Equipe Publication

Connectivité en RDC : le projet satellitaire Monacosat chiffré à 400 millions $

À l’issue de l’audience accordée le 30 août dernier par le président de la République, Félix Tshisekedi, à Jean-Philippe Anvam, représentant de Monacosat, opérateur satellitaire basé à Monaco, de nouveaux détails ont été révélés sur le projet Monacosat. Selon le compte rendu de cette réunion publié par la présidence, il s’agit de l’acquisition d’un satellite grâce à un partenariat avec Monacosat. Coût du projet : 400 millions de dollars.

Cet investissement, qui représente près d’un quart du budget de l’État pour l’exercice 2025, sera financé par un emprunt. « Une banque a déjà mobilisé les fonds nécessaires estimés à 400 millions de dollars américains », a indiqué Jean-Philippe Anvam, cité par la présidence de la République. Le nom de la banque n’a toutefois pas été communiqué.

Néanmoins, la veille, à l’issue d’une rencontre avec le ministre de l’Économie numérique, Augustin Kibassa, la directrice générale de Fidelity Bank, Nneka Onyeali-Ikpe, a affirmé la disponibilité de son institution à financer le projet. Elle a même annoncé la création d’une équipe mixte Fidelity Bank–ministère pour en définir les contours.

En novembre 2024, le gouvernement congolais avait signé à Monaco un protocole d’accord avec Monacosat. Selon le représentant de l’opérateur, ce partenariat porte sur le déploiement d’un satellite congolais destiné à réduire la fracture numérique en RDC. L’objectif est de faciliter l’accès à internet haut débit sur l’ensemble du territoire, notamment dans les zones rurales et enclavées où les infrastructures de télécommunication demeurent insuffisantes.

Cette initiative doit aussi contribuer à renforcer la cybersécurité, soutenir l’enseignement à distance, améliorer la télémédecine et stimuler la croissance de l’économie numérique.

Pour l’heure, il reste à savoir si un accord définitif a été conclu entre les parties. Sa signature constitue un préalable indispensable pour passer à la phase opérationnelle du projet.

Boaz Kabeya

Lire aussi :

Connectivité : le Nigérian Fidelity Bank prête à financer le projet satellitaire Monacosat

Internet par satellite : vers un partenariat entre la RDC et Monacosat

Internet : des réductions d’impôts à l’étude pour faciliter l’accès à Starlink en RDC

Katamba Mining Seeks Approval for 108MW Expansion at Mpiana-Mwanga Plant

Katamba Mining has filed an application with the Electricity Sector Regulation Authority (ARE) for a production concession for the third phase of the Mpiana-Mwanga hydroelectric plant. The company, 70% owned by China's Zijin Mining and 30% by the DRC Mining company Cominière, aims for a planned capacity of 108 MW for the plant located in the Manono territory.

The move follows Katamba Mining's April launch of a tender to hire a subcontractor to build and operate a crushing plant. This facility is intended to produce the sand and gravel needed for the construction of Mpiana-Mwanga III, which is situated more than 90 kilometers northeast of Manono.

With the addition of the projected 108 MW from the third phase, the Mpiana-Mwanga complex would reach a total capacity of 148 MW. The rehabilitation of the first two phases, completed in 2024 at a cost of $80 million, had already boosted the plant’s capacity to 40 MW, a 30% increase from its original output. These upgrades restored installations that were 97 years old and had been out of service since 1998.

The primary goal of these investments is to power the Manono lithium mining project, considered one of the world's largest high-grade lithium deposits. However, Katamba's distribution concession application and statements from Zijin Mining Vice President James Wang confirm that the electricity generated will also supply local communities and key infrastructure. This includes the city and territory of Manono, the village of Kanuka (Tanganyika), the territory of Malemba Nkulu (Haut-Lomami), and the Manono airfield.

According to its 2024 annual report, Zijin Mining, which holds a mining permit for the northeastern zone of the Manono deposit, has identified approximately 2.62 million tonnes of lithium oxide at an average grade of 1.5% during preliminary exploration. This is equivalent to 6.47 million tonnes of lithium carbonate. The company plans to begin production in the first quarter of 2026.

Timothée Manoke (Intern)

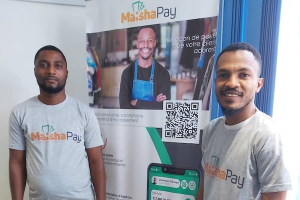

Maishapay joins Visa’s Africa Fintech Accelerator program

Congolese fintech Maishapay has been selected as one of 12 startups for the fourth edition of Visa’s Africa Fintech Accelerator program. The cohort, running from October to December 2025, includes companies working in areas such as SME digitization, digital lending, cross-border payments, payroll management, B2B payments, AI-driven transactions, social commerce, climate insurance, and neobanking.

By joining the program, Maishapay will gain access to tailored mentorship, specialized training, networking opportunities, and direct links to investors. Since its launch, the accelerator has supported 64 fintechs from 17 African countries, with a combined portfolio value of $1.1 billion. The 12-week program is part of Visa’s $1 billion investment plan in Africa through 2027 to boost financial inclusion and strengthen the continent’s digital economy.

Founded in 2018 by Congolese IT entrepreneur Landry Ngoya, Maishapay is a blockchain-based digital wallet. It allows withdrawals, deposits, mobile payments, money transfers, and offers both checking and savings accounts. Available online and offline, it aims to provide banking alternatives for underserved and unbanked populations.

The platform now counts over 68,000 users, connects with 27 e-commerce sites, and is accepted by more than 14,000 merchants in retail, hospitality, and food services. Already active in the DRC, Congo-Brazzaville, Nigeria, Egypt, and Ethiopia, Maishapay focuses mainly on young entrepreneurs and women who are often excluded from traditional financial services.

Visa sélectionne la fintech congolaise Maishapay pour son programme Africa Fintech

La fintech congolaise Maishapay a été retenue parmi les 12 jeunes pousses sélectionnées pour la quatrième édition du programme Africa Fintech Accelerator lancé par Visa. Cette cohorte, prévue d’octobre à décembre 2025, rassemble des entreprises actives dans divers domaines de la fintech : numérisation des PME, prêts digitaux, paiements transfrontaliers, gestion de la paie, paiements B2B, transactions basées sur l’intelligence artificielle, commerce social, assurance climatique et néobanque.

En rejoignant ce dispositif, Maishapay bénéficiera d’un mentorat personnalisé, de formations spécialisées, d’opportunités de réseautage et d’un accès privilégié aux investisseurs. Depuis son lancement, ce programme a déjà accompagné 64 fintechs issues de 17 pays africains, pour une valeur de portefeuille cumulée estimée à 1,1 milliard de dollars. Étendu sur 12 semaines, il s’inscrit dans l’engagement de Visa d’investir 1 milliard de dollars en Afrique d’ici 2027, afin de stimuler l’inclusion financière et de renforcer l’économie numérique du continent.

Fondée en 2018 par Landry Ngoya, informaticien et entrepreneur congolais, Maishapay est un porte-monnaie électronique basé sur la blockchain. La solution permet d’effectuer retraits, dépôts, paiements mobiles, transferts d’argent, ainsi que l’ouverture de comptes courants et d’épargne. Accessible aussi bien en ligne qu’hors ligne, elle se positionne comme une alternative de bancarisation pour les populations peu ou pas bancarisées.

La plateforme revendique aujourd’hui plus de 68 000 utilisateurs, connecte 27 sites e-commerce et est acceptée par plus de 14 000 commerçants dans des secteurs comme le commerce de détail, l’hôtellerie et la restauration. Déjà implantée en RDC, au Congo-Brazzaville, au Nigeria, en Égypte et en Éthiopie, Maishapay cible en priorité les jeunes entrepreneurs et les femmes, souvent exclues des services financiers traditionnels.

Ronsard Luabeya

Lire aussi :

Paiement numérique : Mosolo, le système unifié de la RDC bientôt lancé

Paiement des salaires : les solutions de Rawbank et Equity BCDC à l’est de la RDC

Manono : la phase 3 de la centrale hydroélectrique de Mpiana-Mwanga prévue à 108 MW

La capacité prévue pour la troisième phase de la centrale hydroélectrique de Mpiana-Mwanga, située dans le territoire de Manono, est fixée à 108 MW. Cette donnée ressort de la demande de concession de production déposée auprès de l’Autorité de régulation du secteur de l’électricité (ARE) par Katamba Mining, société détenue à 70 % par le groupe chinois Zijin Mining et à 30 % par la Congolaise d’exploitation minière (Cominière).

Cette démarche intervient alors que Katamba Mining a lancé en avril dernier un appel d’offres pour recruter un sous-traitant chargé de la construction et de l’exploitation d’une centrale de concassage. Cette installation devra produire le sable et le gravier nécessaires aux travaux de Mpiana-Mwanga III, située à plus de 90 km au nord-est de Manono.

Avec les 108 MW projetés dans la troisième phase, le complexe de Mpiana-Mwanga atteindrait une capacité totale de 148 MW. La réhabilitation des deux premières phases, achevée en 2024, avait déjà porté la centrale à 40 MW, soit une hausse de 30 % par rapport à la situation initiale, pour un coût total de 80 millions de dollars. Ces travaux concernaient la remise en état d’installations construites il y a 97 ans et à l’arrêt depuis 1998.

L’objectif principal de ces investissements reste l’approvisionnement en électricité du projet d’exploitation du lithium de Manono, considéré comme l’un des plus importants gisements mondiaux de lithium à haute teneur. Mais la demande de concession de distribution, ainsi que les propos du vice-président de Zijin Mining, James Wang, confirment que l’électricité produite doit aussi alimenter des communautés locales et des infrastructures clés, notamment la ville et le territoire de Manono, le village de Kanuka (Tanganyika), le territoire de Malemba Nkulu (Haut-Lomami) ainsi que l’aérodrome de Manono.

Selon son rapport annuel 2024, Zijin Mining, détenteur d’un permis d’exploitation sur la zone nord-est du gisement de Manono, a identifié lors des recherches préliminaires environ 2,62 millions de tonnes d’oxyde de lithium, à une teneur moyenne de 1,5 %. Cela représente 6,47 millions de tonnes d’équivalent carbonate de lithium. La compagnie prévoit de démarrer la production au premier trimestre 2026.

Timothée Manoke, stagiaire

Lire aussi :

Lithium de Manono : Zijin Mining engage l’extension de la centrale de Mpiana-Mwanga

Lithium de Manono : l’Américain KoBold Metals obtient plusieurs permis de recherche

Rawbank Backs University Basketball to Boost Youth Talent and Brand

Rawbank, the leading banking institution in the Democratic Republic of Congo, is set to launch the second phase of the All Stars Game University 3X3, a university basketball tournament aimed at discovering new athletic talent. The announcement was made on August 29, 2025, in Kinshasa by Rawbank's Brand Manager, Jimmy Baraka, at a press conference. The event will take place from September 18 to 20 in the capital, following the first stage held weeks earlier in Matadi, the capital of Kongo Central province.

The initiative is designed to showcase the technical and athletic abilities of Congolese students while allowing them to earn official FIBA points. According to Baraka, the tournament serves as a platform for young athletes, paving their way to national recognition and, for the top performers, international competitions. The winning team will represent the DRC at the next international FIBA 3X3 tournament, as the HEC Kinshasa team did after winning the first edition.

"By supporting this tournament, Rawbank reaffirms its commitment to investing in human capital and promoting a future built on inclusion and responsibility. We are proud to be associated with an event that energizes the country's university and sports life," said Mustafa Rawji, Rawbank's managing director.

Twelve universities in Kinshasa will participate in this phase: the Catholic University of Congo (UCC), the Protestant University of Congo (UPC), the Haute École de Commerce (HEC), the University of Kinshasa (UNIKIN), the National Pedagogical University (UPN), the Higher Institute of Applied Techniques (ISTA), Belcampus University, William Booth University, the Academy of Fine Arts, the Higher Institute of Computer Science, Programming and Analysis (ISIPA), the National Institute of Building and Public Works (INBTP), and the University of Information and Communication Sciences (UNISIC). Some of these institutions will provide their sports facilities to host the games.

Organized in partnership with the DRC Basketball Federation, the tournament also has the support of Visa and Illicocash. It is part of the bank's We Act program, which supports young people in the DRC in entrepreneurship, digital technology, and financial literacy. Launched two years ago, the program has already provided training and personalized support to nearly 250 young people, according to its manager, Éric Ngeleka.

Ronsard Luabeya

DRC Pauses Insurance Law, Orders a Full Review Despite Prior Adoption

At a cabinet meeting on August 29, 2025, Prime Minister Judith Suminwa announced the creation of an inter-ministerial commission to assess the sector and propose a "thorough reform" to make it "more competitive and bring it up to international standards."

This decision marks an abrupt change in direction. At a previous cabinet meeting on April 11, the government had already adopted a bill to amend the country’s insurance code. At that time, the next step was to submit the text for parliamentary review.

No official explanation has been given for the change of course. The most recent cabinet meeting minutes simply outlined three new pillars for the reform: expanding insurance coverage to all sectors of the national economy; strengthening local reinsurance capacity to limit capital flight; and strategically using the sector’s resources to finance the economy. The government aims to transform the sector into a "strategic pillar of economic development."

The previously adopted bill had already aimed to meet these goals. The minutes from the April meeting stated that the text corrected technical and material errors and introduced new measures to help the sector "fully play its role" in the economy and align with international norms. These included integrating micro-insurance to promote financial inclusion, mandating a minimum subscription by insurance companies in government securities, adopting digital technologies, diversifying premium payment methods, strengthening policyholder rights, and creating a General Directorate of Insurance to oversee mandatory insurance and manage guarantee funds.

The DRC's insurance sector was liberalized in 2015, but effective implementation began only in 2019. Since then, the market has expanded significantly, with revenue growing from $70 million in 2019 to over $350 million in 2024.

Despite this growth, several challenges persist, including low compliance with mandatory insurance, premium flight, a lack of insurance literacy among the population, and a general distrust of insurance companies.

Pierre Mukoko & Boaz Kabeya

DRC, Burundi Move to Reduce Non-Tariff Barriers with New Trade Agreement

The Congolese Control Office (CCO) and the Burundi Bureau of Standards and Quality Control(BBN) signed a memorandum of understanding on August 29, 2025, to implement new sanitary and phytosanitary regulations. The agreement aims to strengthen bilateral cooperation in standardization, quality control, and certification to facilitate trade while protecting consumers. No timeline was provided for the implementation of the new rules.

The partnership includes sharing information on quality assurance, metrology, conformity assessment, and pre- and post-shipment inspection of goods. It also provides for joint capacity-building activities, such as training sessions, workshops, and internships.

In a key step, both countries have agreed to a gradual mutual recognition of conformity certificates. This will allow each nation to accept inspections, tests, and certifications performed by the other. The agreement prioritizes national standards, followed by regional ones from bodies like ARSO, COMESA, and the East African Community (EAC), and finally international standards from organizations like ISO, IEC, and ASTM. The renewable three-year agreement includes an amicable dispute resolution mechanism, with diplomatic channels as a last resort.

This initiative is part of the Great Lakes Trade Facilitation and Integration Project (GLTFIP), which is funded by the World Bank with a total of $250 million. The Democratic Republic of Congo will receive $152 million, Burundi will get $90 million, and the Common Market for Eastern and Southern Africa (COMESA) will receive $8 million. Under the project, four one-stop border posts are planned for the South Kivu province (Kavimvira, Nyamoma, Rubenga, and Kamanyola) to streamline cross-border trade.

This new agreement extends a previous one signed between the DRC and Burundi in March 2022, which covered import duties, taxation, standards, anti-dumping and safeguard measures, fraud prevention, transit facilitation, and cooperation between customs administrations.

Ronsard Luabeya

Bunia’s Supply Lines to Uganda Disrupted by Insecurity and Poor Road Conditions

The supply of basic goods to Bunia has been disrupted by difficulties on the main routes connecting the city to Uganda. The provincial capital of Ituri is largely dependent on imports from Uganda, Kenya, and Tanzania.

According to local sources, the 55 km Bunia-Kasenyi road is now impassable after heavy rains caused the Kisenge River to overflow. This route, used by traders as an alternative to the RN27, allows for the transport of low-tonnage goods shipped across Lake Albert via the ports of Chomia and Kasenyi.

The RN27, the region’s main corridor connecting Bunia to Mahagi (185 km), also faces serious challenges. The road is in poor condition and has been the site of regular clashes between the army and armed groups. From July to August, several ambushes were reported, attributed to CODECO, Zaïre, and the Convention for the Popular Revolution (CRP) militias led by Thomas Lubanga. On August 14, the Congolese armed forces (FARDC) had to escort about a hundred trucks that had been stranded in Mahagi for two weeks to ensure their safe passage to Bunia.

Faced with these obstacles, many traders had turned to the Kasenyi route despite its limited capacity. Its current interruption is increasing fears of a supply shortage from Uganda.

Two Congolese companies, Good News Africa and Congo Éveil Logistique, are in advanced discussions with the government to modernize the RN27 through a public-private partnership. The project, a Build-Operate-Transfer (BOT) model, involves the rehabilitation and operation of the Komanda-Mahagi section (258 km), with the installation of toll booths and weigh stations to preserve the road's condition.

Timothée Manoke (Intern)

FirstBank DRC Taps Mining Expert Mbembo Bemba for New Deputy Role in Growth Push

FirstBank DRC has created a second deputy managing director position, appointing Mbembo Bemba to the role. According to the bank's 2024 Pillar III report, its management committee previously consisted of a managing director and only one deputy.

The Congolese subsidiary of the Nigerian banking group did not explain the reasoning behind the new position, but confirmed that Bemba will also join the board of directors, which previously had eight members. This marks a double promotion for the executive, who joined FirstBank DRC in 2023 as the regional director for the Greater Katanga region.

"In this capacity, he contributed to the expansion of the network and the strengthening of the client portfolio, particularly in the mining sector," the bank stated. Before joining FirstBank, Bemba spent four years at Standard Bank DRC, where he managed the client portfolio in the Katanga mining region.

His promotion comes as FirstBank DRC seeks to strengthen its presence in the mining region, boost retail banking growth through digitalization, and increase the share of revenue from digital products to 30% of total turnover. The bank also aims to expand its network of banking agents from nearly 3,000 to 100,000 by 2029.

The bank's sole deputy managing director previously oversaw commercial segments, including retail services, public institutional clients, NGOs, private banking, and customer experience. Now, Bemba will assist Managing Director Olajide Ayeronwi in implementing the bank's strategy, managing its operations, and strengthening its network across the country. He is expected to draw on his fifteen years of experience in the banking sector.

Boaz Kabeya