News (739)

The Office of Multimodal Freight Management (OGEFREM) announced the start of preliminary construction for the Kalamba-Mbuji dry port in Luiza territory, Kasai-Central province.

Regional Director Matthieu Tshilumba Kalenga confirmed the news on Oct. 16, 2025, after a meeting with Governor Joseph-Moïse Kambulu Nkonko. He said the necessary funds are already in place. The first stage will involve building a security fence around the 70-hectare site.

The completed dry port will include a truck park, service stations, driver housing, and offices for border services, all centralized in a one-stop shop.

The project follows OGEFREM’s acquisition of land titles for the site in February. Located near the DRC-Angola border, the Kalamba-Mbuji dry port is designed to boost trade by linking Kasai-Central with Angolan seaports, particularly the Port of Lobito. It also complements the Kananga-Kalamba-Mbuji road project currently under construction.

In April, OGEFREM Director General William Kazumba Mayombo said the agency had secured advance funding from the African Development Bank (AfDB) to conduct feasibility studies for the Kalamba-Mbuji dry port and planned logistics hubs in Matamba, Bilomba, and Mbulungu. These studies will also assess traffic on the Kandiadi-Kamako-Tshikapa, Kandiadi-Tshikapa, and Tshikapa-Kananga corridors, key routes for cross-border trade.

Ronsard Luabeya

The Democratic Republic of Congo (DRC) signed an agreement on Oct. 20 with Mauritius-based investment firm United Investment LMT (UIL) to strengthen its national digital infrastructure, Congolese media reported. The partnership, first agreed in 2023, is estimated to be worth about $150 million.

The project covers feasibility studies, the rollout of 60,000-80,000 kilometers of fiber-optic cable nationwide, the installation of a new 192-terabit-per-second submarine cable, and the construction of three data centers, according to Scoop RDC. It will also include the establishment of a national telecom operator providing both fixed and wireless services. No implementation timeline was provided.

“The DRC needs at least 40,000 to 50,000 kilometers of fiber to achieve full connectivity. Internet access remains below 30%,” said José Mpanda Kabangu, Minister of Posts and Telecommunications, during the signing of supplementary documents with UIL. “The President wants all 145 territories of the country to be connected. I wish this project every success and will give it my full support.”

Expanding digital infrastructure and connectivity is one of four key goals of the 2026–2030 National Digital Plan (PNN2), which seeks to position the DRC as a regional digital hub. To support the strategy, the government plans to invest $1 billion over five years, alongside $500 million in external funding from international partners.

The country is also pursuing other public-private partnerships. Nigeria’s Fidelity Bank has expressed interest in financing a national telecom satellite project to improve connectivity.

The DRC scored 31/100 on the ITU’s 2024 ICT Development Index, ranking 41st out of 47 African countries. According to GSMA, about 32% of the population still lacked mobile internet coverage in 2024. The organization also noted that the DRC had around 9,631 kilometers of fiber installed, with another 29,000 kilometers planned by public and private operators. The country is connected to the WACS and 2Africa submarine cables, according to Submarine Cable Map.

Isaac K. Kassouwi, Ecofin Agency

Esengo Towers, a joint venture between Orange RDC and Vodacom Congo, plans to invest $179 million over four years to deploy 1,000 telecom towers across the Democratic Republic of Congo (DRC) to expand mobile coverage.

Esengo Towers CEO Jean-Philippe Léonard announced the plan on Oct. 22, 2025, after meeting with Minister of Posts and Telecommunications José Mpanda Kabangu.

The company, founded in January 2025 and equally owned by the two mobile operators, aims to expand rural connectivity by building solar-powered base stations equipped with 2G and 4G technology. It also targets the construction of 2,000 towers within six years.

The project has faced delays. The first station was expected to be operational by end-2025, but the firm still lacks an operating license. Léonard said obtaining the license is crucial before choosing suppliers and finalizing financing, and he now expects construction to begin in 2026.

He asked the minister to help secure authorization from the Regulatory Authority of Posts and Telecommunications (ARPTC). In a ministry statement, Kabangu expressed government support and noted that the DRC needs about 300,000 towers for full coverage, compared with 5,105 currently.

“The 2,000 towers planned by Esengo Towers, though not enough to meet national needs, represent a major contribution, especially for rural areas,” Kabangu said.

Orange RDC and Vodacom Congo will share the infrastructure as anchor tenants for 20 years and open it to other operators to share costs and broaden coverage, targeting 19 million new users and promoting digital inclusion and mobile financial access.

Ronsard Luabeya

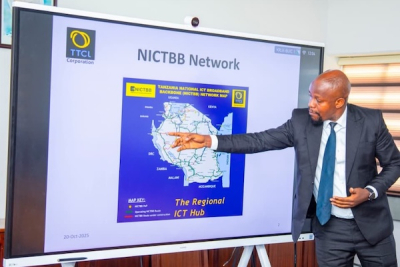

Tanzania’s plan to extend its National ICT Broadband Backbone (NICTBB) to the Democratic Republic of Congo (DRC) was discussed on Oct. 20, 2025, during a meeting at Tanzania Telecommunications Corporation (TTCL) headquarters in Dar es Salaam.

The project will lay a submarine fiber-optic cable across Lake Tanganyika, linking Kigoma in Tanzania and Kalemie in the DRC over roughly 160-186 kilometers.

The Tanzanian delegation was led by Moremi Marwa, TTCL Director General, and Leo Magomba, ICT Infrastructure Director at the Ministry of Communication and Information Technology. The Congolese side was headed by Prosper Ghislain Mpeye, Director General of the Société Congolaise de Fibre Optique (SOCOF).

Few details were disclosed, as the talks are covered by a confidentiality agreement signed in February 2023. The two sides are completing final preparations before construction begins in early 2026, pending environmental approval. Full commissioning is expected by late 2027.

The $15-20 million project is structured as a public-private partnership involving Mauritian firm Bandwidth and Cloud Services Group for technical expertise. The governments of both countries will hold quarterly meetings to track progress and manage financial risks.

Part of the AUDA-NEPAD Priority Action Plan (2021-2030), the interconnection is identified as a key link for digital integration in East and Southern Africa. The NICTBB already connects Zambia, Malawi, Kenya, Uganda, Rwanda, and Burundi; adding the DRC would complete an East–West fiber corridor, boosting regional connectivity.

TTCL, the implementing agency, said the project will accelerate the DRC’s digital transformation and spur economic growth. Fiber deployment could cut bandwidth costs by half and benefit sectors from mining to digital finance, education, and healthcare.

The cable will use single-mode G.652D fiber, starting at 100 Gbps, expandable to several terabits. Joint environmental studies with the Société Congolaise des Postes et Télécommunications (SCPT) aim to ensure compliance with international standards, including the Ramsar Convention protecting Lake Tanganyika.

- OGEFREM confirmed the start of preliminary works for the Kalamba-Mbuji dry port in Kasaï-Central.

- The African Development Bank (AfDB) agreed to pre-finance feasibility studies for the project.

- The dry port aims to boost cross-border trade between the DRC and Angola, connecting to Lobito Port.

The Office for the Management of Multimodal Freight (OGEFREM) has announced the start of preliminary works for the construction of the Kalamba-Mbuji dry port, located in Luiza territory in the Kasaï-Central province of the Democratic Republic of Congo (DRC).

Regional Director Matthieu Tshilumba Kalenga disclosed the information on October 16, 2025, during a meeting with provincial governor Joseph-Moïse Kambulu Nkonko. He confirmed that funding for the initial phase is already available.

The preliminary phase will include securing the 70-hectare site with a perimeter fence and preparing the land for core infrastructure. Planned facilities include a parking area for heavy trucks, fuel stations, driver accommodations, and administrative offices for border control and public services. These will operate under a single-window system to simplify logistics and customs operations.

The announcement follows OGEFREM’s acquisition of property titles for the land in February 2025, ensuring full ownership and legal security for the project site.

Located on the border between the DRC and Angola, the future Kalamba-Mbuji dry port is designed to facilitate trade between the two nations. It will serve as a key logistical link connecting Kasaï-Central to Angola’s seaports, particularly Lobito. The initiative complements ongoing construction on the Kananga–Kalamba-Mbuji road, which aims to strengthen regional trade corridors and reduce transport costs.

In April 2025, OGEFREM’s Director General William Kazumba Mayombo announced that the African Development Bank (AfDB) had agreed to pre-finance feasibility studies for the Kalamba-Mbuji dry port. The studies will also cover additional logistics platforms planned in Matamba, Bilomba, and Mbulungu.

According to OGEFREM, the feasibility work will assess cargo traffic along key routes such as Kandiadi–Kamako–Tshikapa, Kandiadi–Tshikapa, and Tshikapa–Kananga, which are heavily used for cross-border trade.

This article was initially published in French by Ronsard Luabeya

Adapted in English by Ange Jason Quenum

Work on the government’s PDL-145T project has been suspended for more than five months in Dekese, Kasai province, according to local administrator Patrick Bassa quoted by state media Agence Congolaise de Presse (ACP).

Engineers and construction workers stopped work, demanding payment of their salaries and arrears before resuming operations. The first phase of the project in Dekese includes construction of an administrative building, a health center in Ilongaba, and a primary school in Bosenge. None of these facilities have been completed so far.

In Kasai province, the United Nations Development Programme (UNDP) plans 69 infrastructure projects under the PDL-145T: 41 schools, 23 health centers, and five administrative buildings.

The PDL-145T monitoring unit, quoted by ACP, said the projects are at various stages of completion. Twenty-six sites are still in the foundation stage, 17 are under wall construction, and 16 are in the finishing phase. Ten sites have been completed, with eight officially handed over.

BK

During the IMF and World Bank Annual Meetings, the Democratic Republic of Congo’s Finance Minister, Doudou Fwamba, presented a $500 million financing request to the World Bank to support the Lobito Corridor project. According to a statement from the Finance Ministry, the institution has agreed to review the proposal.

In talks with World Bank Managing Director for Operations Anna Bjerde, the minister outlined the government’s vision to spur economic growth along the strategic transport corridor. The discussions focused on strengthening cooperation for the development of two main segments: Tenke–Lubumbashi–Sakania and Tenke–Kolwezi–Dilolo, extending to the Angolan border and the port of Lobito.

Feasibility studies presented in September by a joint European Union–U.S. expert team estimated rehabilitation costs for the Tenke–Kolwezi–Dilolo line at $400–410 million, with $180 million in maintenance costs over ten years. The second phase, covering the Tenke–Lubumbashi–Sakania section and its extension to the Zambian border, would bring total investment to around $1.1 billion.

Fwamba stressed that the project’s economic success depends on expanding energy and mining production and increasing local processing capacity—factors expected to create jobs and stimulate agricultural growth.

Anna Bjerde welcomed Congo’s ongoing economic reforms and highlighted the Lobito Corridor’s strategic value as a regional driver for logistics, energy, and agro-industry.

The Congolese government has pledged to promote cross-border projects similar to those underway in Angola, Zambia, and Tanzania. In April 2025, Prime Minister Judith Suminwa directed the preparation of development projects along the corridor, under the supervision of the Ministers of Transport and Planning and the Mattei Committee experts.

Last September, the World Bank also launched a feasibility study on the corridor’s economic impact, conducted jointly by researchers from the Universities of Lubumbashi and Kolwezi and the Bank’s teams. The study aims to identify investment opportunities along the Congolese section to maximize its economic and social benefits.

The Central Bank of Congo (BCC) has criticized several commercial banks for practices that undermine the use of the national currency. In a statement issued on October 17, 2025, the BCC accused some institutions of “creating long queues at counters under the pretext of liquidity shortages and forcing customers to conduct transactions in foreign currencies, even when they legitimately wish to use the Congolese franc (FC).”

These practices contradict the goals of BCC Governor André Wameso, appointed in July 2025, who has made restoring trust in the franc congolais and reducing dollar dependence his top priorities.

In response, the BCC sent two letters to commercial banks instructing them to immediately replenish cash reserves at the central bank to maintain normal service levels. Banks are also required to keep their branches open until 5 p.m., including weekends for high-traffic locations. The central bank reminded them of their legal obligation to promote the use of the national currency and announced upcoming inspections to verify compliance with liquidity and foreign exchange regulations.

EquityBCDC, the country’s second-largest bank after Rawbank, has already announced it will comply with the BCC’s directives. The bank published a list of branches—Masina Sans Fil, Limete Place C, Matonge, Kintambo, Ngaba, Aviateurs, and its headquarters—that will operate daily from 8 a.m. to 5 p.m. throughout the implementation period of the central bank’s measures.

The Democratic Republic of Congo’s Minister of Infrastructure and Public Works, John Banza Lunda, signed a letter of intent and a cooperation agreement in Belgium on October 8, 2025, with a group of companies known as the Kinshasa Tramways Consortium. The signing marks an early step toward a Public-Private Partnership (PPP) contract for a tramway system in the capital, scheduled for November 2025, according to the Agence congolaise des grands travaux (ACGT).

The Kinshasa Tramways Consortium comprises three firms: Powerchina, which operates in the DRC under the name Sinohydro and has worked on major projects such as road construction and the 150-MW Zongo II hydroelectric plant powering Kinshasa; Prume Tramways RDC, on which little public information exists but which was cited in the ACGT’s 2021 annual report for conducting a tramway feasibility study that same year; and the Belgian company Frateur De Pourcq, founded in 1867 and globally recognized for its expertise in manufacturing railway tracks for trains, tramways, and amusement parks, including its patented prefabricated hybrid rail system.

In a parallel initiative, Congolese firm Congo Trans S.A.R.L. is developing its own $205 million, three-line tramway project for Kinshasa. In June 2025, the company signed a Memorandum of Understanding (MoU) with Moroccan engineering firm Balkan Ingénierie S.A.R.L. for engineering and project-supervision services, valued at 4% of the total cost, or roughly $8.5 million. Under the terms of the protocol, 10% of the total amount — or $820,000 — was expected to be disbursed upon signing. However, according to officials at Congo Trans, the payment has yet to be made, as the company remains in talks with a local bank to secure project financing.

The Congo Trans project includes three routes: Gare Centrale-Kintambo Magasin, Gare Centrale-N’djili Airport, and N’djili Airport-N’sele. It also covers the construction of tram stations, maintenance depots, workshops, a training center, and parking facilities. The agreement provides that at least 95% of the workforce will be Congolese, with a minimum of 50% women, and that a local training center will be created to develop domestic expertise.

These initiatives target Kinshasa’s chronic mobility crisis, in a city of 15 to 20 million residents where traffic congestion, deteriorating roads, and declining public transport efficiency are pushing commuters toward alternative modes of transport, notably motorbikes known locally as Wewa, whose safety record remains a major concern.

Timothée Manoke

Public mass transit operator TRANSCO has begun modernizing its ticketing system, partnering with local technology firm Pimacle and Equity BCDC Bank to digitize fare collection.

Transport Minister Jean-Pierre Bemba met with Transco Director General Sylvestre Bilambo, Equity BCDC CEO Willy Mulumba Kabadi, and Pimacle representatives on October 16, 2025, to review the project’s progress.

The initiative aims to improve urban mobility in Kinshasa while strengthening Transco’s financial management. After testing several digital solutions, Pimacle SARL’s proposal was selected from competing bids.

Founded in 2017, Pimacle specializes in technology services, electronic security, GPS/GPRS systems, and transport logistics. The company serves as a local partner providing technical expertise for digital implementation.

Equity BCDC CEO Willy Mulumba Kabadi praised the ministry’s vision, emphasizing that his bank will support Transco in implementing solutions that advance financial inclusion.

Ronsard Luabeya

More...

Rehabilitation work officially began on October 13, 2025, on the Abombi Bridge in Djugu territory, part of an effort to reopen a key road linking the Mungwalu mining area to Bunia, the capital of Ituri province.

The project, funded by the provincial government and carried out by local firm Sous le Palmier, focuses on the Iga Barrière-Mungwalu road section.

Before work began, the bridge was badly deteriorated, making it difficult for trucks and traders to cross. Vehicles often got stuck, and frequent accidents effectively cut off Mungwalu from the rest of the province, disrupting shipments of minerals, farm produce, and essential goods.

Engineer Joël Kilongo, who oversees the site, said the work mainly involves replacing old materials and strengthening the bridge’s structure.

The rehabilitation is expected to last about two months and is part of a broader series of infrastructure projects launched by provincial authorities to improve access to mining areas and facilitate the movement of goods and people along Ituri’s main economic corridors.

Boaz Kabeya

Chinese mining group Chengtun Mining has agreed to acquire Canadian gold exploration company Loncor Gold in an all-cash transaction valued at C$261 million (about $186 million), gaining control of the Adumbi gold deposit in the Democratic Republic of Congo (DRC).

Loncor and Chengtun announced the definitive arrangement agreement on October 14, 2025. Under the terms, Chengtun will purchase all outstanding common shares of Loncor for C$1.38 per share.

The current proposal represents a 33% premium to Loncor’s 30-day volume-weighted average share price and a 16% premium to its closing price on the Toronto Stock Exchange (TSX) on October 10, 2025. The announcement did not specify if the offer was related to an unsolicited, non-binding bid Loncor received from a third-party investor three months ago.

Loncor holds an 84.68% stake in the Adumbi deposit, which is located in the Ngayu greenstone belt in northeastern DRC, with the Congolese state mining company Sokimo holding the remaining 10%. Adumbi's resources were estimated at 3.66 million ounces of gold in a 2021 preliminary economic assessment.

Deal Structure and Approvals

The agreement includes customary protective clauses, such as a non-solicitation clause and a "fiduciary out" provision that allows Loncor to accept a superior proposal, provided Chengtun is given the right to match the bid. The parties also agreed to reciprocal termination fees of C$10 million under certain conditions.

All outstanding Loncor stock options and warrants will be cashed out for an amount equal to the difference between the transaction consideration and the exercise price. Furthermore, Chengtun will provide Loncor with $3 million in repayable advances within 60 days of signing, intended for the Adumbi exploration program and general corporate needs.

The transaction will be implemented via a plan of arrangement under the Ontario Business Corporations Act and requires approval from two-thirds of Loncor shareholders, TSX acceptance, and necessary regulatory clearances. Closing is expected in the first quarter of 2026, after which Loncor shares will be delisted from the TSX.

Major Loncor shareholders, including Resolute Mining (18%) and Arnold Kondrat (17%), along with the entire board of directors, have signed support agreements, collectively representing about 38% of outstanding shares. The board, supported by a special committee of independent directors, deemed the offer fair and in the best interest of shareholders, with Stifel Canada providing a fairness opinion on the price.

Chengtun’s Expansion into Gold

The acquisition will mark Chengtun’s entry into the gold sector, adding the Adumbi deposit and potential development of other gold projects in the Ngayu belt, such as the Imbo project, to its portfolio.

Chengtun is already active in the DRC’s base metals sector through its subsidiary Congo Chengtun Mining, located in Kolwezi (Lualaba), which focuses on copper, cobalt, and nickel. Its Kalongwe project is expected to produce an estimated 22,600 tons of copper and 3,700 tons of cobalt annually, with plans for a hydrometallurgical plant to process the local ore.

Ronsard Luabeya

The Democratic Republic of Congo (DRC) plans to establish a treasury agreement with commercial banks involved in paying civil servants to guarantee fixed-date salary payments, as the state continues to face liquidity constraints.

According to the Ministry of Public Service, Administrative Modernization, and Public Service Innovation, Minister Jean-Pierre Lihau met on October 8 with bank representatives to discuss the arrangement. Under the plan, banks would advance salaries to public employees, with the government repaying them later with interest.

Data from the Central Bank of Congo (BCC) show that short-term state borrowing rates average 10% annually. At that rate, the potential market for banks could reach about $40 million per year, given that the revised 2025 budget estimates the public wage bill at $4 billion.

Talks also include a proposed pension advance mechanism under which banks would pre-finance retirees’ benefits, reimbursed by the state through monthly installments equivalent to their former salaries, plus interest. This reform, first presented in July 2025, has resurfaced for review.

The Ministry of Budget aims to start payments on the 15th of each month, prioritizing police, military, and teachers. However, delays of up to two weeks persist due to tight treasury conditions. In September, the deficit reached 83.8 billion Congolese francs, with revenues of 3,317.2 billion francs against expenditures of 3,401.2 billion, according to an October 3 economic bulletin.

To address these gaps, the government now plans to rely on bank advances. Financial institutions have expressed readiness to support the initiative, which mirrors the mechanism used to settle the state’s fuel subsidy debts and could take effect in 2026.

A robbery attempt targeted Rawbank’s Victoire branch in Kinshasa’s Kalamu district early on October 16, 2025. According to witnesses, a group of heavily armed men stormed the premises, taking customers and staff hostage.

Security forces quickly responded, surrounding the building and engaging in an exchange of gunfire with the attackers, causing panic around the Victoire roundabout and nearby streets.

In a statement issued the same day, Rawbank confirmed the incident and said the situation was brought under control thanks to the swift and coordinated action of security services. The bank reported no injuries among employees or customers.

Authorities have maintained tight security around the area to allow police and judicial teams to conduct investigations. Rawbank praised the professionalism of law enforcement and the composure of the public during the operation.

Kalamu mayor Charlie Luboya told Radio Okapi that all hostages were safely freed. By midday, some assailants remained inside the bank while others had fled. Several suspects were arrested.