Equipe Publication

Minerais de transition : la RDC prépare une stratégie nationale

La République démocratique du Congo (RDC) avance vers la validation de sa stratégie nationale dédiée aux minéraux et métaux critiques. Le ministère des Mines a lancé, le 7 janvier 2026 à Lubumbashi (Haut-Katanga), les travaux de validation du projet de stratégie.

Prévues pour s’achever le 8 janvier, ces sessions doivent notamment examiner les orientations liées à la promotion de la transformation locale, au développement d’une industrialisation durable, au respect des normes environnementales, sociales et de gouvernance (ESG), à la mobilisation des énergies propres, au renforcement des capacités humaines et technologiques, ainsi qu’à l’amélioration de la gouvernance du secteur et au partage des bénéfices avec les communautés locales.

Selon le ministère des Mines, le projet de stratégie a été élaboré par des experts congolais et africains, avec l’appui de Southern Africa Resources Watch (SARW), partenaire technique et financier du secteur minier congolais depuis près de vingt ans.

Le document ambitionne de doter le pays d’un cadre opérationnel consensuel, orienté vers la diversification économique, l’industrialisation, la création d’emplois et la valorisation des ressources minières nationales.

Le ministère précise que cette étape s’inscrit dans un processus plus large d’élaboration d’une feuille de route visant à repositionner la RDC comme un acteur industriel majeur dans la chaîne de valeur mondiale des minéraux et métaux critiques, essentiels à la transition énergétique et à l’industrialisation verte.

Dans un rapport publié le 20 mars par le Natural Resource Governance Institute (NRGI), intitulé « La République démocratique du Congo face aux enjeux de la transition énergétique : transformer la richesse minière en levier de développement durable », les experts soulignent la nécessité pour la RDC de se doter d’un cadre stratégique cohérent afin de garantir une transition énergétique bénéfique aux populations.

Le rapport pointe notamment le déficit de coordination interinstitutionnelle, les conflits d’intérêts, la politisation de l’action publique et la faible inclusion des parties prenantes, des facteurs qui ont freiné l’émergence d’un cadre harmonisé entre les secteurs minier et énergétique.

La RDC demeure confrontée au défi de la transformation locale de ses ressources minières. D’après un rapport du réseau Publish What You Pay (PWYP), le pays dispose d’un potentiel significatif pour capter davantage de valeur ajoutée, dans un contexte marqué par une croissance soutenue de la demande mondiale en minerais stratégiques liée à la transition vers des économies à faibles émissions de carbone.

Ronsard Luabeya

Lire aussi :

Minerais de transition : la RDC appelée à élaborer une stratégie nationale

Minerais critiques : les réserves de la RDC estimées à 24 000 milliards $

Permis de conduire : le contrat d’Otojuste en RDC étendu à 7 millions de pièces

Selon un document de l’Autorité de régulation des marchés publics (ARMP) consulté par Bankable, le contrat de production de permis de conduire biométriques conclu entre la société Otojuste Sarl et le ministère des Transports a connu des modifications.

Le 17 avril 2025, l’Unité de conseil et de coordination du partenariat public-privé a donné un avis favorable à ce qui constituait alors un projet d’avenant, « sous réserve de la prise en compte des observations et recommandations ». Mais ces observations et recommandations n’ont pas été rendues publiques.

D’après le document de l’ARMP, cet avenant, enregistré le 22 août 2025, prévoit désormais la production de 7 millions de permis, contre 5 millions initialement annoncés lors de la signature du contrat en février 2022. Le texte précise également que l’entreprise devra construire et assurer l’entretien de 23 sites de production, au lieu des 20 centres prévus à l’origine, ainsi que fournir et installer l’ensemble des équipements informatiques nécessaires à la mise en service du système de gestion du processus de délivrance des permis biométriques.

L’investissement, lui, est maintenu à près de 86 millions de dollars et la durée du contrat reste fixée à dix ans. Notre source ne précise toutefois pas à partir de quelle date ce délai court. Alors que le contrat a été signé en février 2022, la délivrance des permis de conduire n’a débuté que le 25 novembre 2024, soit plus de deux ans plus tard.

Sept sites déjà opérationnels dans trois provinces

Plus d’un an après le lancement officiel de la procédure en novembre 2024 par le ministre des Transports, Jean-Pierre Bemba, sept sites d’obtention sont effectivement opérationnels sur le territoire national, selon les informations publiées par la Commission nationale de délivrance des permis de conduire (CONADEP).

Ces sites ne couvrent pour l’instant que trois provinces sur les 26 que compte la RDC : quatre centres sont installés à Kinshasa, un dans le Kongo Central et deux ont été ouverts depuis août 2025 à Lubumbashi, dans la province du Haut-Katanga.

Selon un arrêté conjoint des ministres des Transports et des Finances, signé le 2 août 2023, l’obtention du permis coûte : 38,5 dollars pour la catégorie A (motos et tricycles), 71,5 dollars pour la catégorie B (véhicules de moins de 3,5 tonnes), 99 dollars pour les catégories C, D et E (véhicules de grande capacité ou de transport de marchandises).

Conformément à ce même texte, 60 % des recettes issues des frais perçus reviennent à Otojuste, le solde étant affecté au Trésor public.

Timothée Manoke

Lire aussi :

Permis de conduire biométrique : les affaires commencent pour Otojuste en RDC

Permis de conduire : l’attente se prolonge pour Otojuste, adjudicataire depuis 2022

Kinshasa Renews Talks With Averda on Waste Management Partnership

- Kinshasa authorities said the city is negotiating a new waste management partnership with Averda.

- Technical studies are set to begin on Jan. 7 ahead of work expected in coming weeks.

- The move revives a failed 2017 contract that stalled over financial guarantees and equipment delivery.

Lebanese waste management company Averda is moving toward a partnership with the city-province of Kinshasa to improve waste management in the Congolese capital, which has faced chronic sanitation problems for decades.

Kinshasa Governor Daniel Bumba met Averda executives on Jan. 6, 2026, alongside provincial sanitation officials.

The governor’s office said the meeting aimed to lay the groundwork for a partnership designed to reduce persistent urban waste and improve living conditions for residents.

The governor’s office said technical studies are due to begin on Jan. 7, 2026, ahead of the effective launch of works in the coming weeks.

The initiative forms part of the “Kinshasa Ezo Bonga” (“Kinshasa Is Changing”) program, which the provincial executive is implementing to modernize urban services and strengthen local governance.

Return after failed 2017 contract

The project marks a renewed attempt at cooperation between Kinshasa and Averda following an earlier contract signed in 2017 that produced no tangible results.

The previous partnership collapsed over an administrative dispute.

Averda requested financial guarantees and an advance payment, while the provincial government awaited the delivery of equipment promised to start operations.

Averda, which was founded in 1964 and is headquartered in Dubai, presents itself as one of the leading waste management and recycling companies in emerging markets.

The group said it serves more than 60,000 public- and private-sector clients, ranging from small and medium-sized enterprises to large institutions.

Averda said its activities include household waste collection, street cleaning, waste sorting and recycling, composting, and the secure disposal of hazardous waste, including strictly regulated medical and chemical waste.

The company operates across Gulf countries and several African markets, including the Republic of Congo, Gabon, Angola, South Africa, and Morocco.

This article was initially published in French by Ronsard Luabeya

Adapted in English by Ange Jason Quenum

Kamoa-Kakula Smelter Investment Reaches $1.1 Billion

- Ivanhoe Mines said total investment in the Kamoa-Kakula copper smelter reached $1.1 billion.

- The figure exceeded the $700 million estimate announced in 2021.

- Power infrastructure, including Inga II rehabilitation, accounted for a significant share of costs.

Ivanhoe Mines said total investment in the new smelter at the Kamoa-Kakula copper complex reached $1.1 billion, as the company announced the first production of copper anodes.

The company linked the start-up of the smelter to the full capital deployment in a statement accompanying the production milestone.

Robert Friedland, founder and executive co-chairman of Ivanhoe Mines, said the event marked “the culmination of a $1.1 billion investment.”

The $1.1 billion figure exceeded the capital cost estimate Ivanhoe Mines disclosed during the project’s early development stages.

In a statement dated Nov. 18, 2021, Ivanhoe Mines said expected capital expenditure for the smelter stood “in the region of $700 million,” and the company said operating cash flows from Kamoa-Kakula would fund the project.

Ivanhoe Mines did not explicitly state the reasons for the gap between the 2021 estimate and the 2026 investment figure.

However, the $1.1 billion total appeared to include ancillary infrastructure costs, even though the company built the smelter according to the same design outlined in 2021.

Ivanhoe Mines constructed a direct-to-blister smelter with nominal capacity of 500,000 tonnes per year of blister copper, alongside sulfuric acid by-product production and emissions standards aligned with those of the International Finance Corporation, part of the World Bank Group.

To enable initial anode production, Ivanhoe Mines not only built the smelter but also installed an uninterruptible power supply system.

The company said the 60-megawatt system could provide up to two hours of instant backup power, protecting the smelter from voltage fluctuations on the Democratic Republic of Congo’s national grid.

In parallel, the company required 50 megawatts of clean electricity to commission the smelter.

To secure that supply, Ivanhoe Mines rehabilitated turbine five at the Inga II hydroelectric dam, which has total installed capacity of 178 megawatts.

Kamoa Copper, owner of the Kamoa-Kakula complex, estimated the investment at $450 million, including ongoing grid modernization works.

This article was initially published in French by Boaz Kabeya

Adapted in English by Ange Jason Quenum

Gestion des déchets : Kinshasa se tourne de nouveau vers Averda

La société libanaise Averda est en voie de conclure un nouveau partenariat avec la ville-province de Kinshasa afin d’améliorer la gestion des déchets dans la capitale congolaise, confrontée depuis plusieurs décennies à des problèmes d’insalubrité.

Le gouverneur de Kinshasa, Daniel Bumba, s’est entretenu, le 6 janvier 2026, avec les responsables de cette entreprise, en présence des services provinciaux en charge de l’assainissement. Selon une communication du gouvernorat, cette rencontre visait à poser les bases de ce partenariat, dont l’objectif est de réduire l’insalubrité chronique et d’améliorer le cadre de vie des habitants.

La même source précise que les études techniques devraient débuter le 7 janvier 2026, en vue du lancement effectif des travaux dans les prochaines semaines. Cette initiative s’inscrit dans le cadre du programme « Kinshasa Ezo Bonga » (« Kinshasa change »), porté par l’exécutif provincial et axé sur la modernisation des services urbains et l’amélioration de la gouvernance locale.

Un retour après un premier contrat en 2017

Ce projet n’est toutefois pas une première tentative de collaboration entre Kinshasa et Averda. En 2017, les autorités provinciales avaient déjà signé un contrat avec l’entreprise, sans réel impact sur le terrain. Le partenariat avait alors achoppé sur un différend administratif, lié notamment aux exigences de garanties financières et d’une avance de fonds formulées par l’entreprise, tandis que le gouvernement provincial attendait l’arrivée des équipements promis pour le démarrage des travaux.

Fondée en 1964 et basée à Dubaï, Averda se présente comme l’un des leaders de la gestion des déchets et du recyclage dans les pays émergents. Le groupe revendique un portefeuille de plus de 60 000 clients, issus aussi bien du secteur public que privé, allant des petites et moyennes entreprises aux grandes institutions.

Les activités d’Averda couvrent notamment la collecte des ordures ménagères, le nettoyage des voies publiques, le tri et le recyclage des déchets, le compostage, ainsi que l’élimination sécurisée des déchets dangereux, y compris les déchets médicaux et chimiques soumis à une réglementation stricte. Le groupe est actif dans les pays du Golfe et en Afrique, où il opère déjà en République du Congo, au Gabon, en Angola, en Afrique du Sud et au Maroc.

Ronsard Luabeya

Kamoa-Kakula : l’investissement dans la fonderie chiffré à 1,1 milliard $

Dans son communiqué annonçant la première production d’anodes de cuivre de la nouvelle fonderie du complexe cuprifère de Kamoa-Kakula, Ivanhoe Mines, développeur du projet, associe cette mise en production à un investissement total de 1,1 milliard de dollars.

Dans une déclaration incluse dans ce document, le fondateur et co-président exécutif du groupe, Robert Friedland, indique que cette étape constitue « l’aboutissement d’un investissement de 1,1 milliard de dollars ».

Ce montant s’écarte de l’estimation qui avait été communiquée lors des phases initiales du projet. Dans un communiqué daté du 18 novembre 2021, Ivanhoe Mines indiquait que le coût en capital attendu se situait « dans la région de 700 millions de dollars » pour la fonderie, en précisant que ce financement devait provenir des flux de trésorerie de Kamoa-Kakula.

La compagnie n’a pas indiqué explicitement les raisons de l’écart entre l’estimation de 2021 et l’investissement annoncé en 2026. Mais il apparaît que le montant de 1,1 milliard de dollars intègre des coûts connexes, d’autant que le projet a été réalisé sur le même modèle que celui présenté en 2021 : une installation direct-to-blister, dotée d’une capacité nominale de 500 000 tonnes par an de cuivre blister, avec un sous-produit d’acide sulfurique et des standards d’émissions alignés sur ceux de la Société financière internationale, une institution du groupe de la Banque mondiale.

Pour produire les premières anodes de cuivre, il a non seulement fallu construire la fonderie, mais également installer un système d’alimentation électrique sans interruption. Selon Ivanhoe Mines, ce dispositif de 60 MW peut fournir jusqu’à deux heures d’alimentation instantanée de secours à la fonderie, la protégeant contre les fluctuations de tension du réseau national congolais.

Pour obtenir les 50 MW d’électricité propre qui ont permis la mise en service de la fonderie, il a par ailleurs fallu réhabiliter la turbine 5 du barrage hydroélectrique d’Inga II (178 MW). Un investissement que Kamoa Copper, propriétaire du complexe cuprifère, estime à 450 millions de dollars, en incluant les travaux de modernisation du réseau toujours en cours.

Boaz Kabeya

Lire aussi :

Cuivre : la fonderie de Kamoa-Kakula livre ses premières anodes pures à 99,7 %

Kamoa-Kakula : la demande électrique projetée à 347 MW d’ici fin 2028

Corridor Kolwezi–Lubumbashi : la sécurité des conducteurs zambiens inquiète Lusaka

Le ministre congolais de l’Intérieur, Jacquemain Shabani, a reçu en audience, le 6 janvier 2026, l’ambassadeur de la Zambie en République démocratique du Congo (RDC), Paulu Kosita. Les échanges ont porté principalement sur les questions de sécurisation transfrontalière, avec un accent sur le corridor routier Kolwezi–Lubumbashi, régulièrement emprunté par les transporteurs zambiens.

Selon la communication du ministère de l’Intérieur, cette rencontre s’inscrit dans un contexte marqué par des signalements d’actes d’insécurité dont seraient récemment victimes certains conducteurs zambiens sur cet axe du sud de la RDC, essentiel pour le commerce régional et l’acheminement des marchandises.

Face à ces préoccupations, le diplomate zambien a sollicité des garanties de la part des autorités congolaises quant à la protection des transporteurs. En réponse, Jacquemain Shabani a assuré de l’implication du gouvernement congolais afin de mettre un terme aux incidents signalés, en renforçant les dispositifs sécuritaires le long du corridor et en veillant à la protection effective des usagers de la route, sans distinction de nationalité.

Cette démarche intervient à la suite d’un incident survenu récemment à Sakania, cité frontalière entre la RDC et la Zambie. Selon des médias locaux, un transporteur zambien, identifié comme Golden Siwakwi, aurait été interpellé et placé en garde à vue après avoir menacé un ressortissant congolais à l’aide d’une machette. Relâché le 6 janvier 2025, le conducteur aurait invoqué la légitime défense.

La rencontre entre le ministre congolais de l’Intérieur et l’ambassadeur zambien s’inscrit également dans la perspective de la tenue prochaine de la Commission mixte défense et sécurité RDC–Zambie, prévue à Lubumbashi, dans la province du Haut-Katanga. Jacquemain Shabani a précisé que cette commission constituera un cadre de concertation privilégié pour ajuster et harmoniser les mesures sécuritaires le long de la frontière commune, dans le but de préserver les intérêts mutuels des deux États et de renforcer la sécurité transfrontalière.

Ronsard Luabeya

Lire aussi :

Corridor RDC-Zambie : une plateforme pour optimiser le transport et réduire les coûts

Climat des affaires : les services publics, talon d’Achille de la RDC

La République démocratique du Congo (RDC) fait son entrée dans Business Ready (B-READY), le nouveau baromètre de la Banque mondiale sur l’environnement des affaires. Les résultats mettent en évidence un contraste : si le cadre réglementaire progresse, la faiblesse des services publics et de l’environnement institutionnel demeure le principal frein à l’attractivité économique du pays.

Dans sa deuxième édition, publiée à la fin du mois de décembre 2025, le nouveau baromètre mondial de l’environnement des affaires de la Banque mondiale — Business Ready (B-READY) —, lancé depuis 2024, intègre la République démocratique du Congo (RDC). Il ressort de ce rapport que les services publics constituent le point faible du pays en matière de facilitation des affaires.

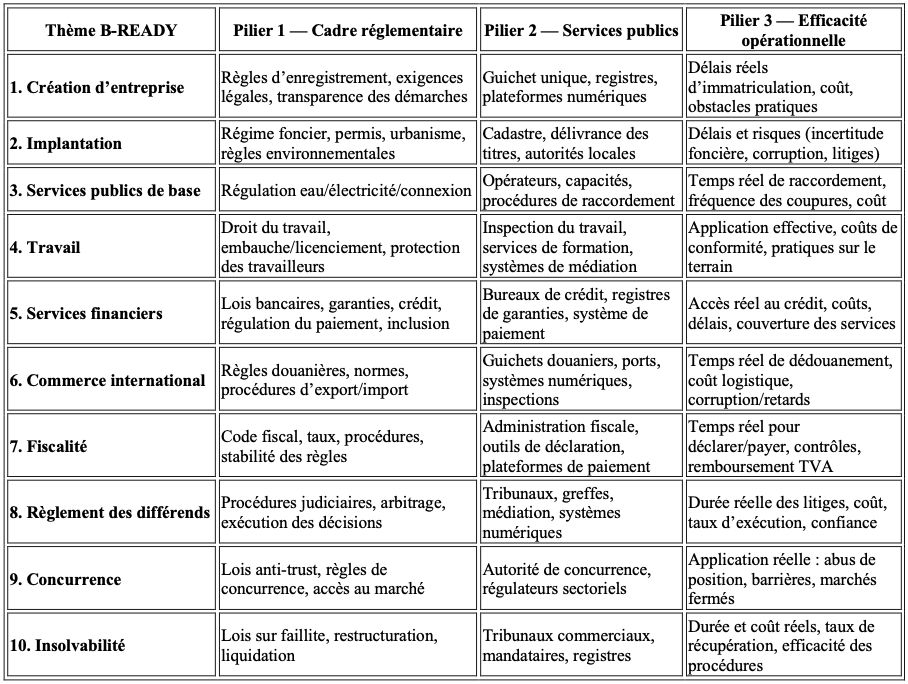

Ce baromètre, qui remplace le Doing Business, évalue les pays sur trois aspects (piliers) :le cadre réglementaire (qualité des lois, règles, procédures…), les services publics (disponibilité et qualité des services chargés d’appliquer ces règles), l’efficacité opérationnelle (réalité sur le terrain : délais, coûts, pratiques).

Chacun de ces piliers est évalué sur l’ensemble des étapes (thèmes) de la vie d’une entreprise : création, implantation, services de base, travail, services financiers, commerce international, fiscalité, règlement des différends, concurrence et insolvabilité. Les notes vont de 0 à 100 points.

Critères d’évaluation

Des résultats contrastés pour la RDC

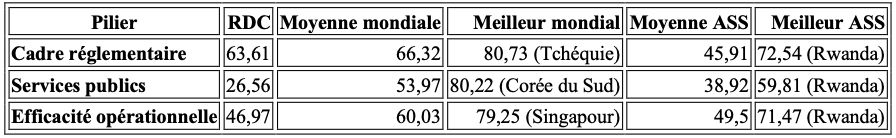

Pour la RDC, les résultats montrent un contraste marqué : 63,61 sur le cadre réglementaire, 46,97 sur l’efficacité opérationnelle, 26,56 seulement sur les services publics.

En plus d’enregistrer la performance moyenne la plus faible parmi les piliers, les services publics constituent celui où les écarts avec les autres pays du monde sont les plus importants.

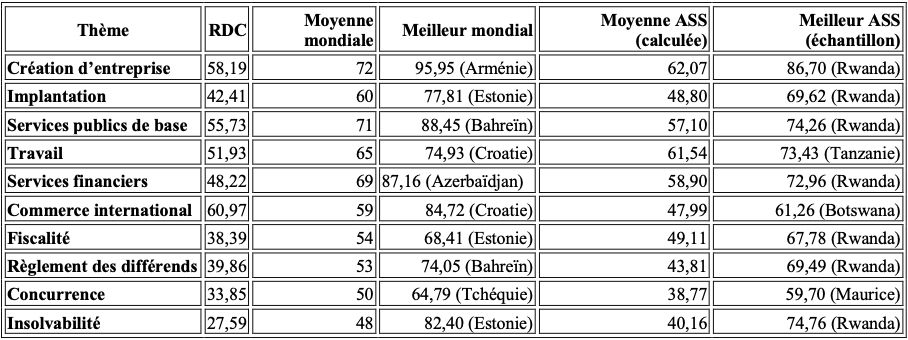

Le problème viendrait essentiellement de l’environnement institutionnel. Car si la RDC obtient 55,73 sur les services publics de base, elle reste faible sur plusieurs domaines liés au fonctionnement des institutions, tels que : l’insolvabilité (27,59), la concurrence (33,85), la fiscalité (38,39), la justice commerciale (39,86).

La faiblesse de ces indicateurs a des conséquences directes : elle limite la capacité du pays à attirer des capitaux privés, complique l’accès au crédit et fragilise les entreprises lorsqu’elles doivent gérer un conflit commercial ou une restructuration.

Résultat par pilier

Résultat par thème

Une note aussi faible en matière d’insolvabilité signifie concrètement une capacité limitée de restructuration, des coûts de défaut élevés, ainsi qu’un recouvrement lent et incertain. Cela contribue à expliquer le coût élevé du crédit, la faible profondeur financière et la quasi-absence de financement à long terme en RDC.

En matière de concurrence, le faible score traduit, en pratique, un manque de prévisibilité sur l’égalité des règles du jeu, des barrières à l’entrée, des distorsions, ainsi que des mécanismes insuffisants de lutte contre les abus.

Renforcer les capacités administratives

Les scores sur la fiscalité et la justice reflètent, quant à eux, un niveau élevé d’incertitude et des coûts de transaction importants. Une fiscalité imprévisible alimente le contentieux, tandis qu’une justice peu efficace rend ce contentieux plus risqué.

Le B-READY 2025 montre que la RDC peut améliorer son attractivité sans nécessairement changer toutes les lois. Selon la Banque mondiale, le vrai enjeu est de parvenir à rééquilibrer l’effort entre la norme et la mise en œuvre. Le rapport rappelle que les pays peuvent adopter des règles ambitieuses, mais restent pénalisés s’ils ne disposent pas des capacités administratives et opérationnelles nécessaires pour les rendre effectives.

Pour la RDC, le basculement viendra donc de réformes d’exécution : digitalisation des procédures, transparence, simplification, accès effectif aux services administratifs et réduction des délais.

Pierre Mukoko

Lire aussi :

Révision du code des investissements : les travaux lancés à Kinshasa

PPP : Kinshasa veut arrimer sa loi aux standards internationaux

Foncier : un nouveau projet de loi pour sécuriser les terres et numériser le cadastre en RDC

Or : Morgan Stanley projette l’once à 4 800 $ d’ici le 4ᵉ trimestre 2026

La banque américaine Morgan Stanley anticipe un prix de l’or à 4 800 dollars l’once au quatrième trimestre 2026, selon une note publiée le 5 janvier 2026 et relayée par plusieurs médias internationaux. Cette projection, si elle se concrétise, dépasserait les sommets atteints fin 2025 par le métal jaune.

Dans son analyse, Morgan Stanley met en avant plusieurs facteurs susceptibles de soutenir le cours de l’or. La banque cite notamment la perspective de nouvelles baisses des taux d’intérêt, un changement de leadership attendu à la tête de la Réserve fédérale américaine, ainsi que la poursuite des achats d’or par les banques centrales et certains fonds d’investissement.

Des taux d’intérêt plus bas réduisent en effet le rendement des placements obligataires, ce qui tend historiquement à renforcer l’attrait de l’or — un actif qui ne génère pas de revenu mais est perçu comme une réserve de valeur.

La note mentionne également les récents événements au Venezuela comme un facteur susceptible de renforcer la position de l’or en tant que valeur refuge, sans toutefois les intégrer explicitement dans la construction de sa prévision chiffrée.

D’autres analystes encore plus optimistes

La projection de Morgan Stanley s’inscrit dans le prolongement d’un cycle haussier amorcé bien plus tôt que prévu. Dès octobre 2025, l’or avait franchi pour la première fois le seuil symbolique des 4 000 dollars l’once, prenant de vitesse les prévisions de plusieurs institutions financières.

Le métal précieux a ensuite atteint un record historique à 4 549,71 dollars l’once le 26 décembre 2025, et a terminé l’année sur une progression annuelle d’environ 64 %, sa meilleure performance depuis 1979, selon les données de marché.

Si Morgan Stanley s’attend à ce que la tendance haussière se poursuive en 2026, d’autres analystes sont encore plus optimistes. JP Morgan, Bank of America ou encore le cabinet Metals Focus ont précédemment évoqué la possibilité que le prix du métal jaune dépasse le seuil des 5 000 dollars l’once cette année.

Le marché est suivi de près par de nombreux pays producteurs, notamment en Afrique, où l’or constitue une source importante de revenus d’exportation et de recettes publiques.

Agence Ecofin

Lire aussi :

Mine d’or de Kibali : la production s’accélère, mais l’objectif annuel reste incertain

Or artisanal : le Maniema devient le premier centre d’exportation légale en RDC

UBA Appoints Michael Kayembe as CEO of DR Congo Subsidiary

- UBA appointed Congolese banker Michael Kayembe as chief executive of its DR Congo subsidiary.

- The move followed UBA’s strategy to localize management announced by chairman Tony Elumelu.

- UBA RDC reported sharply higher profits in 2024 and planned aggressive branch expansion through 2028.

United Bank for Africa appointed Michael Kayembe as chief executive officer of its subsidiary in the Democratic Republic of Congo.

Kayembe replaced Nigerian executive Sampson Aneke, who previously held the position. Gisèle Bondo continued to serve as deputy chief executive, a role she assumed in February 2024.

The appointment aligned with the management localization strategy announced in November 2025 by UBA Group chairman Tony Elumelu during his visit to the Democratic Republic of Congo.

At that time, Elumelu said the group would appoint a Congolese national to lead the local subsidiary. The strategy also provided for the appointment of nine Congolese members to the bank’s board.

Michael Kayembe brought more than 20 years of banking experience in the Democratic Republic of Congo.

Before joining UBA RDC, Kayembe held senior management roles at Rawbank. He served as head of Corporate and Investment Banking and as regional director for eastern DR Congo, where he oversaw operations across several provinces.

He previously spent more than 14 years at Citigroup Congo. He led corporate banking and global banking network activities after serving as branch manager in Lubumbashi.

Michael Kayembe held an MBA from Kennesaw State University. He specialized in strategy, financial analysis, and business development. At UBA RDC, he assumed responsibility for driving growth strategy, improving operational performance, and strengthening institutional partnerships.

The appointment came as UBA expanded its operations in the Democratic Republic of Congo. UBA has operated in the country since 2011. The bank currently maintained operations in Kinshasa, Lubumbashi, and Matadi.

Under its 2024–2028 strategic plan, UBA aimed to expand its branch network to 21 outlets by 2028, compared with three currently. The plan also included a significant expansion of its automated teller machine network.

UBA RDC recorded strong financial performance in 2024. The bank posted net profit of 21 billion naira, up from 4.3 billion naira the previous year. Operating income rose to 22.8 billion naira. At group level, UBA targeted customer deposits of $1.8 billion by 2028.

Boaz Kabeya