Equipe Publication

Ports, routes, mines… : ces secteurs visés par les Émirats arabes unis en RDC

L’entreprise publique émiratie Abu Dhabi Ports envisage d’investir dans les ports de Matadi et de Boma. La question a été évoquée lors de l’audience que le président de la République, Félix-Antoine Tshisekedi, a accordé le 16 novembre 2025 au ministre d’État émirati en charge des Affaires étrangères, Sheikh Shakhboot Nahyan Al Nahyan.

À ce stade, aucun détail supplémentaire n’a été communiqué sur les ambitions d’Abu Dhabi Ports. Mais selon la présidence de la République démocratique du Congo (RDC), ces projets s’inscrivent dans un programme plus vaste incluant la construction du corridor de Lobito, de deux ports secs, ainsi que de routes reliant Kolwezi à Dilolo, et la RDC à l’Angola et à la Zambie.

Cet ensemble s’inscrit dans une volonté de dynamiser la coopération économique entre les deux pays. Toujours selon la présidence congolaise, les échanges entre Tshisekedi et son hôte ont également porté sur le secteur minier, l’échange de renseignements financiers pour lutter contre le blanchiment d’argent et le financement du terrorisme, ainsi que sur une collaboration entre les banques centrales. Les deux parties ont évoqué la finalisation d’un accord de libre-échange attendu depuis plusieurs mois et la tenue d’un forum économique destiné à mobiliser des financements.

Entre 2021 et 2023, les exportations congolaises vers les Émirats ont atteint en moyenne 1,059 milliard de dollars par an, contre 1,89 milliard de dollars d’importations, générant un déficit commercial annuel moyen de 831 millions de dollars. Ces exportations sont majoritairement composées de produits miniers — cuivre raffiné, or et diamants. Elles pourraient se renforcer avec l’acquisition par le conglomérat émirati IRH/IHC de 56 % d’Alphamin Resources, propriétaire de la mine d’étain de Bisie, ce qui renforce la présence des Émirats dans le secteur minier congolais.

Deux sociétés émiraties, Lone Star Ltd et Business Gate, ont également manifesté leur intérêt pour des projets énergétiques dans la province de la Tshopo, notamment dans le secteur des énergies renouvelables.

Boaz Kabeya

Lire aussi :

Étain : l’Émirati IRH conclut un deal à 367 millions $ pour prendre le contrôle de Bisie

L’Émirati NG9 Holding intéressé par les projets de Buenassa Resources et Kipay Energy en RDC

Accord de libre-échange avec les Émirats : la RDC vise 3 milliards $ d’exportations d’ici 2030

UBA DRC: Tony Elumelu Announces “Congolization” of Management

- UBA will appoint a Congolese national as CEO of UBA DRC and add nine Congolese board members.

- The bank plans to expand from 3 to 21 branches by 2028 and target USD 1.8 billion in deposits.

- UBA DRC grew net profit 388% in 2024, reaching 21 billion naira.

United Bank for Africa Chairman Tony Elumelu announced a sweeping localisation plan for UBA Democratic Republic of Congo after meeting President Félix Tshisekedi on November 16, 2025. Elumelu outlined the changes during a visit to Kinshasa, according to a summary posted by the presidency on X.

The presidency stated that UBA DRC will appoint a Congolese national to lead the subsidiary. It added that nine Congolese members will join the board as part of a strategy to progressively “Congolize” the management structure. The subsidiary is currently led by Nigerian national Sampson Aneke, who is supported by Deputy Managing Director Gisèle Bondo, appointed in February 2024.

Elumelu said the bank plans to extend its branch network into several provinces across the country. “We believe in the potential of the DRC, especially its youth. The opening of new branches will help create jobs,” he said.

UBA has operated in the DRC since 2011. The bank currently maintains branches in Kinshasa, Lubumbashi and Matadi. The group detailed in its 2024 Pillar Report that its 2024–2028 strategic plan targets a major expansion—growing from three to 21 branches by 2028 and increasing its ATM network. The subsidiary also aims to reach a deposit base of $1.8 billion over the same period.

UBA DRC significantly increased its contribution to group results in 2024. The bank reported a net profit of 21 billion naira, compared with 4.3 billion naira in 2023. This performance marks a 388% year-on-year increase, according to documents reviewed by Bankable. The results mainly reflect growth in operating income, which rose from 4.3 billion to 22.8 billion naira.

Elumelu said the group also plans to expand its involvement in infrastructure financing in the DRC. Through the Tony Elumelu Foundation, he reaffirmed the bank’s commitment to supporting local entrepreneurship. Since the launch of the foundation’s programme, 350 young Congolese entrepreneurs have received financial support.

This article was initially published in French by Ronsard Luabeya

Adapted in English by Ange Jason Quenum

Financement des projets : le FPI prospecte de nouveaux partenariats à Singapour

Le Fonds de Promotion de l’Industrie (FPI) a exprimé son intérêt pour nouer des partenariats avec trois institutions économiques de Singapour : la Singapore Cooperation Enterprise (SCE), l’Economic Development Board (EDB) et Enterprise Singapore (ESG). Son directeur général, Hervé Claude Ntumba Batukonke, a rencontré les responsables de ces agences lors d’une mission de prospection économique effectuée à Singapour du 1ᵉʳ au 8 novembre 2025, à l’invitation de Embed Financial Group Holdings (EFGH Singapore).

Selon une note du FPI, les échanges avec la Singapore Cooperation Enterprise ont porté sur la gouvernance industrielle, la digitalisation et le transfert de compétences. La SCE, chargée de concevoir et de mettre en œuvre des partenariats gouvernement-gouvernement (G2G) et des programmes de renforcement des capacités, a salué les réformes en cours en RDC dans ces domaines.

La rencontre avec l’Economic Development Board, organisme chargé de l’attraction des investissements dans les technologies, la finance, l’industrie et la biotechnologie, a permis d’identifier des pistes de coopération pour mobiliser des investisseurs autour des projets industriels congolais.

Des discussions ont également eu lieu avec Enterprise Singapore, qui voit en la RDC un partenaire potentiel pour ses futures initiatives industrielles. Cette institution, chargée de soutenir l’expansion internationale des entreprises singapouriennes, revendique près de 20 milliards de dollars d’investissements engagés sur divers projets en Afrique. L’agence accompagne notamment les PME à travers le financement, l’assistance technique et la formation.

Selon Hervé Claude Ntumba, ces rencontres ont permis de mettre en valeur les atouts économiques de la RDC et de promouvoir de nouvelles opportunités d’investissement dans le secteur industriel. À l’issue de la mission, le FPI et les agences singapouriennes ont convenu de travailler à la formalisation d’un cadre de coopération bilatérale, de préparer la participation du FPI à la Conférence internationale de 2027 avec une liste de projets prioritaires, et de mettre en place un mécanisme de suivi pour accompagner la concrétisation des intentions d’investissement.

Ronsard Luabeya

Lire aussi :

Financement des projets : le FPI explore un partenariat avec la SFI

UBA RDC : Tony Elumelu annonce la congolisation du management

En visite en République démocratique du Congo, le président du conseil d’administration du groupe United Bank for Africa (UBA), Tony Elumelu, a annoncé d’importants ajustements de gouvernance au sein de la filiale congolaise. L’annonce a été faite à l’issue d’une audience accordée, le 16 novembre 2025, par le président Félix Tshisekedi.

Selon le compte rendu de la présidence publié sur X, UBA RDC sera désormais dirigée par un Congolais. Par ailleurs, neuf Congolais feront leur entrée au conseil d’administration, dans le cadre d’une stratégie de congolisation progressive du management. La filiale est actuellement dirigée par le Nigérian Sampson Aneke, secondé par Gisèle Bondo, nommée directrice générale adjointe en février 2024.

Tony Elumelu a également indiqué que le groupe prévoit d’étendre son réseau bancaire à travers plusieurs provinces du pays. « Nous croyons au potentiel de la RDC, notamment de sa jeunesse. L’ouverture de nouvelles agences contribuera à créer des emplois », a-t-il déclaré.

Présente en RDC depuis 2011, UBA n’opère aujourd’hui que dans trois villes : Kinshasa, Lubumbashi et Matadi. Selon son rapport Pilier 2024, son plan stratégique 2024-2028 prévoit une expansion majeure, avec le passage de 3 à 21 agences d’ici 2028, ainsi qu’un renforcement du réseau de distributeurs automatiques. La banque vise également une base de dépôts de 1,8 milliard USD à cet horizon.

Sur le plan financier, UBA RDC a significativement accru sa contribution aux performances du groupe. En 2024, son bénéfice net a atteint 21 milliards de nairas, contre 4,3 milliards en 2023, soit une hausse annuelle de 388 %, selon des documents consultés par Bankable. Cette performance est principalement attribuée à la forte croissance du résultat d’exploitation, passé de 4,3 milliards à 22,8 milliards de nairas sur la même période.

Tony Elumelu a ajouté que le groupe s’intéresse aussi au financement d’infrastructures en RDC. À travers la Fondation Tony Elumelu, il a réitéré son engagement en faveur de l’entrepreneuriat local. Depuis le lancement du programme, 350 jeunes entrepreneurs congolais ont bénéficié d’un appui financier.

Ronsard Luabeya

Lire aussi :

UBA RDC vise une multiplication de ses dépôts pour atteindre 1,8 milliard $ d’ici 2028

UBA: la contribution de la RDC au bénéfice du groupe multipliée par 5 en 2024

North Kivu Begins Weapons Surrender Program As Insecurity Persists

North Kivu province in eastern Democratic Republic of Congo has launched a new campaign to collect illegally held weapons and ammunition. The move comes as the region, which remains under a state of siege, faces persistent insecurity.

The provincial government said in a statement issued on November 12 that military governor Major-General Evariste Kakule Somo signed an order on October 29 authorizing the operation.

The order offers cash rewards to anyone who voluntarily hands in weapons: 100 dollars for an AK-47 or similar rifle, 200 dollars for a support weapon, and 1 dollar per round of ammunition. It also guarantees anonymity and immunity from prosecution for participants.

A commission that includes the Disarmament, Demobilization, Community Recovery and Stabilization Program (PDDRCS) has been set up to oversee the campaign. The provincial government said the effort is funded by the central government with possible support from technical and financial partners and individual donors.

The initiative follows a rise in violent crime in Beni and Butembo, where banks, homes and businesses have been repeatedly targeted by armed groups. Civil society groups have urged authorities to tighten controls on the movement of weapons in the province.

Similar programs have been carried out in the past. Between 2008 and 2011, the NGO Peace and Reconciliation (PAREC) ran a weapons-collection campaign across several provinces after waves of violence. In North Kivu, PAREC sought to collect 30,000 weapons and had recovered about 9,347 by October 2010, according to local media. By July 2011, it had handed over more than 7,545 weapons and 54 tons of ammunition to military experts. In Kinshasa, more than 11,000 illegally held weapons were recovered in 2009, Le Figaro reported.

Timothée Manoke

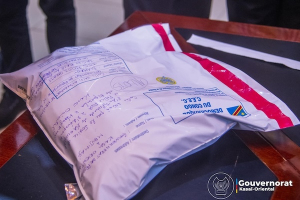

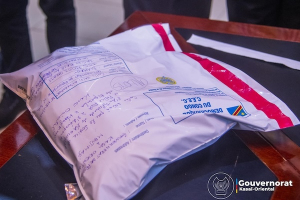

Kasai Oriental: 13 kg of Undeclared Diamonds Seized en Route to Kinshasa

Security officers at Bipemba Airport in Mbujimayi, Democratic Republic of Congo, seized 13 kilograms of diamonds on November 11, 2025, after discovering the cargo had not been declared for transport to Kinshasa.

Provincial anti-fraud services and the Provincial Mining Division said the stones were not listed on any official paperwork and had not been reported to the authorities, in breach of national traceability rules.

The diamonds were brought to interim provincial governor Daniel Kazadi Cilumbayi, who called a security meeting with all agencies active at the airport, including the police, the National Intelligence Agency, the Mining Division, and anti-fraud units. The meeting focused on determining how the attempted smuggling occurred and improving coordination among security services.

Kazadi praised the officers involved and said the provincial government remained committed to tackling mineral trafficking. “There will be no tolerance for such practices. The law must be strictly applied,” he said, adding that smuggling undermines supply-chain transparency and deprives the province of revenue.

The governor instructed security and mining authorities to strengthen checks at all exit points in the province and urged closer cooperation among the institutions responsible for anti-fraud work.

The seized diamonds were transferred to the Centre for Expertise, Evaluation and Certification (CEEC) and the Provincial Mining Division for technical analysis and valuation, the governor’s office said. With no claimant for the cargo, an investigation has been opened to identify those responsible.

Ronsard Luabeya

Kasaï oriental : saisie de 13 kg de diamants en partance pour Kinshasa

Les services de sécurité déployés à l’aéroport de Bipemba, dans la ville de Mbujimayi, ont intercepté, le 11 novembre 2025, une cargaison de 13 kilogrammes de diamants en partance pour Kinshasa. Selon les services provinciaux d’antifraude et la Division provinciale des mines, cette marchandise ne figurait sur aucun document officiel et n’avait pas été déclarée auprès des institutions compétentes, en violation des règles de traçabilité.

Après la saisie, les pierres ont été présentées au gouverneur intérimaire du Kasaï oriental, Daniel Kazadi Cilumbayi, qui a aussitôt convoqué une réunion de sécurité avec les différents services opérant à l’aéroport — police, Agence nationale de renseignements, Division des mines et services d’antifraude — afin de clarifier les circonstances de cette tentative d’exportation illicite et de renforcer la coordination entre structures de contrôle.

Le gouverneur a salué la vigilance des agents impliqués dans l’opération et réaffirmé la détermination du gouvernement provincial à lutter contre la fraude minière. « Il n’y aura aucune tolérance face à de telles pratiques. La loi doit s’appliquer dans toute sa rigueur », a-t-il déclaré, estimant que ces actes fragilisent la transparence de la filière et privent la province de recettes importantes.

Pour prévenir de nouveaux cas, Daniel Kazadi a instruit les services concernés de renforcer les contrôles dans tous les points de sortie de la province et insisté sur la nécessité d’une collaboration étroite entre toutes les institutions engagées dans la lutte contre la fraude.

Selon la cellule de communication du gouvernorat, les diamants interceptés ont été remis au Centre d’expertise, d’évaluation et de certification (CEEC) ainsi qu’à la Division provinciale des mines pour des analyses techniques et une évaluation officielle. Les propriétaires de la cargaison ne se sont pas présentés, ce qui a conduit à l’ouverture d’une enquête visant à établir les responsabilités.

Ronsard Luabeya

Lire aussi :

Diamants : la commercialisation de nouveau libéralisée en RDC

Nord-Kivu : un programme de rachat d’armes pour tenter d’enrayer l’insécurité

La province du Nord-Kivu, sous état de siège, a lancé une nouvelle campagne de ramassage des armes et munitions détenues illégalement afin de lutter contre l’insécurité persistante dans la région. Selon un communiqué publié le 12 novembre 2025 sur les comptes officiels du gouvernement provincial, le gouverneur militaire, général-major Evariste Kakule Somo, a signé, le 29 octobre 2025, un arrêté officialisant l’opération.

L’arrêté prévoit, à son article 7, une contrepartie financière pour toute personne remettant volontairement une arme ou des munitions : 100 dollars pour une arme de type AK-47 ou équivalent, 200 dollars pour une arme d’appui, et 1 dollar par munition déposée. L’article 10 garantit la discrétion des personnes qui se présenteront et l’absence de poursuites pendant toute la période de mise en œuvre de la campagne.

Une commission chargée de coordonner les opérations a été mise en place, avec la participation du Programme de désarmement, démobilisation, relèvement communautaire et stabilisation (PDDRCS).

Le gouvernement provincial précise que la nouvelle campagne est financée par le gouvernement central, et, le cas échéant, par ses partenaires techniques et financiers, ainsi que par toute personne « éprise de paix » souhaitant soutenir la stabilisation de la province.

Cette initiative intervient dans un contexte de recrudescence de la criminalité, particulièrement dans les villes de Beni et Butembo, où se multiplient les braquages d’institutions financières, les incursions dans les domiciles, les meurtres attribués à des hommes armés, ainsi que les appels répétés de la société civile en faveur d’un contrôle strict de la circulation des armes. Elle s’inscrit dans la continuité d’initiatives antérieures.

Entre 2008 et 2011, l’ONG Paix et Réconciliation (PAREC) avait mené une opération similaire dans plusieurs provinces après des cycles de violences. Au Nord-Kivu, elle s’était fixé l’objectif de collecter 30 000 armes et, selon les médias provinciaux, elle avait récupéré près de 9 347 armes d’ici octobre 2010. En juillet 2011, elle avait remis plus de 7 545 armes ainsi que 54 tonnes de munitions aux experts militaires. À Kinshasa, en 2009, plus de 11 000 armes détenues illégalement par des civils avaient également été récupérées, selon Le Figaro.

Timothée Manoke

Regulator Sues AVZ for Non-Disclosure in DRC’s Manono Lithium Dispute

The Australian Securities and Investments Commission (ASIC) said on Tuesday, Nov. 11, that it had initiated Federal Court proceedings against AVZ Minerals, the mining company that claimed mining rights over the Manono lithium deposit in the Democratic Republic of Congo (DRC).

The regulator alleges that the company and two of its directors failed to meet their disclosure obligations to investors concerning the legal dispute surrounding the project. AVZ was listed on the Australian Securities Exchange (ASX) until trading was suspended in May 2022. It was delisted in May 2024.

Through its subsidiary Dathcom Mining, AVZ held a 75 percent stake in a licence covering part of the Manono site, which is widely regarded as the DRC’s largest lithium deposit, but it never secured the mining rights. In October 2023, joint-venture partner Cominière, a state-owned company, announced that it had signed an agreement to operate part of the deposit with China’s Zijin Mining Group. AVZ is contesting these developments and has launched several international legal proceedings to defend its claims.

ASIC alleges that the company failed to disclose information about the dispute for nearly a year. Managing Director Nigel Ferguson and Technical Director Graeme Johnston are also accused of breaching their duties as directors by allowing the publication of “false or misleading” announcements to the ASX.

“It was all but impossible for retail investors to travel to an overseas location in central Africa where the company’s operations were being conducted. In those circumstances, investors rely on the company to provide accurate and timely information. We allege Mr Ferguson and Mr Johnston failed to inform investors of the ongoing issues in this case for nearly 12 months,” ASIC Deputy Chair Sarah Court said.

AVZ and its directors “strongly denied all allegations of wrongdoing” in a statement issued shortly afterward, saying they will vigorously defend themselves in court.

Emiliano Tossou

DRC Begins Review of 2002 Investment Code to Improve Investor Appeal

The Democratic Republic of Congo (DRC) launched a review of its investment code. The process is being led by the National Investment Promotion Agency (ANAPI) in partnership with the Fragile States Facility (FSF) and the African Development Bank (AfDB). The review opened in Kinshasa on Nov. 11 and ended on Nov. 13, and was officially launched by Planning and Development Aid Coordination Minister Guylain Nyembo. Its aim is to modernize the legal framework and make the country more attractive to investors.

Adopted in 2002, the current investment code is now seen as hindering investor interest. According to ANAPI Director General Rachel Pungu, the code is weighed down by burdensome administrative procedures, unclear tax incentives and weak legal clarity and investment protection. The revision seeks to make the code more competitive within the region and to promote investment that creates jobs and generates wealth by strengthening legal and judicial security in business practices.

Pungu also noted that the code was drafted when the country still had 11 provinces and no longer reflects the current administrative structure of 26 provinces, which limits its scope. She added that the code contains poorly defined eligibility criteria for tax benefits, including a 35 percent value-added requirement with no clear justification, and lacks financial benchmarks to assess project profitability.

The complex approval process and the code’s narrow scope are also seen as obstacles, especially as competition intensifies within the African Continental Free Trade Area (AfCFTA), the Common Market for Eastern and Southern Africa (COMESA) and the Southern African Development Community (SADC). Limited investment in key sectors such as agriculture, together with a patchwork of tax exemption schemes, has further contributed to the code becoming outdated.

The review also includes the development of a national business climate policy and a national investment policy. These tools are intended to provide a long-term framework for improving the business environment and encouraging investment across the entire country.

Youmann Consulting Group, commissioned by the FSF, is providing technical support and is expected to deliver three documents by the end of the year: a revised investment code, a national business climate policy and a national investment policy. These documents will then be submitted to the government for validation before their final adoption.

Ronsard Luabeya