News (739)

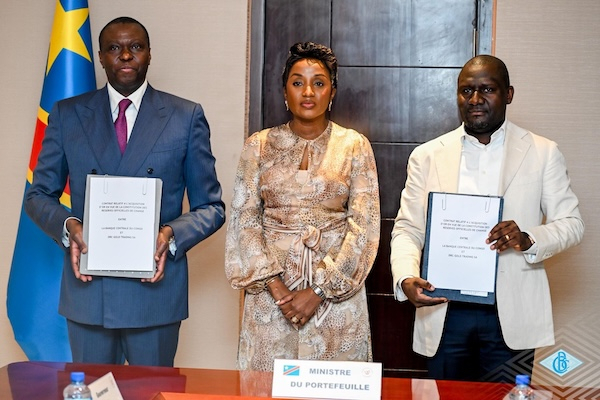

The Democratic Republic of Congo's central bank has moved to add gold to its official reserves, signing an agreement on Feb. 20 with DRC Gold Trading, the state-owned company responsible for collecting and exporting artisanal gold.

Under the deal, the Central Bank of the Congo (BCC) will serve as the primary buyer of gold produced by the country's artisanal miners through DRC Gold Trading, Governor André Wameso said at the signing ceremony.

The project is designed to “correct a major historical anomaly”: the fact that a leading gold producer holds no physical gold in its vaults. For the BCC, the initiative also aims to reinforce the stability of the Congolese franc and strengthen the country's financial sovereignty, against a backdrop of rising gold prices and a broader push to diversify reserve assets.

The move is consistent with the priorities Wameso has pursued since his appointment as central bank governor in July 2025: reducing the country's structural dependence on the dollar and restoring confidence in the Congolese franc. Since September 2025, the national currency has appreciated 19%.

The financial terms of the BCC-DRC Gold Trading partnership, including the payment currency, purchase price, volumes, timeline, delivery arrangements, storage, auditing and transparency mechanisms, have not been publicly disclosed. Those details are critical to assessing Wameso’s strategy.

Challenges

The BCC said that holding monetary gold will protect its reserves against inflation and geopolitical shocks. Described as a safe-haven asset with no counterparty risk, gold would help reduce the reserves’ exposure to fiat currency depreciation and bolster confidence in the national currency. The extent of that effect will depend, in part, on gold’s eventual share of total reserves.

According to several monetarists, the project’s impact on franc stability will also hinge on the purchasing framework, particularly the payment currency. If gold is purchased in Congolese francs, the operation could support use of the national currency, but it would strengthen the franc only if the BCC prevents those purchases from generating uncontrolled monetary expansion. If the liquidity injected into the economy is not subsequently absorbed or offset, the operation could stoke inflation and increase demand for dollars. Conversely, if gold is purchased in dollars, the arrangement could enhance the appeal of the official channel in a heavily dollarized sector, but it could also strain foreign currency liquidity if payments draw down foreign exchange reserves.

Wameso must also contend with competition from informal supply networks. To draw gold away from those channels, the official buyer must offer sufficiently attractive pricing and payment terms while guarding against the re-labeling of smuggled gold. For several players in the sector, payments in Congolese francs are widely seen as a drawback.

In 2025, the DRC channeled 2.3 metric tons of artisanal gold through official channels, according to official statistics described as preliminary and incomplete. For 2026, DRC Gold Trading is targeting 15 to 18 metric tons of artisanal gold per year and more than $2 billion in export revenues. To establish itself as the primary buyer, the BCC must also address a liquidity challenge: balancing foreign exchange interventions, which involve selling dollars, buying francs and meeting priority public import needs, with gold purchases.

Pierre Mukoko & Ronsard Luabeya

Anhui Foreign Economic Construction Ltd Congo Corp (SACIM) has completed its first public sale of 288,000 carats of industrial diamonds in Antwerp, Belgium, the Consulate General of the Democratic Republic of Congo in the city said.

The sale was held from Feb. 16 to Feb. 20, 2026, with technical support from Belgian firm Samir Gems, active in the diamond and jewelry trade, and the Antwerp World Diamond Centre (AWDC). A total of 67 international companies took part, with leading buyers from China, India, the United States and Italy.

The transaction marks the return of Congolese industrial diamonds to the Antwerp market after more than a decade, the Consulate said. However, the interruption did not affect all exports. Official statistics show Belgium among the importers of Congolese industrial diamonds in 2024 and 2025, with 3.96 million and 1.7 million carats respectively.

Following the sale, Sacim, Samir Gems and the AWDC agreed on an annual schedule of public sales and a framework for technical and institutional support aimed at strengthening the long-term presence of Congolese diamonds in Antwerp.

The sale comes eight months after the liberalization of diamond trading by Congolese producers. In June 2025, then-Minister of Mines Kizito Pakabomba repealed a 2022 decree that regulated mineral sales through the Center for Expertise, Evaluation and Certification of Precious and Semi-Precious Mineral Substances (CEEC). The framework limited producers to a restricted list of buyers, a system that could influence prices. As a major player in the sector, Sacim was among the companies most affected.

The terms of the Antwerp sale were not disclosed. Official 2025 mining statistics nonetheless show an improvement in Sacim’s average sales price. In 2024, when the sector’s average price stood at $9.63 per carat, Sacim recorded $11.38. In 2025, the company maintained an average price of $11 while the sector average fell to $7.4 per carat. Natural diamond prices have been declining for several years.

According to official data, exports by Sacim, jointly owned by China’s Anhui Foreign Economic Construction Corporation (AFECC) and the Congolese state, were halved, falling from 2,887,100.25 carats in 2024 to 1,151,865.58 carats in 2025. The company accounted for 13.5% of national output, producing just over 1.1 million carats.

Ronsard Luabeya

Tshopo province, in north-central Democratic Republic of Congo, has recorded its first official exports of artisanal gold, according to 2025 mining statistics released on Feb. 3.

The data, described as “provisional and partial,” show that Tshopo exported 125.26 kilograms of gold over five months. The figures may reflect the launch of DRC Gold Trading’s operations in the province. The state-owned company, which channels and exports Congolese artisanal gold, now lists Kisangani, the provincial capital, among its operational locations, though it has not disclosed when the branch opened.

Governor Paulin Lendongolia Lebabonga announced plans for the office as early as June 2025, saying it would help tighten oversight of gold trading, curb fraud and secure revenue for the province. Provincial authorities said transactions should go through licensed trading houses and be integrated into the formal banking system.

Mining Data

The move comes amid wider regulatory problems in the province’s mining sector. In January 2025, the provincial government suspended mining activities to compel companies to register with the authorities. Of 142 companies identified as operating in the province, the provincial mines minister said only one was compliant at the time, with the others accused of operating outside legal requirements.

Actualité.cd reported in February 2025 that civil society groups across several territories had flagged the presence of foreign nationals operating illegally and partnering with local cooperatives.

According to the Ministry of Mines, Tshopo has four active artisanal gold cooperatives, two of which are officially listed as “in production.” Despite being listed as active, the province had not appeared in national mining statistics before 2025.

Some buying houses reported monthly volumes of around 10 grams, figures considered too low to cover their operating costs. Provincial authorities suspect that part of the gold output is bypassing formal channels and being smuggled to Uganda, a country frequently cited as a transit hub in regional gold trafficking networks.

Timothée Manoke

The Democratic Republic of Congo has ordered an audit of the civil service payroll, according to the minutes of a Council of Ministers meeting held on Feb. 20, 2026.

The government said the audit is intended to safeguard public finances and ensure it can continue funding its priorities, including the regular and timely payment of salaries. The aim is to secure long-term payroll stability and prevent delays that could undermine social stability.

A Rapidly Expanding Wage Bill

The public wage bill has risen sharply in recent years. In a January 2026 report, the International Monetary Fund said salaries for military and police personnel were doubled at the start of 2025, alongside the recruitment of new security forces. Additional spending pressures came from the education and health sectors, as well as the hiring of 2,500 magistrates later in the year.

As a result, the wage bill is estimated to have exceeded its budgeted level by around 19% in 2025. Between 2021 and 2025, it more than doubled in nominal terms and rose 46% in real terms, now accounting for more than 50% of tax revenues.

To curb the increase, the Ministry of Public Service said in August 2025 it was preparing a biometric registration of employees under the central government’s supplementary budget, aimed at tightening control over staffing levels and payroll costs.

On Dec. 18, 2025, Public Service Minister Jean-Pierre Lihau announced the retirement of 2,000 eligible employees. He said that from January 2026, at least 30,000 employees would be retired each year.

Wage Bill Targets and Pay Reform

In the original 2025 budget, the government allocated $3.4 billion for salaries. Following the doubling of military and police pay, the wage bill is now expected to reach $4 billion, equivalent to 23.3% of total expenditure and 4.8% of GDP. The government aims to keep the wage bill below 5% of GDP over the medium term.

To support that target, it announced plans in December 2025 to adopt a new pay policy, developed in consultation with unions, to improve equity and efficiency in public sector remuneration, reduce unjustified disparities and limit hiring to essential positions.

The minutes of the Feb. 20 meeting state that the payroll audit is part of a broader effort to strengthen fiscal consolidation and budget discipline, rather than a short-term response.

The Prime Minister will coordinate the audit, with support from the General Inspectorate of Finance and other oversight bodies. The Deputy Prime Minister in charge of the Budget will ensure staffing levels on the payroll match those approved in the budget. Results are expected within 30 days.

Boaz Kabeya

The Sovereign Gold Reserve Token (SGRT) is already in pre-sale on the WinstantGold platform, Bankable observed on Feb. 22, 2026. Its official launch is scheduled later this year in Kinshasa.

The SGRT is a gold-backed crypto asset issued by the Fonds social de la République démocratique du Congo (FSRDC), a public institution under the presidency responsible for reconstruction, poverty reduction and improving living standards.

To achieve those goals, the FSRDC, coordinated by Philippe Ngwala Malemba, a social development expert who spent 10 years at the African Development Bank, is relying on the AXIS program (Asset-eXchange-Impact-Sovereign) to fund sustainable local development. The program aims to convert local resources, such as artisanal gold or forest carbon, into digital assets that can be sold to investors to raise funds without resorting to conventional borrowing.

The SGRT is the first in a planned series of crypto assets. According to the promoters, each SGRT purchased corresponds to one gram of gold yet to be produced. The token would be guaranteed by the state, with four grams of "sovereign underground gold" pledged as collateral, based on the principle that unextracted gold remains state property under the country's laws. How that commitment would be legally structured remains unclear.

Legal tender?

Although the token's value is tied to that of gold, its sale price has not been disclosed at this stage. The acquisition cost will, however, include a government issuance tax equivalent to 3% of the SGRT purchase price, as set out in the AXIS program white paper published last December. For the pre-sale, promoters are promising discounts of "up to 35% below intrinsic value."

According to promotional materials, purchasing an SGRT also entitles the buyer to a bonus token: the FCRT (Forest Carbon Reserve Token), which purportedly represents "carbon credits generated by ethical gold extraction and sustainable practices in the DRC." A promotional video states that "FCRT holders receive a share of revenues generated by the sale of carbon credits, creating a potential income stream," with a promised annual return of 20% to 50%. That promise, however, assumes the promoters can overcome the difficulties of accessing carbon credit markets, which African countries have repeatedly flagged as a persistent obstacle.

The AXIS program's website also states that "the SGRT and FCRT are both recognized as legal tender by the Democratic Republic of Congo." No confirmation of that legal status from the Central Bank of Congo (BCC) has been identified. The white paper, which assigns the BCC a central supervisory role, recommends the adoption of "a specific directive" to govern the convertibility, circulation and interoperability of the SGRT with the banking system and electronic currencies.

Liquidity challenge

According to the white paper, SGRT issuance is capped at 50 million tokens and is expected to unfold over five years. From the sixth year, a second crypto asset would be issued, backed by extracted, refined and certified gold: the SGCT (Secured GoldConnect Token). The SGRT tokens would then be progressively converted into SGCT at a rate of 10% of the total stock per year over a 10-year period. The project is designed to run for 15 years, which is also the duration of the public-private partnership underpinning it.

That PPP, announced on June 28, 2025, links the FSRDC to Phoenix Capital. Based in Sint Maarten, Netherlands, Phoenix Capital describes itself as a company specializing in the tokenization of natural assets, without disclosing any prior track record. Chaired by Alain Lemieux, it signed a partnership with Winstant Ltd for the development of WinstantGold, the platform for issuing and managing the AXIS program's crypto assets. Led by Hervé Lacorne, Winstant Ltd describes itself as a Hong Kong-based startup incubator specializing in financial technology, regulatory technology and biotechnology solutions.

Under the proposed structure, the funds raised through the sale of the initial tokens are intended to finance the production of gold and community carbon certificates, which would in turn serve as backing for the SGCT and FCRT tokens respectively. The arrangement raises questions about liquidity, particularly as no clear buyback mechanism is outlined. To recoup an investment, token holders would need to resell their tokens to third parties or use them for payments. Phoenix Capital says it has made millions of dollars’ worth of international purchases using SGRT.

Custodian undisclosed

Gold would be produced through the Goldconnect initiative, which is intended to organize, trace and formalize artisanal gold in Congo. The initiative would draw on more than 300 gold mining cooperatives supervised by the Service d'assistance et d'encadrement des mines artisanales et de petite échelle (SAEMAPE) under the partnership between the FSRDC and Phoenix Capital. Operations would take place in artisanal mining zones made available by the state. A framework agreement was signed on Feb. 19 between the Ministry of Mines and the FSRDC.

Backing a single token would require the production of four grams of gold. "According to Goldconnect's ethical extraction cost model, producing one gram of gold requires approximately three grams of underground reserves," the white paper states. Over 15 years, the Goldconnect initiative would therefore need to produce at least 200 metric tons of gold, equivalent to more than 13.5 metric tons per year, compared with a peak of five metric tons in official artisanal production to date.

After extraction, the gold intended for backing would need to be refined to a purity level consistent with international market standards, cast into bars, and then stored with a custodian based in Dubai whose name has not been disclosed.

Pierre Mukoko

Air Congo has taken delivery of a third Boeing 737-800, expanding the national carrier’s fleet to three aircraft as it moves to scale up operations and launch regional services.

An official reception was held on Feb. 19, 2026, at N’djili International Airport in the presence of Transport Minister Jean-Pierre Bemba.

Chief Executive Weldegeorgis Mesfin said the additional aircraft would improve on-time performance, increase frequencies on certain routes and enhance overall operational efficiency.

“We are welcoming our third aircraft of the same type today, a symbol of our growth and our commitment to providing modern, safe and reliable air transport,” he said.

When the second aircraft was delivered in December 2024, Mesfin said the airline aimed to expand its fleet to between six and eight aircraft to support its medium-term growth strategy.

Air Congo, which is 51% owned by the Congolese state and 49% by Ethiopian Airlines, plans to gradually launch regional services across Central, Southern and West Africa. Destinations targeted this year include Johannesburg; Cotonou; Douala; N’Djamena; Nairobi; and Dar es Salaam.

Mesfin said the expansion is designed to tap growing domestic and regional demand while strengthening the Democratic Republic of Congo’s connectivity with major African hubs.

The airline also expects to take delivery next month of an ATR 72-600 to reinforce its domestic network. The turboprop will serve Beni, Bunia, Isiro, Gbadolite, Mbandaka and Kalemie.

Mesfin said the strategy forms part of a broader ambition to develop a coherent air transport network capable of supporting the country’s economic and social development.

Founded in 2024, Air Congo has so far focused on domestic routes, including Goma, Lubumbashi, Kisangani, Mbujimayi, Kananga, Kindu, Kolwezi and Bukavu.

Ronsard Luabeya

Two years after tensions that led to a settlement agreement with the Democratic Republic of Congo's private-sector subcontracting regulator, Kibali Gold Mine is once again under scrutiny. In a decision signed on Feb. 17, 2026, Director General Miguel Kashal of the Autorité de régulation de la sous-traitance dans le secteur privé (ARSP) ordered the cancellation of several subcontracting agreements between Kibali, the DRC's top gold producer, and three service providers: KMS SAU, Boart Longyear SAU and TAI Services SAS. Kibali operates the Kibali gold mine in Haut-Uélé province.

The ARSP contends that KMS SAU and Boart Longyear SAU are not majority Congolese-owned companies and therefore do not meet the eligibility requirements set out in Article 6 of the Feb. 8, 2017 subcontracting law. Little information is publicly available on KMS, but Boart Longyear is an Australian mining group specializing in exploration and production drilling, as well as geotechnical services and drilling equipment and technologies.

According to the regulator, Boart Longyear, which operates in Australia, Africa and the Americas, was granted a waiver in September 2024. However, the ARSP said the conditions attached to that waiver, notably those related to technology transfer, were not complied with.

The situation regarding TAI Services SAS is different. The ARSP argues that the contract for the purchasing center positioned the company as a "commercial intermediary" between Kibali and Congolese contractors, a situation that sparked tensions among local communities in Watsa territory, where the mine is located. The decision states that such an arrangement, including the collection of a percentage-based commission on contracts awarded to local subcontractors, "runs counter to local content requirements." The regulator added that the contractual relationship must be direct between the principal company and the eligible subcontractor.

Earlier dispute

The Feb. 17 decision follows an earlier episode in January 2024, when the ARSP threatened to shut the mine and announced legal proceedings against a subcontracting company, TCFF, which it accused of capturing the bulk of contracts and collecting commissions. A settlement agreement between the ARSP and Kibali was ultimately signed after those discussions.

At the time, the regulator said more than 390 contracts had been opened to eligible subcontractors and highlighted a restructuring of the contractual framework. Mine operator Barrick Mining said in a statement published on March 1, 2024, that it was working "with the ARSP on a series of local content initiatives." That collaboration did not result in full compliance with the law, as the latest decision indicates.

The violations cited in the latest ruling are nonetheless less serious than those raised in 2024. At that time, Kibali was accused of setting up a front company to carry out subcontracting work linked to its own production activities. "We conclude unequivocally that TCFF is none other than Kibali Gold in disguise," Kashal said then. The 2026 decision does not allege a systemic scheme to capture subcontracting contracts but instead cites a limited number of instances of non-compliance.

A strategic mine

The Feb. 17 decision is based on findings from an inspection mission conducted in November 2025. During that visit, Kibali Gold's director general committed to implementing the recommendations. "We have an inspection mission currently at Kibali (...). Where improvements are needed, we will work with the ARSP and the provincial authorities to address them, and where progress has already been made, we will look at how to build on it," Cyrille Mutombo said.

To prevent any abrupt disruption to operations, the ARSP has provided for a transition period to allow new tenders to be launched in compliance with the law.

As the only industrial enterprise in Haut-Uélé province, Kibali is a key driver of economic activity for both the province and the country. In July 2025, Barrick said in a press release that $3.1 billion had been paid to local contractors and partners since 2009. The group said it supports more than 700 Congolese companies and noted that Kibali's tenders are published jointly with the ARSP. Barrick had already stated in March 2024 that 95% of the mine's more than 6,500 employees were Congolese nationals.

Kibali is also a key earnings contributor for its shareholders: Barrick Mining holds 45%, AngloGold Ashanti 45% and state-owned Sokimo 10%. The mine posted revenue of $2.3 billion in 2025, up 40% from 2024. That growth lifted Kibali's contribution to Barrick's results by 67%, from $316 million in 2024 to $527 million in 2025, despite a 13% increase in costs.

Pierre Mukoko & Timothée Manoke

The Democratic Republic of Congo and the United Nations Office for Project Services (UNOPS) have advanced their partnership. On Feb. 18, 2026, in Kinshasa, the Ministry of Infrastructure and Public Works (ITP) and UNOPS signed a memorandum of understanding (MOU).

The document was signed by ITP Minister John Banza and UNOPS Country Director for the DRC Mouna El-Jaouhari. Presented as a key step in the country’s infrastructure reconstruction, the memorandum aims to transform the country’s infrastructure while strengthening local capacities.

The agreement is structured around four main components. The first covers infrastructure development and rehabilitation, including the construction of new facilities and the restoration of existing infrastructure nationwide. The second focuses on skills transfer, notably strengthening the capacity of Congolese institutions and improving construction standards and methods. The third promotes strategic cooperation, positioning infrastructure as a driver of economic growth. The fourth addresses social impact and progress toward the Sustainable Development Goals (SDGs), through improved connectivity, poverty reduction and better access to basic services, particularly via road projects.

The MOU is described as a flexible framework agreement, with monitoring mechanisms designed to allow adjustments and reinforce cooperation as implementation advances. It does not specify priority projects, funding amounts or a timeline. Instead, it establishes a strategic framework to be implemented through project-specific agreements.

UNOPS specializes in project implementation. It supports states, U.N. agencies, donors and other partners by providing project management, procurement and infrastructure services, operating under a self-financing model based on fees charged to projects. The organization has been active in the DRC for several years. According to its public data, UNOPS carried out more than 53 projects in the country in 2024, with a total value of about $61.2 million and 26 partners. Its portfolio includes transport infrastructure, health, water, vocational training and stabilization programs in the east.

The agency says it has contributed to the construction or rehabilitation of 132 health centers, 27 vaccine depots and 16 regional drug distribution centers. It also reports water infrastructure projects benefiting 45,000 people in rural areas, as well as road rehabilitation and bridge construction operations.

By formalizing their cooperation through this agreement, Kinshasa and UNOPS are placing these activities within a structured framework under the ITP ministry. The key challenge now is to turn this partnership into funded, planned and implemented projects.

Boaz Kabeya

Belgium, the Democratic Republic of Congo and U.S. company KoBold Metals are at odds over access to colonial-era geological records held at the Royal Museum for Central Africa (AfricaMuseum) in Tervuren. Belgian authorities are refusing to allow KoBold to digitize the archival collection under the terms agreed in Kinshasa, according to several Belgian media reports. The archives are considered strategically significant for mineral exploration.

A deal signed between the DRC and KoBold in Kinshasa on July 17, 2025, explicitly aims to provide free public access to historical geoscientific data via the National Geological Service of Congo (SGNC). The agreement also stipulated that KoBold would deploy a team to the DRC's geological archives held at the Royal Museum for Central Africa to begin digitizing documents before July 31, 2025.

Seven months later, that digitization has yet to begin. Belgian authorities have blocked KoBold's team from accessing the archives, arguing that federal public archives cannot be entrusted to a foreign private company that has no direct contractual relationship with the Belgian state. "We cannot delegate full responsibility for managing our archives to a private company," outside the Belgian and European legal framework, AfricaMuseum Director Bart Ouvry said.

Belgium has also pointed to an existing digitization program already underway, funded by the European Union. The project provides for gradual digitization of the archives over several years, with copies to be transferred in stages to Congolese authorities. Museum officials said the program would span four to five years, with completion expected around 2031. The data would then be made accessible under a framework agreed between the relevant institutions, including the SGNC.

Control of geological data

The Tervuren archives are described as a vast collection of maps, reports and technical surveys covering nearly 500 linear meters of documents. For KoBold, which specializes in artificial intelligence-assisted exploration, the historical data represents essential raw material for the "large-scale mineral exploration" program outlined in its agreement with the DRC. Rapid access to the historical records would reduce geological risk and help guide investment decisions.

The agreement ties this effort to a broader strategy of American exploration and investment in the DRC. It cites a desire to "attract more investment from the American private sector, particularly in the critical minerals sector," and refers to "secure supply chains to the United States" in the context of regional initiatives such as the Lobito Corridor. That approach was reinforced by a strategic partnership concluded between Kinshasa and Washington last December.

Belgium has officially cited the public status of the archives and the absence of a direct contractual framework with the Belgian state. By promoting the existing European program and declining to allow KoBold direct access, Belgium has effectively retained control over the pace and conditions under which data described as strategically significant is made available.

In a context of intensifying international competition over critical minerals, the dispute over the colonial archives goes beyond a straightforward administrative matter. It underscores a broader shift: control of geological data has become central to the power dynamics surrounding the DRC's critical resources.

Pierre Mukoko & Boaz Kabeya

Kamoa-Kakula copper mine in the Democratic Republic of Congo generated revenue of $3.28 billion in 2025, up 5% from $3.11 billion in 2024, according to figures published by operator Ivanhoe Mines on Feb. 18, 2026.

The revenue increase came despite lower production and sales following a seismic event in May 2025. Kamoa-Kakula sold 351,674 tonnes of copper in 2025, down 11.4% from 396,972 tonnes in 2024. Production declined by a similar percentage, falling to 388,841 tonnes from 437,061 tonnes.

Higher copper prices helped offset the decline. The average realized price rose to $4.40 per pound, or roughly $9,700 per tonne, in 2025, compared with $4.09 per pound the previous year, an increase of 7.6%.

On the operational side, Kamoa-Kakula reported EBITDA of $1.45 billion in 2025, representing a margin of 44%, down from $1.81 billion and a 58% margin in 2024.

Profit down

Rising costs weighed on profitability. The cost of sales increased to $2.82 per pound in 2025 from $1.71 per pound in 2024, equivalent to roughly $6,220 per tonne versus $3,770 per tonne. That increase of more than 65% squeezed margins by narrowing the spread between the selling price and production costs.

Net profit after tax fell 56.6% to $439.7 million from $776.9 million, even as the tax charge declined to $317.7 million in 2025 from $345.5 million in 2024.

For 2026, Kamoa-Kakula has set production guidance of up to 420,000 tonnes, unchanged from 2025. Ivanhoe expects sales to rise by around 30,000 tonnes as the mine draws down unsold inventory. Revenue could increase further, with the company anticipating “copper prices close to record levels.”

Ivanhoe Mines and its Chinese partner Zijin Mining each hold a 39.6% stake in Kamoa-Kakula, while the Congolese state owns 20% and Crystal River holds 0.8% through the Kamoa Copper joint venture.

Pierre Mukoko

More...

The Democratic Republic of Congo, Zambia, Mozambique, Zimbabwe and Botswana are developing a financing model for the construction of one-stop border posts. On Feb. 18, 2026, trade ministers from the five countries reviewed the project with officials from DP World and the secretary-general of the African Continental Free Trade Area (AfCFTA) during a meeting in Dubai.

According to a statement from the Congolese Ministry of Foreign Trade, the initiative aims to cut waiting times and ease cross-border transit, two factors that directly affect logistics costs and the competitiveness of goods in the region. The one-stop border post model is based on coordinated controls and harmonized procedures, eliminating duplication between neighboring countries and speeding up trade flows.

The project prioritizes full digitization of procedures, with reduced manual intervention, improved traceability and faster data processing. The objective is to improve the predictability of transit times while reducing administrative bottlenecks and the costs faced by businesses.

The participation of DP World and the AfCFTA secretariat signals a shift toward implementation. Discussions moved beyond general commitments to focus on a structure compatible with public-private partnerships (PPPs). Under this model, a logistics operator would manage project engineering, including design, equipment, digital systems and logistics integration, while customs, immigration and security functions would remain under state authority.

The delegations agreed to adopt a financial model developed by a joint team of experts tasked with the assignment. They set a 15-day deadline to finalize the financing framework, project timeline and country-specific administrative procedures within the PPP framework.

The initiative forms part of the operational rollout of AfCFTA instruments and broader regional integration efforts in southern Africa. In that context, the DRC and Zambia signed an agreement in December 2025 to modernize and build border infrastructure. The deal includes the development of facilities at Kasumbalesa, Kambimba, Kipushi and Mokambo, as well as other entry points to be identified later by mutual agreement.

The two countries have yet to define the technical, financial and operational arrangements needed to make the one-stop border posts fully operational, in line with regional coordination requirements.

Ronsard Luabeya

Gécamines and Glencore have concluded two agreements within days of each other, significantly expanding the state-owned company's ability to sell copper and cobalt independently.

Both agreements concern Kamoto Copper Company (KCC), a mine 70% owned by the Anglo-Swiss commodities group and 30% by Gécamines.

The first agreement was signed on the sidelines of Mining Indaba, held Feb. 9-12 in Cape Town, and grants Gécamines the right to market its share of KCC's production in proportion to its stake. The second deal, announced Feb. 18, aims to increase output and extend the mine's operating life.

According to Glencore, the second agreement is expected to be finalized in the coming months after lease contracts are registered with the national mining cadastre. It will grant KCC access to additional land. That access is needed to “fully unlock KCC's potential by improving the efficiency of the mine, processing facilities and other key infrastructure,” said Mark Davis, Glencore's chief operating officer for Copper Africa.

The additional land should help KCC reach a long-term copper production target of around 300,000 tonnes per year, up from less than 200,000 tonnes currently, and extend the mine's life into the mid-2040s, Davis said. That trajectory would provide Gécamines with about 90,000 tonnes of copper per year, along with significant cobalt volumes.

Glencore said it is prioritizing copper production as it already has sufficient volumes to meet its 2026 and 2027 export quotas. The company does not expect that position to last beyond two years. “For 2028 and beyond, we assume similar price and payment levels to those of the fourth quarter of 2025, as well as the ability to market substantially all of our cobalt production,” the company said in its 2025 resources and reserves report. At KCC, cobalt output typically exceeds 30,000 tonnes per year and is expected to rise as the mine ramps up.

The two agreements deepen Gécamines’s push into mineral trading, a segment where it had until recently maintained only a limited presence. Prior to the Glencore deals, the state company concluded other agreements this year granting it the right to market its share of output from several mines, including Tenke Fungurume Mining (TFM), which is 80% controlled by China’s CMOC and 20% owned by Gécamines. TFM produces more than 400,000 tonnes of copper and around 25,000 tonnes of cobalt annually.

Gécamines is also in advanced talks with Ivanhoe Mines over a deal that would allow it to market up to 50% of output from the Kipushi zinc mine, despite holding only a 38% stake, compared with 62% for the Canadian company. Production at Kipushi is expected to reach between 240,000 and 290,000 tonnes of zinc concentrate in 2026, strengthening its position in the global market.

Pierre Mukoko

A Congolese human rights organization has detailed the sanctions imposed on Chinese company Congo Dongfang Mining (CDM) over a pollution incident that affected Lubumbashi, capital of Haut-Katanga province, on Nov. 4, 2025. The Institut de recherche en droits humains (IRDH) disclosed the penalties in a press release dated Feb. 16, 2026, citing a letter from the mines minister dated Jan. 17, 2026.

According to the civil society group, CDM was fined $6.63 million and ordered to pay $6 million in collective compensation. The IRDH described the fine as low but acknowledged that it is consistent with the statutory penalty scale for the violations identified. The Institute said the collective compensation was “grossly inadequate given the scale of the damage.”

On Nov. 4, 2025, large volumes of water from CDM’s retention basin spilled into several areas around its facilities, including the Moïse market, which supplies much of northern Lubumbashi. A document published by the IRDH in January estimated that about 2.5 million cubic meters of acid leachate were released into the environment. Analyses cited in the same document found heavy metal concentrations exceeding international standards by several thousand times, with immediate impacts on local communities. The document recorded “504 documented health cases (skin, digestive and respiratory conditions), 258 damaged agricultural fields, 42 contaminated wells and 29 livestock losses.”

More Than $100 Million Demanded

The total amount sought by affected communities stands at $106.84 million, according to the IRDH. Of that sum, $100 million is claimed over exposure to endocrine disruptors, which have irreversible effects on the hormonal system and may pose serious risks across generations.

“This fund is intended to finance a medical reference center specializing in the diagnosis, treatment and long-term monitoring of mining-related illnesses. The center will also include research and epidemiological surveillance functions,” the IRDH said.

Following the incident, the mines minister suspended CDM’s operations at its Lubumbashi site for an initial period of three months. In a statement published Feb. 13, 2026, the Ministry of Mines said the resumption of activities at the CDM/Joli-Site facility is conditional on several measures, including the effective fulfillment of social obligations toward neighboring communities and the strengthening of monitoring, prevention and early-warning systems to prevent a recurrence.

The IRDH nonetheless said CDM does not appear to be fully meeting its compensation obligations. According to the Institute, the company has limited itself to donations or projects already included in its operating agreement, without clearly separating those contractual commitments from compensation measures linked to the environmental incident.

Timothée Manoke

The $50 million promised by President Félix Tshisekedi in December 2024 to relaunch Société Minière de Bakwanga (MIBA) is available. André Kabanda, the company’s director general, said on Feb. 14, 2026, that disbursement is now contingent on shareholders finalizing discussions on the company’s recapitalization.

MIBA is owned 80% by the Congolese state and 20% by ASA Resource. To maintain that ownership structure following the $50 million injection, the private partner would need to contribute $12.5 million in line with its stake. Ongoing talks are focused on agreeing those terms, among other issues.

A general shareholders’ meeting was held several weeks ago and is expected to be followed by a board meeting this week, Kabanda said. The state’s contribution has already been approved, he added.

A $70 Million Baseline Recovery Plan

The funds are intended to finance a $70 million baseline recovery plan approved by the Council of Ministers in August 2025. The plan targets production of nearly 2.5 million carats in 2026. It is structured around five priorities: certification of mineral reserves, securing title to mining concessions, productive investments, management of personnel costs, and the establishment of a monitoring and evaluation framework.

The recovery plan is based on a broader blueprint developed by the Steering Committee for the Reform of State Portfolio Companies, Copirep, valued at more than $400 million.

On April 8, 2025, MIBA’s director general presented four South African companies, Bond Equipment, Mining Services, Athur Mining and Consulmet, which he said had expressed interest in helping restart operations. The companies were expected to submit bids to supply modern equipment following site visits to MIBA’s infrastructure and mining areas. No update on the process has been provided since then.

Ronsard Luabeya