Global demand for cobalt should grow faster than supply in the coming years, shifting the market from a surplus in 2024 to a deficit by the early 2030s. The Cobalt Institute disclosed the forecast in its annual report published on May 14, 2025.

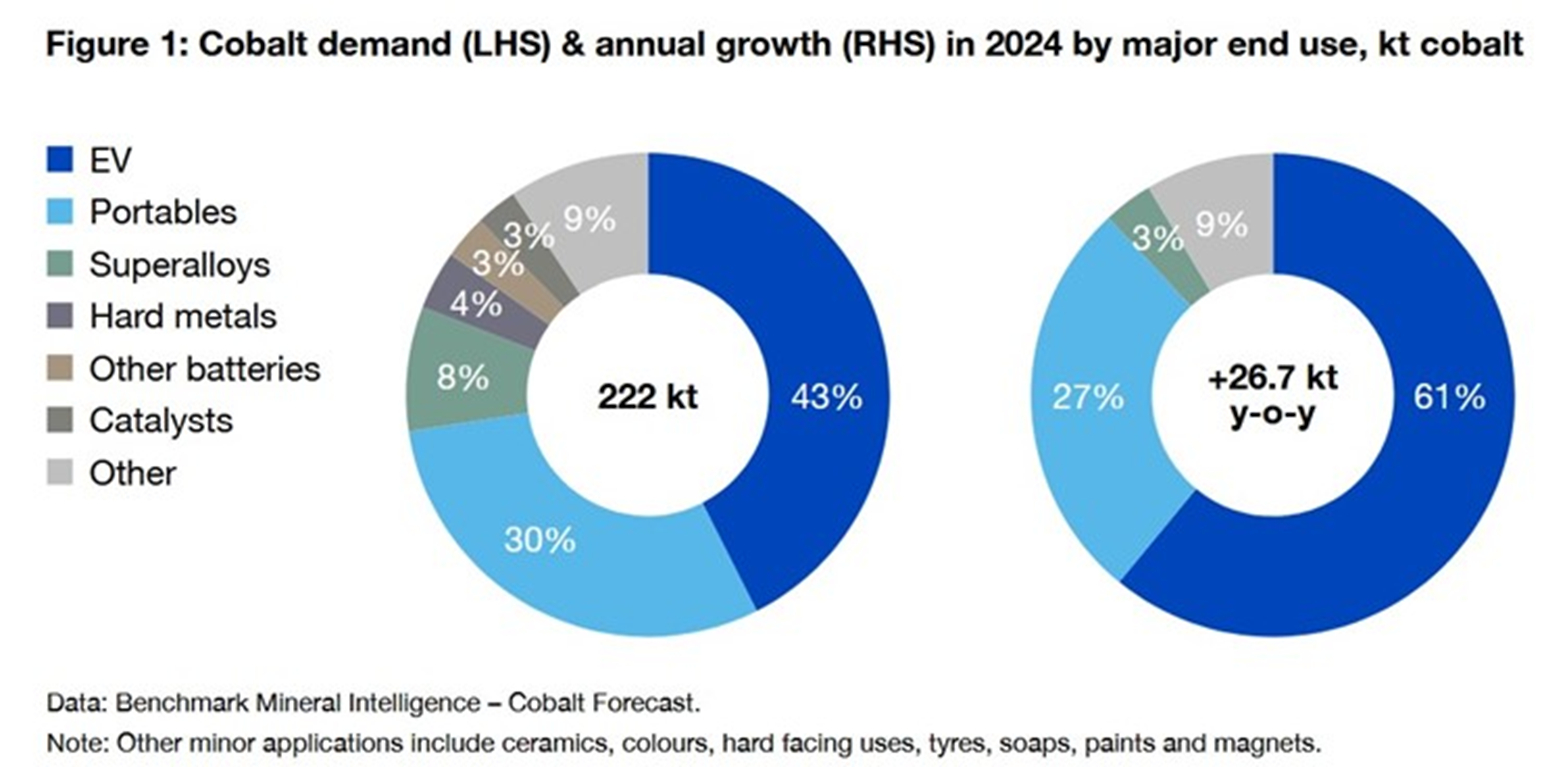

The source, Cobalt Market Report 2024, forecasts an average annual growth in global demand of 7% by the decade’s end, reaching 400,000 tonnes by the early 2030s. This growth will be driven primarily by the rapid expansion of the electric battery sector.

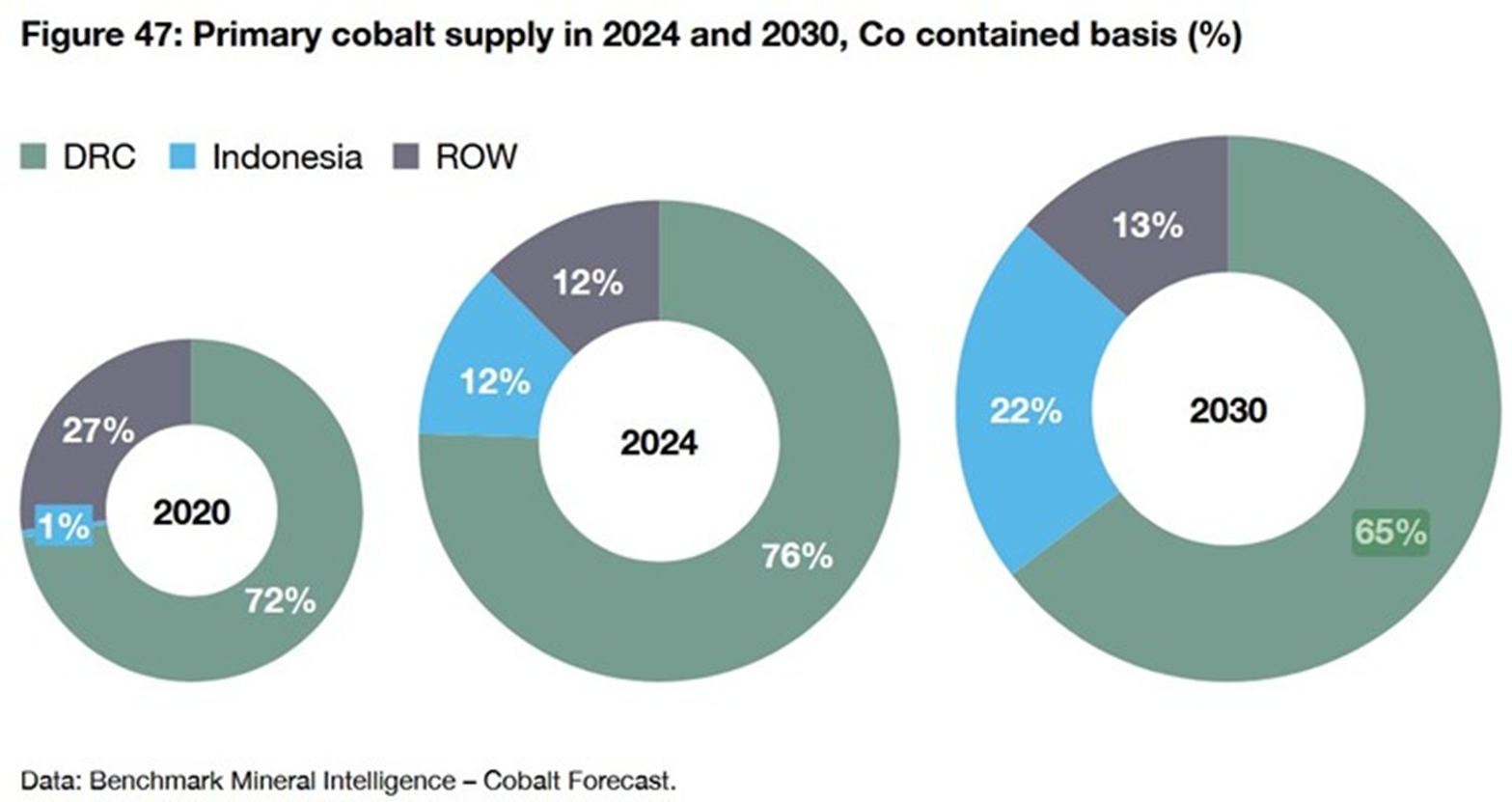

Meanwhile, global supply is expected to grow at an average annual rate of only 5% between now and 2030. The Democratic Republic of Congo (DRC), which accounted for 76% of primary supply in 2024, will see its share fall to 65%, while Indonesia’s share is expected to rise from 12% to 22% due to a rapid increase in production.

In the short term, market trends will largely depend on the strategy adopted by the DRC, particularly following the four-month ban on cobalt exports imposed in February 2025 to boost prices. This measure could be extended, but Kinshasa has not clarified its intentions. On March 14, the government announced plans to set export quotas and to cooperate with Indonesia to manage oversupply and better control prices. However, there is currently no information on how these decisions will be implemented.

Early this year, cobalt prices rebounded, spurred by the DRC’s export ban and an anticipated smaller surplus in the coming years. These conditions create a favorable backdrop for price recovery.

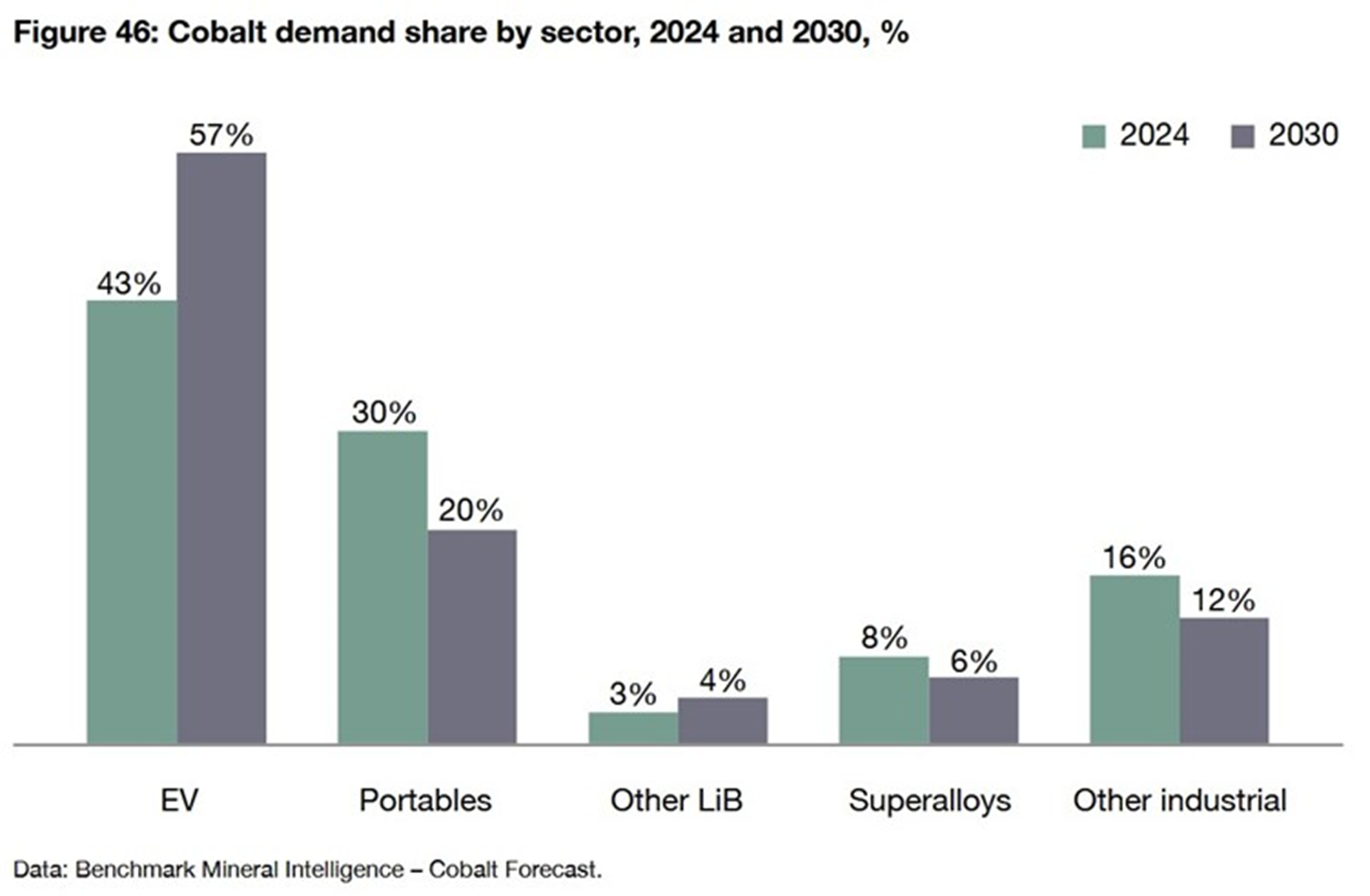

In 2024, global demand for cobalt rose by 14% to 222,000 tonnes. The electric battery segment was the main driver, accounting for 76% of total consumption and 94% of annual growth. Electric vehicles alone accounted for 43% of demand, with sales up 26%.

Demand for computers and mobile devices (phones, tablets, computers) also rose 12%. The rise of artificial intelligence, with its need for intensive computing, fueled an increase in battery capacity.

A surplus of 32,000 tonnes in 2024

Demand in the superalloys and military applications segments also grew, supported by rising defense spending.

But for the third consecutive year, supply growth outpaced demand. In 2024, global primary production reached 254,000 tonnes (+22% compared to 2023), driven by the ramp-up of Congolese mines operated by the Chinese group CMOC.

With 30,000 tonnes mined (+82% in one year), Indonesia established itself as the world’s second-largest producer. The market thus recorded a surplus of 32,000 tonnes in 2024—almost 15% of total demand—compared with 25,000 tonnes in 2023.

Founded in 1982, the Cobalt Institute brings together the main players in the cobalt value chain—including producers, users, recyclers, and traders—who represent around 80% of the global market.

This article was initially published in French by Walid Kéfi (Ecofin Agency)

Edited in English by Ola Schad Akinocho