Equipe Publication

Droits de trafic maritime : vers la révision du PPP entre Pads Corporation et la RDC

Un an après la signature du partenariat public-privé (PPP) entre le ministère congolais des Transports et la société Pads Corporation Sarl pour la digitalisation et la collecte des redevances perçues au sein de ce ministère, le projet fait désormais l’objet d’un réexamen. Cette réévaluation intervient à la suite de contestations formulées par la société publique Lignes Maritimes Congolaises (LMC), qui dénonce notamment sa non-implication dans le projet et la nouvelle répartition des droits de trafic maritime induite par le contrat.

Pour trouver une issue, des réunions de concertation se sont tenues les 3 et 4 novembre 2025 à Kinshasa. Autour de la table figuraient les ministres des Transports, Jean-Pierre Bemba, et du Portefeuille, Julie Mbuyi, les dirigeants de la LMC, ainsi que le comité directeur de Pads Corporation.

À l’issue des discussions, le président du Conseil d’administration de la LMC, Lambert Mende, a salué un dialogue constructif, estimant que ces premières rencontres ont permis de clarifier le cadre du partenariat et d’obtenir des « ajustements du gouvernement », sans plus de précisions. Selon la même source, les deux ministres ont instruit les experts de la LMC et de Pads Corporation d’élaborer un document de procédure définissant les mécanismes de collaboration entre les deux parties.

Signé en mars 2024, le PPP porte sur la conception, le financement, l’exploitation et la maintenance d’une plateforme numérique dédiée à la collecte automatisée des redevances perçues au sein du ministère des Transports. Le projet, d’un coût de 11 millions de dollars pour une durée de 10 ans, a introduit une nouvelle répartition des droits de trafic maritime, jusqu’ici entièrement alloués à la LMC : 10 % pour Pads Corporation, 17,5 % pour le fonctionnement de certaines administrations, et le reste pour la LMC.

La société publique dénonce cette répartition, qu’elle considère comme une perte de revenus et une réduction de ses prérogatives financières. Du côté du ministère des Transports, le PPP avec Pads Corporation est présenté comme une initiative de modernisation, visant à améliorer la transparence et sécuriser les flux financiers, en vue d’accompagner la reconstruction de la flotte nationale de la LMC.

Créée en 1974, la Lignes Maritimes Congolaises est chargée d’assurer le transport maritime international des marchandises congolaises. En mai 2025, l’entreprise avait annoncé un projet d’acquisition de deux nouveaux navires pour moderniser sa flotte.

Ronsard Luabeya

Lire aussi :

Secteur maritime : lancement de la BMRD en 2026, une opportunité pour la RDC

Transport maritime : l’armateur public LMC en passe d’acquérir deux navires

DRC’s Industry Fund, IFC Explore Co-Financing in Mining, Agriculture, and Energy

The Democratic Republic of Congo's Industry Promotion Fund (FPI) and the International Finance Corporation (IFC) are exploring a collaboration to co-finance industrial projects in the country.

FPI Director General Hervé Claude Ntumba met with IFC Country Representative Malick Fall on Nov. 5, 2025, to discuss priority sectors for potential joint support.

According to a note from the FPI, the discussions focused on aligning the two institutions’ interventions in sectors deemed critical to developing the Congolese industrial base, including agriculture, energy, mining, telecommunications, and infrastructure.

Beyond co-financing projects, the two organizations are also considering establishing joint programs for training and capacity building to support local Congolese expertise.

Ntumba emphasized that the DRC’s economic recovery relies on close cooperation between local and international financial institutions. He stressed that the country's development requires sustainable partnerships built on a shared vision of progress.

The meeting comes as the IFC is already working with Congolese authorities on several initiatives, including establishing a capital market, developing an accessible and sustainable housing finance ecosystem, and implementing major projects in the power and agricultural sectors.

Since 2021, the IFC has invested over $550 million in the DRC, primarily in telecommunications, the financial sector, and energy.

Ronsard Luabeya

DRC Nears $456 Million IMF Disbursement After Program Review

The Democratic Republic of Congo is nearing a $456 million disbursement from the International Monetary Fund (IMF) under its three-year economic and financial program.

The amount includes $268 million from the Extended Credit Facility (ECF) and $188 million from the Resilience and Sustainability Facility (RSF), according to a source familiar with the matter.

Following a mission from Oct. 22 to Nov. 5, 2025, IMF staff and Congolese authorities reached a staff-level agreement on the second review of the ECF and the first review of the RSF, the IMF said in a statement. The agreement marks a key step toward releasing the funds.

The next stages involve review by the IMF’s Management and approval by its Executive Board, scheduled to meet in December 2025. A favorable decision, which typically follows such agreements, would trigger the immediate disbursement.

Unlike previous tranches, most of the upcoming funds will be allocated as budget support, transferred directly to the Treasury to support the national budget. An IMF official said $188 million from the RSF and $189 million from the ECF will go toward budget support, totaling $377 million.

The remaining $79 million will be credited to the Central Bank of Congo’s account at the Bank for International Settlements to strengthen the country’s foreign reserves.

The IMF noted that the DRC’s external stability has improved, driven by growing reserves and a narrower current account deficit, though reserves remain below the recommended adequacy level. Persistent insecurity in the eastern provinces and recurring health crises, such as Ebola outbreaks, continue to strain public finances.

For 2026, the DRC projects a budget of 59.02 trillion Congolese francs ($20.3 billion) based on the average exchange rate used for fiscal assumptions. Defense spending will represent nearly 15% of the total, or 7.93 trillion francs ($2.7 billion). The overall budget is up 16.4% from the revised 2025 finance law. To help fund it, the government is relying on external budget support, projected to rise 28.1% to 3.80 trillion francs ($1.3 billion).

Pierre Mukoko

DR Congo Revokes Mining Rights for Seven Companies Over Unpaid Fees

The Democratic Republic of Congo's Ministry of Mines revoked the mining rights of seven companies in late October 2025 as part of its policy to enforce stricter compliance in the sector. The revocations were issued for failure to pay annual surface rights fees.

According to a list published by the Mining Cadastre (CAMI) on Nov. 3, Geocore was the most affected entity, losing two separate mining titles. One of the titles, granted in 2021, covered five mining squares in the Nyunzu and Kongolo territories of Tanganyika province, authorizing the company to conduct exploration and prospecting for gold, cassiterite, coltan, and wolframite.

Another notable firm was Regal Maniema, which had its Research Permit No. 3279 revoked. The company had previously faced the threat of forfeiture for the same reason, following a similar procedure initiated in 2021 over unpaid fees for the 2019 financial year.

These forfeiture decisions are based on Article 289 of the DRC's 2018 Revised Mining Code. The code allows affected companies to appeal the decision before competent authorities within 30 days of notification and publication. If no appeal is filed, the forfeiture is formally registered with the Mining Cadastre and published in the official gazette.

Under the Mining Code, the payment of surface rights is the second main condition for maintaining the validity of a mining title, after providing proof of the effective start of exploration or exploitation work. These rights are due annually, calculated based on the perimeter area and the permit’s validity period. The fees range from $0.03 to $1.14 per hectare, payable in Congolese francs at the current exchange rate.

Timothée Manoke

DR Congo to Build 707 km of Rural Roads in Kasai Central

The Democratic Republic of Congo plans to begin construction in 2026 on 707 kilometers of rural feeder roads in Kasai Central province under the National Agricultural Development Program (PNDA).

Technical studies are underway and expected to conclude by the end of 2025, clearing the way for work to start. The initiative aims to improve market access for farmers and strengthen rural connectivity across three territories, Demba, Luiza, and Dibaya, covering 201 km, 246 km, and 260 km respectively.

About 70% of the work will be carried out by the Directorate of Agricultural Feeder Roads using the labor-intensive HIMO approach, which favors local employment over heavy machinery.

To speed up implementation, the PNDA and the Directorate of Agricultural Feeder Roads signed an agreement on February 24, 2025. It includes training programs for HIMO team leaders drawn from local road maintenance committees, small and medium enterprises, and community development NGOs.

The $300 million PNDA, financed by the World Bank, spans four provinces, Kasai, Kasai Central, Kongo Central, and Kwilu. It aims to strengthen agricultural value chains for high-yield maize, cassava, soybeans, and poultry, while improving the flow of farm goods. In the long term, the program targets the construction and rehabilitation of 3,049 kilometers of rural feeder roads across twelve territories in the four provinces.

Ronsard Luabeya

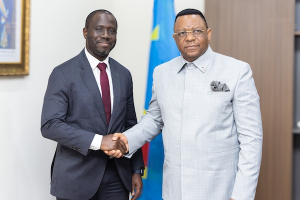

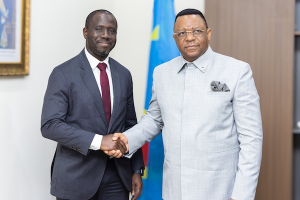

Financement des projets : le FPI explore un partenariat avec la SFI

Le Fonds de promotion de l’industrie (FPI) et la Société financière internationale (SFI/IFC) examinent les possibilités d’une collaboration visant à cofinancer des projets industriels en République démocratique du Congo (RDC). Le 5 novembre 2025, le directeur général du FPI, Hervé Claude Ntumba, a échangé avec Malick Fall, représentant pays de la SFI, sur les secteurs prioritaires susceptibles de bénéficier d’un appui.

Selon une note du FPI, les discussions ont porté sur l’alignement des interventions des deux institutions dans les domaines jugés essentiels au développement du tissu industriel congolais, notamment l’agriculture, l’énergie, les mines, les télécommunications et les infrastructures.

Outre le cofinancement de projets, les deux parties envisagent également la mise en place de programmes conjoints de formation et de renforcement des capacités, destinés à soutenir l’expertise congolaise.

Pour Hervé Claude Ntumba, la relance économique de la RDC repose sur une coopération étroite entre institutions financières locales et internationales. Il estime que le développement du pays nécessite des partenariats durables, fondés sur une vision commune du progrès.

Cette rencontre intervient alors que la SFI collabore déjà avec les autorités congolaises sur plusieurs chantiers, notamment la mise en place d’un marché des capitaux, le développement d’un écosystème de financement du logement accessible et durable, ainsi que la réalisation de projets structurants dans les secteurs électrique et agricole.

Depuis 2021, la SFI affirme avoir investi plus de 550 millions de dollars en RDC, principalement dans les télécommunications, le secteur financier et l’énergie.

Ronsard Luabeya

Lire aussi :

Malick Fall (IFC) : « Nous travaillons pour développer le marché des capitaux en RDC »

FPI : un système de gestion numérique attendu d’ici la fin de l’année

Compte unique du Trésor : l’intersyndicale redoute la perte d’autonomie financière du FPI

Securiport Deal Triggers Confusion Over Airport Security Fee in DR Congo

Excerpts from a contract signed between the Congolese government—through the Ministries of Interior and Transport—and U.S. company Securiport for an integrated border and immigration security system have circulated on social media since November 3, 2025, sparking widespread controversy. At the center of the debate is Article 38, which concerns the partner’s remuneration.

The article stipulates a $30 security fee to be charged to every air passenger, both on arrival and departure, at all international airports in the Democratic Republic of Congo. Many online users interpreted this as the introduction of a new airport tax, in a context where the public has long demanded the removal of existing levies such as the GoPass, currently set at $50 for international flights and $15 for domestic ones.

However, according to a senior official at the Ministry of Interior quoted by several media outlets, the security fee already exists. It is included in airline ticket prices for international flights to and from the DRC and collected by IATA-affiliated airlines. These revenues, previously allocated to several public agencies including the Directorate General of Migration (DGM), have been partly redirected to finance the Securiport LLC contract, the source said.

This version was confirmed by multiple airlines, which stated they already pay a boarding and security fee to Congolese authorities. In their fare breakdowns, Qatar Airways, Uganda Airlines, and Kenya Airways list a $43.75 charge, while Ethiopian Airlines shows $58 and Air France up to $66.

Fund management mechanism

According to the contract, the $30 security fee will now be paid monthly into a joint account managed by the government and Securiport. The document specifies that an irrevocable monthly transfer order will allocate 85% of the collected funds to Securiport—to recover its investment—and 15% to the Congolese state.

The agreement is structured as a Build–Train–Maintain–Transfer (BTMT) public-private partnership. It involves the deployment of an integrated border and immigration management system, including the installation of technological equipment, centralization of migration data, and digital management of passenger flows at airports, land borders, and seaports.

Securiport is responsible for financing, designing, installing, and maintaining the system while training officials from the two ministries. At the end of the contract—whose duration is not specified in the available excerpts—ownership of all infrastructure, equipment, and software will transfer to the Congolese government.

According to authorities, the project aims to strengthen national security in response to rising transnational threats such as document forgery, identity fraud, infiltration by radicalized individuals, and other cross-border criminal activities. It is intended as part of broader efforts to enhance airport and border security across the country.

Based in Virginia, the United States, Securiport specializes in immigration control and civil aviation security and already operates in Côte d’Ivoire, Sierra Leone, Senegal, and The Gambia, where it provides similar services. In these countries, the security fee ranges between $20 and $25; in The Gambia, for example, 25% of the collected amounts go to the Gambia Civil Aviation Authority (GCAA).

No official statement has yet clarified how Securiport was selected. According to a source close to the executive, the process began about a decade ago, and the company was chosen following a competitive tender.

As of now, the government has issued no official communication on the matter, leaving questions unanswered and public concerns unresolved.

Africell and Vodacom explore Starlink partnership in DR Congo

Telecom operators Africell and Vodacom, active in the Democratic Republic of Congo (DR Congo), are exploring potential partnerships with Starlink, the global satellite Internet provider, to expand their network coverage nationwide.

Africell DR Congo CEO Kory Webster confirmed to U.S. media outlet Semafor that the company is holding “active discussions” with Starlink on an operational partnership. A Vodacom executive, also quoted by the outlet, said the operator is considering a similar satellite collaboration to strengthen coverage in rural and hard-to-reach areas. No further details have been disclosed.

In May 2025, Airtel Africa signed a partnership with SpaceX, making it the first operator in DR Congo to collaborate with Starlink. Vodacom and Africell’s current moves appear to be a response to this competitive advantage.

Experts say Starlink’s network could be used to connect base transceiver stations (BTS) in remote areas to telecom operators’ core networks, where voice and data traffic are managed. The solution is seen as a lower-cost alternative to the VSAT technology currently in use and could help operators expand coverage while improving commercial and financial performance.

The Airtel–SpaceX partnership therefore gives Airtel Congo a strategic edge in the race for an estimated 15 million new mobile Internet subscribers expected in DR Congo between 2025 and 2030, according to GSMA projections.

Data from the Congolese postal and telecom regulator (ARPTC) show that by the end of 2024, the country had 32.94 million active mobile Internet subscriptions (90-day basis). Airtel had 9.66 million users, representing 29.33% of the market, behind Vodacom (37.78%) and Orange (29.97%), but ahead of Africell (2.92%). However, in terms of Internet revenue, Airtel led with $365.5 million (37.7% market share), followed by Orange (31.5%), Vodacom (27%), and Africell (3.8%).

Programme avec le FMI : la RDC en voie de recevoir plus de 450 millions $

La République démocratique du Congo (RDC) se rapproche d’un décaissement de près de 456 millions de dollars dans le cadre de son programme économique et financier triennal avec le Fonds monétaire international (FMI). Ce montant comprend 268 millions de dollars au titre de la Facilité élargie de crédit (FEC) et 188 millions de dollars au titre de la Facilité pour la résilience et la durabilité (FRD), précise une source interne.

Selon un communiqué du FMI, à l’issue d’une mission conduite du 22 octobre au 5 novembre 2025, les services du Fonds et les autorités congolaises sont parvenus à un accord préliminaire sur la deuxième revue du volet FEC et la première revue du volet FRD. Cette avancée marque la validation de la première étape vers le décaissement des 456 millions de dollars.

Les prochaines étapes concernent l’examen du dossier par la direction générale du FMI, puis par son conseil d’administration, dont la réunion est prévue en décembre 2025. Si le dossier reçoit un avis favorable — ce qui est probable, ces instances désavouant rarement les conclusions de leurs missions —, le décaissement interviendra immédiatement après.

Contrairement aux précédents versements, il s’agira en grande partie d’appuis budgétaires, c’est-à-dire de fonds transférés directement au Trésor public pour le financement du budget de l’État. Selon un responsable du FMI, 188 millions de dollars au titre de la FRD et 189 millions sur les 268 millions de la FEC seront versés sous ce mécanisme, soit un total de 377 millions de dollars.

Le solde de 79 millions de dollars sera crédité sur le compte de la Banque centrale du Congo (BCC) logé auprès de la Banque des règlements internationaux (BRI), afin de renforcer les réserves internationales du pays.

Cette répartition reflète les besoins économiques actuels de la RDC. D’après le FMI, la stabilité extérieure du pays s’est renforcée, soutenue par l’accumulation continue des réserves internationales et la réduction du déficit du compte courant, bien que le niveau des réserves demeure inférieur au seuil d’adéquation recommandé. Parallèlement, le conflit armé à l’est du pays et les épidémies récurrentes, comme celle de la maladie à virus Ebola, continuent d’exercer une pression importante sur les finances publiques.

Pour 2026, la RDC prévoit un budget de 59 020,5 milliards de francs congolais (FC), soit 20,3 milliards de dollars au taux de change moyen retenu dans les hypothèses budgétaires. Près de 15 % de ce budget, en hausse de 16,4 % par rapport à la loi de finances rectificative de 2025, sera consacré à la défense nationale, soit 7 929,7 milliards de FC (2,7 milliards de dollars). Pour financer ce budget, le gouvernement compte en partie sur les appuis budgétaires, attendus à 3 800,2 milliards de FC (1,3 milliard de dollars), en hausse de 28,1 % par rapport à 2025.

Pierre Mukoko

Lire aussi :

Le FMI décaisse 262 millions $ pour renforcer le matelas de devises de la RDC

Budget 2025 : le FMI et la Banque mondiale atténuent l’impact de la crise à l’est de la RDC

Sun Africa to develop 4,000 MW renewable energy project in DR Congo

The Democratic Republic of Congo (DR Congo) and U.S. developer Sun Africa signed in late October 2025 a memorandum of understanding to implement a program called “Energy for Prosperity,” according to Mike Luntadila Koketua, president of MFS Group, which serves as the developer’s local partner.

According to Luntadila, the program aims to install generation infrastructure with a total capacity of 4,000 MW by combining solar power, hydropower, and energy storage. It also includes plans to reinforce high- and medium-voltage transmission lines to modernize the national grid and support the country’s industrial transformation.

This is a large-scale initiative. For context, the Electricity Sector Regulatory Authority (ARE) estimated the country’s installed capacity at 3,646.5 MW in 2024, meaning the project’s planned capacity exceeds current levels. However, several details remain unclear, including the exact location of the plants, construction timeline, and financing structure.

Sun Africa describes itself as a developer of large-scale renewable energy and off-grid electrification solutions, including mini-grids and solar kits, across Africa. Its projects so far range from 25.4 to 370 MW, mainly in Angola, with rural electrification initiatives also planned in Nigeria and Namibia.

Based in Miami, the company announced in August 2024 that it had become the “new private partner” of the Power Africa initiative, under a plan to add up to 6,500 MW of new capacity and connect more than eight million households and businesses across the continent.