The Democratic Republic of Congo (DRC) has joined other African nations in a united effort to counter the growing market for synthetic diamonds. During the International Ministerial Roundtable on Natural Diamonds, held in Luanda, Angola, from June 17 to 19, 2025, Africa's leading diamond producers and global industry leaders pledged 1% of their revenues to promote and market natural diamonds. Along with the DRC, Botswana, Namibia, South Africa, and Angola are also signatories to this agreement.

The diamond sector has been significantly impacted by the rise of synthetic diamonds, often perceived as more affordable and environmentally friendly. This shift has intensified pressure on natural diamonds, leading to a sharp decline in prices. Prices fell from $12.50 per carat in 2022 to $9.60 in 2024, a 23.2% drop.

Promoting Natural Diamonds

The Natural Diamond Council, a nonprofit organization dedicated to promoting natural diamonds, is leading a global awareness campaign. According to Angola’s Ministry of Mineral Resources, as cited by Le Monde, this campaign aims to educate a new generation of consumers about the rarity, authenticity, and socioeconomic benefits that natural diamonds bring to local communities and producing countries.

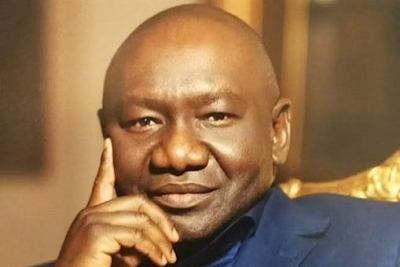

At the roundtable, Kizito Pakabomba Kapinga Mulume, the DRC’s Minister of Mines, urged a coordinated effort to revitalize the natural diamond sector. He described the sector as a driver of development, a vehicle for peace, and a vital source of added value for local populations. He also emphasized the need to establish an ethical, traceable, transparent, and fair value chain for African natural diamonds.

Despite being among the world’s top diamond producers, the DRC faces significant challenges in its diamond sector. Official figures show that the country’s diamond exports have dropped from 17.9 million carats in 2017 to just 9.2 million in 2024. This decline is largely attributed to structural difficulties faced by the country's main producers, including Bakwanga Mining Company (MIBA) and Anhui-Congo Mining Investment Corporation (SACIM).

This article was initially published in French by Ronsard Luabeya (intern)

Edited in English by Mouka Mezonlin