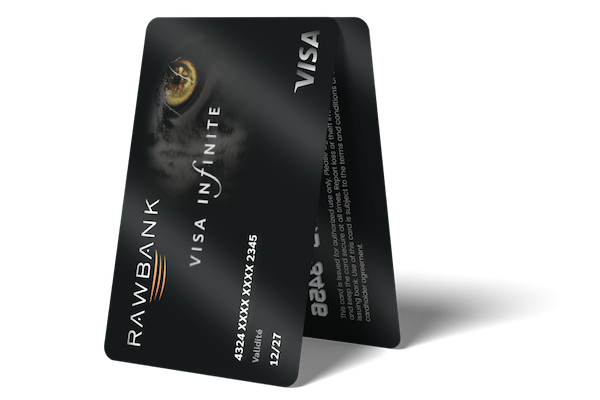

Premium Visa cardholders in the Democratic Republic of Congo saw a sharp increase in international travel spending and high-end retail purchases in December 2025, according to a Feb. 10, 2026 statement from Visa.

Data from the Visa Consulting & Analytics Retail Spend Monitor, based on a subset of VisaNet transactions and supplemented by estimates for other payment methods, showed that international travel spending by premium Visa cardholders rose more than 45% year-on-year during the holiday period from Dec. 1 to Dec. 31, 2025.

Spending in the DRC by international Visa cardholders, both premium and non-premium, also increased. Visitors from the United Arab Emirates, Zambia, the Czech Republic and Portugal were among the fastest-growing segments, with spending rising more than 75%.

Among Congolese premium Visa cardholders, international travel spending rose 45%. Spending on travel to destinations including France, China, Morocco and the United States increased by about 85%.

Luxury retail also recorded strong growth. Spending on clothing and jewelry abroad by premium Visa cardholders rose more than 55% during the holiday period.

Sophie Kafuti, Visa Cluster Head DRC, said the results reflect changing consumer behavior during the holidays. She said the company aims to support these trends by offering “secure, seamless and innovative payment solutions for consumers and businesses.”

In the DRC, Visa has expanded its local presence through partnerships with commercial banks and fintechs. In September 2025, it launched VisaPay, an application designed to facilitate digital payments for consumers and improve everyday payment transactions.

Ronsard Luabeya

The price of gray cement has risen sharply in Mbuji-Mayi, the capital of DRC's Kasai Oriental province. According to local sources, a 50-kilogram bag has been selling for between $30 and $32 since last weekend, nearly double the price in Kinshasa and Haut-Katanga. The range represents an increase of 20% to 28% from the $25 seen a week earlier.

According to the same sources, the increase stems from tight supply on the local market following disruptions, particularly after the collapse of the Katongoka bridge in Haut-Lomami province on a route used to transport cement to Kasai Oriental. Reduced deliveries have led several warehouses in the city to run out of stock.

The cement market had faced supply pressures before. In June 2025, the price per bag rose from $24 to $27 in Mbuji-Mayi, linked to warehouse shortages and sustained demand from construction companies operating in the province.

At that time, the Federation of Congolese Enterprises (FEC) cited logistical constraints, including disruptions to freight shipments from Greater Katanga due to limited availability of wagons from the National Railway Company of Congo (SNCC).

Under construction since August 2024, the Katanda cement plant is expected to help stabilize prices in the province. With an annual capacity of 300,000 tons, expandable to 1.2 million tons, the plant was scheduled to begin production in February 2026. But according to information gathered locally, that has not yet happened.

Boaz Kabey

Work to rehabilitate a 65-km section of National Highway 18 (RN18) in Kwilu province began on February 9, 2026, covering the stretch between Petit-Kasaï and Bulungu, as well as a secondary road serving the Vanga Catholic mission.

The project is part of the Sino-Congolese cooperation programme implemented by the Société d’Infrastructures Sino-Congolaise (SISC) and financed by Sino-Congolaise des Mines (Sicomines). It includes strengthening the road surface, installing drainage ditches and systems, and repairing and reinforcing structures such as bridges and culverts to ensure year-round trafficability and improve safety.

Sinohydro 14, a subcontractor to SISC, is carrying out the works under the supervision of the Congolese Agency for Major Works (ACGT). The start of construction follows a site assessment conducted in June 2025 by ACGT engineers to gather technical data.

The rehabilitation comes amid concerns over the deteriorating state of the road and erosion risks around Bulungu, which threatened to render sections impassable, isolate villages and hinder access to essential services, particularly healthcare and education.

In April 2025, elected officials from Bulungu had already alerted the Office of Roads to the degradation of several segments, notably the 5-km Kimbulu stretch leading to the Vanga referral hospital in Kilunda sector. In a letter signed by Serge Maseka Ndombe, vice-president of the Kwilu Provincial Assembly, provincial deputies requested financial and logistical support to maintain or rehabilitate the section, citing the need to facilitate patient access and support local socio-economic activity.

The letter underscored the strategic importance of the road for evacuating agricultural produce and maintaining access to basic services in Bulungu territory. RN18 connects National Highway 1 (RN1) to remote rural communities, serving as a key corridor for the movement of people, goods and farm output to regional markets.

Boaz Kabeya

The Butembo copper project, located in the insecure eastern Democratic Republic of Congo, has been acquired by African Discovery Group (AFDG). The U.S.-traded company said it signed a definitive share purchase agreement with Grabin Mining SAS, which holds the permit covering the project.

AFDG said the deal was structured as a reverse takeover, a mechanism that allows a listed company to bring an unlisted asset onto the market, typically by issuing shares to the asset’s owners. The company said shares were issued to the permit holders and that the mining interest is now owned by the U.S.-domiciled entity.

In effect, the Butembo project now sits within the structure of the U.S.-listed issuer, with the former asset holders becoming shareholders. The transaction remains subject to regulatory approval, including in the DRC.

A company listed on a lightly regulated market

AFDG trades on the U.S. OTC market, a less regulated segment than major exchanges such as the NYSE or Nasdaq. Public filings show the company has shifted strategy in the past before pivoting toward metals.

The group also announced a name change and now operates as Copper Intelligence. It describes itself as the first independent DRC-focused company listed in the United States and positions itself as a vehicle dedicated to acquiring and exploring copper assets in the country.

The new management team is led by Andrew Groves, presented as the founder of several African mining companies, including Camec, African Platinum and Central African Gold, all reportedly sold. The team also includes Aldo Cesano, who cites 40 years of experience in mining and logistics development in the DRC, Zimbabwe and southern Africa.

An asset described as prospective

Copper Intelligence describes Butembo as a near-surface exploration target with a low strip ratio. The project lies about 50 kilometers from the Ugandan border, near the Kilembe mine, which has verified reserves of around 4 million tonnes. The company highlights high-grade samples of up to 18% copper and says it has access to rail infrastructure.

However, there is no evidence of a mineral resource estimate compliant with international reporting standards, nor of a declared mineral reserve. The statement does not outline a detailed technical program, such as drilling plans, timelines or budget, required to assess the project at an industrial scale.

Bringing Butembo under a U.S.-listed structure could improve visibility and potentially ease access to funding for exploration. It also increases exposure to reporting requirements and investor scrutiny, even if OTC standards are lighter than those of major exchanges.

“We are delighted to hold this status as a dedicated US company operating in Africa, aggregating assets in the DRC's highest grade copper deposits in the world,” Copper Intelligence President Andrew Groves said.

The key challenge will now be technical: converting a prospective asset into a defined and financeable project supported by independent data capable of underpinning an economic assessment.

Pierre Mukoko & Ronsard Luabeya

Commodities trader Mercuria announced on Feb. 9, 2026, "the completion of its first copper and cobalt transaction" with Entreprise Générale du Cobalt (EGC). The statement did not specify whether the deal involved a direct purchase, an offtake contract, or a marketing mandate.

The announcement indicated simply that the transaction involves its first export shipment of copper and cobalt, without disclosing volumes. "The copper cathodes are intended for shipment to either the United States of America, the United Arab Emirates or Saudi Arabia," the statement said, positioning the operation as an extension of the joint venture between Gécamines, EGC's sole shareholder, and Mercuria, announced in late 2025 and dedicated to trading critical minerals.

In November 2019, EGC was mandated to develop a responsible artisanal cobalt value chain in the Democratic Republic of Congo (DRC) by organizing and regulating artisanal and small-scale mining. In this capacity, the company holds a monopoly on the purchase, processing, refining, sale, and export of cobalt extracted by artisanal miners or artisanal mining companies in the country.

Strengthened by Export Quotas

This position was also strengthened by the cobalt export quota policy that took effect in the DRC on Oct. 16. Under this policy, EGC was allocated the fifth-largest export quota: 1,775 metric tons for 2025, and 5,640 metric tons for 2026 and 2027, subject to possible adjustments based on global market developments by the end of 2026 or prospects for local processing of cobalt hydroxide into higher-value products. Problems with the new export system in 2025 led to the rollover of that year's quotas into 2026. In total, EGC could export up to 7,415 metric tons of cobalt in 2026.

On Nov. 13 in Kolwezi, EGC presented its first production of 1,000 metric tons of artisanal cobalt, described as structured, ethical, and traceable. The copper cathodes mentioned in the transaction announced by Mercuria were reportedly produced from copper residues recovered after processing artisanal cobalt.

Also on Feb. 9, 2026, EGC and Trafigura, another commodities trader, announced they had agreed to "the first delivery of copper and cobalt to global markets via the Lobito Atlantic Railway (LAR)," without specifying either the quantity or the date. According to Franck Rogozin, Trafigura's head of metals and minerals for Africa, the aim is to "collaborate with EGC to facilitate the transport of copper and cobalt from responsible sources to global markets via the most efficient transport route from the DRC's Copperbelt."

Implementing the Partnership with the United States

Alongside Vecturis and Mota-Engil, Trafigura is a member of the LAR consortium, which has held since July 2022 a 30-year concession to operate and modernize the Angolan section of the Lobito corridor, 1,300 kilometers between the deep-water port of Lobito on Angola's Atlantic coast and the DRC border at Luau. In theory, this is the shortest route for exporting mining products from Kolwezi. But the roughly 450-kilometer Kolwezi-Luau line is in poor condition.

According to EGC's director general, Eric Kalala, the first copper shipment will go to U.S.-based customers, marking a tangible step in implementing the strategic partnership signed on Dec. 4 between Washington and Kinshasa in the critical minerals sector.

Under that agreement, Congolese state-owned companies must prioritize the U.S. market for their mining exports. The agreement also stipulates that over the next five years, 50% of copper, 30% of cobalt, and 90% of zinc marketed by these companies will transit through the Lobito corridor.

EGC and Trafigura have had a commercial agreement in place since 2020. The partnership provides financing to EGC to fulfill its mandate, in exchange for a portion of its cobalt hydroxide production. The companies have not disclosed the terms of the agreement. But in June 2022, in an open letter to the prime minister, a group of civil society organizations claimed the partnership involved financing of around $80 million for 50% of production, without further details.

Pierre Mukoko & Ronsard Luabeya

Finance ministers from the Democratic Republic of Congo (DRC) and the Republic of Congo are set to sign a bilateral agreement on Feb. 12, 2026, establishing a special tax regime for the construction and operation of the Kinshasa-Brazzaville road-rail bridge.

The announcement followed technical meetings in Kinshasa held to finalise the documents. The project was officially launched on Feb. 3 by Jean-Claude Mido Mbuete, deputy director-general of the Congolese Agency for Major Works (ACGT), and was described as a key step toward implementation.

“Today we have a harmonised tax and customs framework for this project. We also have a bilateral agreement establishing that framework, which will allow us to relaunch the call for tenders for the Congo River road-rail bridge between Brazzaville and Kinshasa in the coming days,” said Caddy Elisabeth Ndala, head of the Brazzaville delegation, after the meetings.

The absence of a dedicated tax regime had delayed the selection of a concessionaire. The signing of the bilateral agreement is expected to restart the process.

According to Congolese authorities in Brazzaville, the tender had initially been scheduled for June, followed by the selection of a partner in September 2025 and the opening of negotiations with the chosen concessionaire to reach financial close. Authorities on both sides of the river had said construction would be officially launched before the end of the year.

A project valued at more than $700 million

“Technical assessments put the cost of the project at around $700 million. This should be seen as a first phase, as additional components are expected to be added over time,” Alexis Gisaro, then DRC minister of Infrastructure and Public Works, said in January last year. In 2017, the African Development Bank (AfDB) estimated the cost of the project at $550 million.

The road-rail bridge, designed to link the two closest capital cities in the world, is among the major infrastructure projects aimed at boosting regional integration under the New Partnership for Africa’s Development (NEPAD). It is also a strategic link along the Tripoli–Windhoek transport corridor, which runs through Chad, Cameroon, the two Congos and Angola.

Project coordination and implementation have been assigned to the Economic Community of Central African States (ECCAS). Feasibility studies have already been completed and were financed by the AfDB and the two Congolese states.

First proposed in the 1990s under former Zaire president Mobutu Sese Seko, the project involves the construction of a 1,575-metre toll bridge across the Congo River. It will include a railway line, a roadway with pedestrian access and a border control post on each bank.

Once completed, the bridge is expected to ease mobility and trade between the two cities, which are currently linked only by river transport. Annual passenger traffic is projected to rise from 750,000 to more than 3 million, while freight volumes are expected to increase from 340,000 to nearly 2 million tonnes.

Boaz Kabeya

The Kinsuka hydroelectric power plant project, developed by the Kinsuka Power joint venture between Great Lakes Energy, owned by entrepreneur Yves Kabongo, and Forrest Group subsidiary Congo Énergie, has secured all required regulatory approvals for electricity generation. The announcement was made by Minister of Hydraulic Resources and Electricity Aimé Molendo Sakombi during a briefing at the Council of Ministers meeting on February 6, 2026.

The minister, however, called for government backing to facilitate the final steps needed to move the project into construction, without elaborating. These may include site preparation, financial close, or tax exemptions for the import of machinery and equipment. Total investment in the project is estimated at around $2.8 billion, with construction expected to take five years.

The project involves the construction of a hydroelectric power plant on Kwidi Island in Kongo Central province. Feasibility studies conducted by Tractebel and validated in 2018 provide for the installation of 12 turbines, each with a capacity of 75 MW, for total installed capacity of 900 MW and average annual output estimated at 7,450 GWh.

Of the electricity generated, around 600 MW is expected to be supplied to mining companies via new high-voltage transmission lines to be developed by Great Lakes Energy, while the remaining 300 MW will be allocated to supply Kinshasa.

According to the minister, the project is intended to address several of the country’s structural challenges. It aims to reduce Kinshasa’s chronic power deficit by improving electricity availability and reliability for households, public services, and economic activity, strengthen national energy security by expanding generation capacity from a renewable and competitive source, and support the objectives of the DRC Energy Compact by accelerating electricity access and economic growth.

Ronsard Luabeya

On February 7, 2026, Agriculture and Food Security Minister Muhindo Nzangi Butondo signed a Memorandum of Understanding (MoU) with Greek firm Géothermiki for technical studies to establish agropoles across the country.

The Greek firm will support the Ministry of Agriculture and Food Security in conducting the technical studies needed to set up pilot sites in several provinces, ahead of a gradual nationwide rollout, the ministry said. The MoU will need to be followed by the signing of a formal public contract.

Founded in 1996, Géothermiki Hellas operates in the agricultural sector and specializes in the dehydration and processing of fruits and vegetables.

The Congolese government has stepped up initiatives in recent months aimed at organizing and modernizing the agricultural sector. Last August, the Ministry of Industry signed a protocol agreement with ETIC International Africa Holdings Ltd to develop an agropole in Tshopo province. No public update has been provided on progress since that agreement was signed.

In July, the Ministry of Agriculture organized “Agropole Days” in Kinshasa to promote a new agricultural strategy and highlight the role of agropoles in boosting agricultural production and processing.

Separately, the DRC signed another international cooperation agreement with Ukraine in January 2026 covering agriculture, food and nutrition. The agreement was concluded in Berlin during the Global Forum for Food and Agriculture and includes provisions for the transfer of agricultural technologies to boost productivity and strengthen local agricultural value chains.

Boaz Kabeya

Transport Minister Jean-Pierre Bemba said preparations were underway for an international tender to rehabilitate the Tenke-Kolwezi-Dilolo rail section, scheduled for April 2026, with construction expected to begin in the final quarter of the year.

The announcement was made at the first Lobito Corridor coordination meeting, held on February 5, 2025, in Luanda, Angola.

According to feasibility studies presented last September by a delegation of experts from the European Union and the United States, the rehabilitation of the Dilolo-Kolwezi-Tenke railway line—the Congolese segment of the corridor—will require between $400 million and $410 million in investment, in addition to maintenance costs estimated at $180 million over a ten-year period.

The government has yet to specify the project’s delivery structure, though a public-private partnership (PPP) is under consideration. Officials said the Democratic Republic of Congo has initiated institutional reforms aimed at establishing a PPP framework aligned with international standards.

Officials also confirmed that the World Bank will coordinate the project’s financial and technical structuring. The Bretton Woods institution has been appointed lead arranger by the DRC and has committed $500 million in financing.

Emergency repairs underway

Pending full-scale rehabilitation, Bemba said emergency repairs are being carried out on nearly 80 kilometres of critical sections to maintain rail operations.

Meanwhile, feasibility studies are continuing on the Tenke-Lubumbashi-Sakania section, with World Bank support. A call for co-financing has been launched for this stretch. According to the studies presented last September, extending the line to the Zambian border will require at least $690 million in investment.

In a statement released on December 5, the U.S. International Development Finance Corporation (DFC) said it had issued a letter of intent to Mota-Engil, signalling its willingness to finance the rehabilitation, operation and transfer of the Dilolo-Sakania railway line for more than $1 billion.

Mota-Engil is part of the Lobito Atlantic Railway (LAR) consortium, alongside Trafigura and Vecturis. The consortium has held a 30-year concession since July 2022 to operate and modernise the Angolan section of the corridor.

Ronsard Luabeya

The Democratic Republic of Congo’s state electricity utility, SNEL, has launched a call for expressions of interest to hire a firm to migrate its commercial management application to a web-based platform. The project aims to transform the tool currently used to manage low-voltage customers into an internet-accessible solution, as part of a broader modernization of the company’s commercial management system.

The initiative follows a call for expressions of interest signed on Jan. 26, 2026, by SNEL’s Director General, Teddy Lwamba Muba, and published on the website of the Public Procurement Regulatory Authority (ARMP). In the document, SNEL cites technical limitations of the existing application, known as GCOWEB-BT, as the main justification for the project.

According to the notice, the software must be installed individually on each workstation, with updates carried out computer by computer, a process described as time-consuming. The document also points to high memory and resource usage, which can affect performance during routine management operations and billing calculations. It further highlights accessibility constraints. The application reportedly works only on the workstation where it is installed, cannot be accessed from other devices such as tablets or smartphones, and shows inconsistent performance on operating systems other than Windows.

Against this backdrop, SNEL plans to migrate to a web-based application that would be accessible wherever an internet connection is available, while improving performance, ergonomics, and functionality. The document highlights an approach that would allow centralized deployment and maintenance, as well as easier integration with other systems.

A multi-million-dollar challenge

According to SNEL’s latest available detailed report for the 2022 fiscal year, reviewed in hard copy, low-voltage customers accounted for around 16.6% of revenue, or $124.8 million, out of total turnover of $752 million. The same report puts the number of low-voltage customers at nearly 797,600, representing about 99% of the customer base. These figures underscore the importance of management tools better suited to this portfolio.

At this stage, the notice does not disclose the cost of the project but states that the estimated duration of the assignment is eight calendar months. Most of the work will be carried out at SNEL’s headquarters in Kinshasa, with a planned rollout across all provinces served by the utility. Candidate firms must demonstrate proven experience, including at least five years of activity and a minimum of two similar assignments completed over the past three years.

In terms of expected outcomes, SNEL highlights gains in accessibility and performance. The impact analysis outlined in the 2022 report also points to potential improvements in operational reliability and traceability, while identifying risks related in particular to data migration, cybersecurity, and staff adoption of the new system.

Applications must be submitted to SNEL’s Procurement and Markets Department in Kinshasa/Gombe no later than March 3, 2026, at 2 p.m. local time, in accordance with the terms set out in the notice published by the ARMP.

Timothée Manoke

More...

The United States has renewed the African Growth and Opportunity Act (AGOA), extending the program until Dec. 31, 2026. According to the Office of the United States Trade Representative (USTR), President Donald Trump signed the legislation on Feb. 3. The extension applies retroactively from Sept. 30, 2025, the date on which the previous authorization expired.

The renewal maintains preferential access to the U.S. market for eligible African countries, including the Democratic Republic of Congo (DRC).

The decision comes amid a sharp surge in Congolese exports to the United States in 2025. Between January and July, exports reached $1.3 billion, exceeding the combined total of the previous eight years. More than $1 billion worth of goods were shipped between April and July alone, with monthly exports peaking at nearly $400 million in June.

Momentum, however, weakened in the second half of the year. Exports fell to $86.9 million in September, dropped further to $12.3 million in October, and then rebounded modestly to $38.2 million in November. December data are not yet available.

Even so, 2025 is shaping up to be a record year in bilateral trade. Congolese exports to the United States are approaching $2 billion, generating an estimated trade surplus of $1.6 billion.

Trade diversion?

In July 2024, the Congolese government adopted a national strategy to boost exports to the United States under AGOA. The plan aims to raise bilateral trade to between $3 billion and $5 billion over the 2025-2030 period.

The strategy targets 26 sectors. These include 21 non-mining industries such as coffee, cocoa, palm oil and pineapple, as well as five mining sectors: copper, diamonds, gold, cobalt and the so-called 3Ts, cassiterite, wolframite and coltan.

However, the strategy alone does not fully explain the recent surge. The United Nations Economic Commission for Africa (UNECA), which has also observed rising exports from other African countries to the United States, attributes the trend to strong U.S. demand for African raw materials and trade diversion effects. The timing of these increases, coinciding with the escalation of the U.S.-China trade war, supports this analysis.

To sustain the momentum, the Ministry of Foreign Trade has reminded exporters of the requirements for accessing the U.S. market. These include compliance with quality and certification standards, notably those of the Food and Drug Administration, adherence to the Congolese Control Office’s regulations, and packaging requirements. The ministry also encourages exporters to use the Congolese diaspora in the United States as commercial intermediaries.

Boaz Kabeya

Rio Tinto formally ended discussions with Glencore on Feb. 5, 2026 over a potential merger or other combination after the parties failed to reach an agreement. The Anglo-Swiss group confirmed the decision shortly afterwards. Under the UK Takeover Code, Rio Tinto is now restricted from making a new offer in the near term, except under limited circumstances.

Glencore said it is now focusing on executing its 2026 priorities, including meeting operational targets, de-risking its portfolio and pursuing organic growth.

Democratic Republic of Congo

In the Democratic Republic of Congo (DRC), where Glencore controls the Mutanda Mining (Mumi) and Kamoto Copper Company (KCC) copper and cobalt mines, this strategic focus has increased the relevance of a proposed partnership with the Orion Critical Mineral Consortium (Orion CMC). Based on details disclosed so far, the proposed transaction aligns with Glencore’s 2026 priorities and would involve neither a change of control nor operational disruption. Instead, it would provide a capital injection and risk-sharing to support the development of existing assets and potentially fund new acquisitions.

The Orion option is outlined in a non-binding memorandum of understanding announced on Feb. 3, 2026. It envisages the acquisition by the U.S.-backed consortium of 40% of Glencore’s interests in Mumi and KCC, based on a combined enterprise value of about $9 billion, including debt.

Capital structure

Under the proposed capital reconfiguration, Glencore would remain the majority shareholder, with a 57% stake in Mumi and 42% in KCC, alongside Orion CMC with 38% and 28%, the Congolese state with 5% of Mumi, and state miner Gécamines with 30% of KCC.

The framework would allow Orion CMC to appoint non-executive directors and to direct the sale of its share of production to designated buyers, in line with the strategic partnership between the United States and the DRC. Glencore would retain operational control of the mines.

The transaction remains subject to due diligence, the signing of binding documentation and the receipt of regulatory approvals. Completion would also depend on governance arrangements and approvals from Congolese shareholders. Glencore and Orion said they intend to work with the government and Gécamines.

Pierre Mukoko

Egyptian civil engineering firm Safrimex is set to begin rehabilitation work at Bandundu Airport in Kwilu Province.

Company representative Glody Asani announced the move on Feb. 2, 2026, during a meeting with Governor Philippe Akamituna Ndolo. The project involves rehabilitating the airport’s runway and apron to improve landing and take-off safety for the presidential aircraft and other planes.

The project is part of preparations for the 13th Provincial Governors’ Conference and a planned visit by President Félix-Antoine Tshisekedi to Bandundu, the provincial capital. Originally scheduled for Dec. 9 to 13, the conference was postponed indefinitely by order of the president.

The airport had not received the repairs needed to ensure the safety and smooth operation of flights. According to the Prime Minister’s office, this followed the termination of a contract between the Office of Roads and the Régie des Voies Aériennes (RVA), as the Office of Roads lacked the technical and financial capacity to complete the work within the required timeframe. The project was subsequently awarded to Safrimex.

During a Council of Ministers meeting on Jan. 23, 2026, Prime Minister Judith Suminwa instructed the ministers of Transport and Finance to finalize the contracting process without delay and ensure the rapid execution of the work.

According to Fiston Mwemu, commander of Bandundu Airport, the project will begin with a preliminary study, considered essential before the start of the rehabilitation works. He said work would begin shortly.

Separately, a new airport is planned for Bandundu with support from the African Development Bank (AfDB). It is expected to be built on a site further from the city centre and is seen as a way to open up the region and stimulate investment.

Ronsard Luabeya

The Congolese Agency for Large Works (ACGT) announced the launch of modernization studies for the port of Bumba in Mongala province on Feb. 3, 2025. ACGT Director General Nico Nzau Nzau disclosed the information to Prime Minister Judith Suminwa during her official visit to the province.

According to the ACGT director general, the modernization project is expected to move into its implementation phase in the coming days. It includes the replacement of two dilapidated cranes, installed in 1955 and out of service since 1992, with modern equipment. The port platform will be entirely redeveloped to accommodate around ten boats, with the construction of a wider quay suited to current requirements. The rehabilitation of Avenue du Port, which is 1,700 meters long, as well as erosion control works along several affected sections of the riverbank, are also planned.

The cost of the project has not yet been disclosed, but financing will be provided under the Sino-Congolese program.

The port of Bumba, which measures 410 by 110 meters, is currently in an advanced state of decay, significantly constraining its operations. The infrastructure is managed by the public company CFU-F (Uélés-River Railway). It is connected to the Vicicongo railway line (Bumba–Isiro), which is used to transport agricultural products, including coffee and rice, to the river for shipment to other provinces.

A modernization plan had already been announced in 2019. It included the rehabilitation of the administrative building, the development of the docking quay, the construction of a boundary wall, and the reconstruction of five warehouses. These works were to be financed by the Congolese state, according to theSteering Committee for the Reform of Enterprises of the State Portfolio (COPIREP). However, the project has yet to materialize.

Ronsard Luabeya