News (639)

International Resources Holding (IRH), a subsidiary of the Emirati conglomerate International Holding Company (IHC), just sealed a deal to acquire almost 100% of Tremont Master Holdings. Valued at C$503 million–around US$367 million–the deal will give IRH indirect control of 56% of Alphamin Resources. The latter owns the Bisie tin mine, the largest tin mine in the Democratic Republic of Congo (DRC).

According to Bloomberg, an IRH delegation visited the DRC last November to conduct a due diligence mission. Although the offer is lower than Alphamin's current capitalization on the Toronto Stock Exchange, Denham Capital, Tremont's sole shareholder, stands to gain. The American fund previously held 57% of Alphamin.

Located in North Kivu, the Bisie project has developed in a difficult security environment. Alphamin has held an 80.75% stake since 2012, when the tin market was still uncertain. The remainder of the capital is divided between the South African state-owned company IDC (14.25%) and the Congolese state (5%). Between 2019 and the end of 2024, the mine generated cumulative sales of $2.3 billion for a gross margin of $689.5 million. The company paid $115 million in dividends in 2022-2023, and expects a payment of $70 million in October 2025 in respect of fiscal 2024.

The transaction is still subject to prior authorization by the Congolese authorities. Under article 178 bis of the revised Mining Code, any indirect transfer of mining rights must be approved by the State, on pain of nullity. A transfer fee, previously set at 1% of the transaction value, is also payable.

For IRH, this acquisition is part of a broader strategy to build up a portfolio of critical mining assets. According to Africa Intelligence, the group is also in discussions with Gécamines to obtain new permits in the DRC, although this information has not yet been confirmed. Alphamin is also studying other expansion projects in the country.

This operation illustrates the Emirates' growing interest in transitional minerals. Saudi Arabia has stepped up diplomatic exchanges with Kinshasa around a framework for sustainable supply chains. Dubai remains one of the major outlets for Congolese artisanal gold, as the Governor of South Kivu recently reminded us. By 2023, collaboration between the Emirati group Primera Gold and the Congolese government had led to a surge of over 12,000% in gold channeled through the Primera Gold DRC joint venture.

This article was initially published in French by Georges Auréole Bamba

Edited in English by Ola Schad Akinocho

As of December 31, 2024, projects underway in the Democratic Republic of Congo (DRC) financed by entities within the Agence Française de Développement (AFD) group totaled €760.4 million, or around $823 million at the average exchange rate for 2024.

This portfolio accounted for roughly 24% of the Group’s total commitments in Central Africa, which stand at an estimated €3.2 billion.

The portfolio comprises 61 projects focused on improving access to basic services, strengthening regional resilience, promoting economic diversification, supporting the energy transition, and preserving natural resources. These initiatives are managed by three key institutions within the group: AFD itself, Proparco, and Expertise France.

AFD holds the largest share, with projects valued at €643.5 million (around $696.6 million), followed by Expertise France with $86.6 million, and Proparco with nearly $40 million in active projects.

Between 2020 and 2024, AFD primarily mobilized financing in the DRC through sovereign loans, French government grants, and budget support. Its investments target critical sectors for the country’s development, including infrastructure, transport, urban development, education, vocational training, governance, health, and sustainable natural resource management.

Proparco, the AFD Group’s private sector arm, supports private financial institutions and small and medium-sized enterprises via debt financing, guarantees, and equity instruments.

Expertise France, the Group’s technical cooperation agency, oversees eight projects spanning entrepreneurship, fragility and vulnerability, health, sport, and culture. In 2024, Expertise France expanded its footprint by establishing an operational country office in the DRC during the second quarter.

Boaz Kabeya (intern)

In Kinshasa, a sprawling metropolis home to an estimated 15 to 20 million people, traffic congestion has become a daily ordeal for commuters. Endless gridlocks, deteriorating public transportation, poorly maintained roads, and a lack of clear signage and traffic enforcement have driven many residents to embrace a more flexible mode of transport: the taxi-bike, locally known as the Wewa.

This trend, mirrored in several other cities across the Democratic Republic of Congo (DRC), intensified in 2025. A study conducted by Congolese firm Target SARL from March 1 to 7, 2025, across all 26 provinces found that 71% of users now rely primarily on motorcycle cabs, up from 67% in 2023. The service appeals to all age groups, though usage tends to decline slightly with age.

“Its success stems from its ability to avoid traffic jams, cover short distances quickly, and offer more affordable prices than conventional taxis,” the study explains. The main advantage remains the Wewa’s agility, weaving through congested streets to significantly cut travel times, especially during rush hours.

“I used to take two hours to get to my workplace by bus. Today, by taking a motorcycle cab, I’m there in less than 40 minutes,” says Séraphin Mbuyi, a loincloth seller at Kinshasa’s bustling Zando market. “I live on 18th Street, Limete. I used to leave very early to be among the first at work and avoid traffic jams. Now, I don’t have to. I’m certainly stressed, but I know I can find a motorcycle to get me there,” he adds.

An Unregulated Sector

Yet, the sector remains largely unregulated. In February 2024, the Congolese National Police (PNC) banned motorcyclists from Gombe, Kinshasa’s most upscale district. However, the ban is frequently ignored. At the Socimat crossroads, right in the heart of Gombe, motorcycle cabs openly ply their trade.

Most operators are young men from working-class neighborhoods who enter the business without formal training or licenses. They often ride without helmets, flout traffic laws, and lack insurance, increasing risks for passengers. The low cost of motorcycles and minimal barriers to entry have made this a livelihood for thousands of unemployed Congolese. Local authorities acknowledge the urgent need to regulate and structure the market, but face challenges in implementing a coherent strategy.

Amid growing demand for safer, more reliable motorcycle transport, digital mobility platform Yango—a subsidiary of Russian tech giant Yandex—launched a motorcycle ride-hailing service in Kinshasa in 2023, aiming to professionalize the sector and offer a more secure alternative.

Ronsard Luabeya (intern)

The National Assembly of the DR Congo is examining the rectifying finance bill for the fiscal year 2025. Adopted on May 23 by the Council of Ministers, the revised budget reduces expenditures to 50,691.8 billion Congolese francs (CF), approximately $17.2 billion, down 1.7% from the initial budget’s CF51,553.5 billion.

The budget was downscaled due to economic constraints linked to security issues in eastern DRC. It was partially offset by new financial support expected from the International Monetary Fund (IMF) and the World Bank (WB). On May 22, the WB’s Executive Board approved $600 million in budgetary support, with $165.4 million scheduled for disbursement this year. Concurrently, the country is nearing a positive conclusion of the first review of its new IMF program, which should unlock an additional $266.7 million.

The escalating conflict in the east, where several towns have fallen under the control of the M23 armed group, has directly impacted public revenue mobilization. At a press briefing in Kinshasa on April 9, 2025, Finance Minister Doudou Fwamba estimated that the loss of territorial control would deprive the state of roughly 4.5% of its budgetary resources—an estimated shortfall of nearly CF2,320 billion, or about $1 billion. This gap cannot be fully bridged by external budgetary aid, forcing the government to revise spending forecasts downward.

In response, and to manage rising security expenditures while maintaining the domestic budget balance target set by the IMF program, the executive has adopted adjustment measures. These include reducing institutional operating costs and refocusing public spending. Nevertheless, the government asserts it is paying “particular attention” to key priorities such as free primary education, universal health coverage with free maternity care, continuation of the local development program (PDL-145 territories), economic diversification, and preserving the population’s purchasing power.

The rectifying budget is based on slightly revised macroeconomic assumptions. Growth forecasts have been trimmed to 5.3% from the initial 5.4%, with the overall budget deficit expected to remain around 1.8% of GDP. Average inflation is projected at 8.8%, and the average exchange rate at 2,859 CF per US dollar. Fiscal pressure is forecast to decline to 12.5% from 15.1%, primarily due to a drop in current revenues affected by the economic slowdown in the east and disruption of trade corridors.

Boaz Kabeya (intern)

In a significant development for the artisanal gold sector in the Democratic Republic of Congo, DRC Gold Trading SA, a state-owned enterprise specializing in the purchase, marketing, and export of artisanal gold, announced on March 25, 2025, that it had successfully channeled over 280 kilograms of artisanal gold into Maniema province through its Kindu branch. This volume was achieved just two months after the branch's inauguration.

The company reported injecting more than US$27 million into the provincial economy, a feat largely attributed to its strategic partnership with Rawbank. This collaboration aligns with DRC Gold Trading SA's broader objective of integrating artisanal gold production into the formal economic circuit.

Cyprien Birhingingwa, Deputy Managing Director of DRC Gold Trading SA, added that the firm’s Kindu branch collected nearly 50kg of artisanal gold in its first week of operation–a notable achievement given that Maniema was excluded from the Cellule technique de coordination et de planification minière (CTCPM) annual gold production statistics for 2024. The province's governor, Moïse Mussa Kabuankubi, labeled the performance "a great feat."

According to recent estimates, the Kindu facility could partially offset production losses experienced in South Kivu. The facility only opened last March, the same month DRC Gold Trading SA stopped buying artisanal gold in South Kivu on March 11, 2025, following the advance of M23 rebels into the province.

Timothée Manoke (intern)

Rawbank, the leading bank in the Democratic Republic of the Congo (DRC), recorded a 42% growth in healthy loans, net of provisions, granted to small and medium-sized enterprises (SMEs) and households in 2024. The surge was reported in the bank’s regulatory financial communication.

Outstanding loans to the two segments rose from 1,094 billion Congolese francs (CF) in 2023 to CF1,550 billion in 2024—up by CF456 billion, or roughly $166 million at the year’s average exchange rate. The bank thus confirms its commitment to these two customer segments, often seen as more exposed to economic risks.

In detail, net performing loans granted to SMEs stood at CFA555.4 billion in 2024, up 67% year-on-year. The bank extended around CFA1,000 billion to households, up 30%. In its report, Rawbank did not explain these dynamics but underscored, more generally, the adoption of a strengthened risk management approach.

Provisions for risks associated with these two segments fell by 27% for SMEs and 40% for households. In addition, outstanding problem loans fell by 91%, suggesting improved collection performance. Although household overdue loans are up 40%, they only represent around 2% of healthy loans, limiting the overall impact.

Rawbank’s overall credit portfolio improved in 2024. Total healthy loans net of provisions—still largely dominated by loans to the extractive sector—reached CF5,606 billion, up 51%. At the same time, provisions for bad debts fell by 38%, and overdue loans by 35%.

Against this backdrop, interest income on loans continued to underpin net banking income, contributing CF554 billion, up 28%. To this must be added CF148 billion in credit commissions. Rawbank also derives significant revenues from its other banking services, which generated CF581 billion in 2024.

This performance underscores Rawbank’s dual strategy: expanding support for SMEs and households while maintaining rigorous risk controls and a diversified revenue base.

Georges Auréole Bamba

The Kakobola hydropower dam, a key project in the Democratic Republic of the Congo (DRC), has entered its final phase, during which transmission lines and supply networks are being set up. Teddy Lwamba, the Ministry of Electricity, presented this phase during the May 23 Council of Ministers. On the occasion, he also signaled the facility’s imminent commissioning.

According to official meeting minutes, "the Minister of Finance was instructed to take charge of the costs enabling the completion of the work," though specific financial details and completion deadlines remain undisclosed. The firm in charge of the works is also unknown at present. However, after a four-year hiatus, work resumed in August 2020, with reports indicating that the Indian firm WAPCOS Ltd was tasked with constructing the transmission lines.

According to Minister Lwamba, the first phase is already complete, with the construction of the 10.5-megawatt power plant. Situated in the Gungu territory of Kwilu province, the project commenced in 2010 under the stewardship of the Indian company Angelique International Ltd. The total project cost was estimated at US$55 million, jointly financed by India Exim Bank and the Congolese government.

The minutes from the Council of Ministers meeting held on June 10, 2022, state: "The Minister of Finance has been instructed to release the necessary funds corresponding to the Democratic Republic of Congo's counterpart to this project, and to examine with all of his departments the possibilities of granting all the facilities required to the Indian contractor, so that the supply of electricity to the towns of Kikwit, Gungu and Idiofa by the Kakobola power station will be effective before the end of April 2023."

Upon completion of the transmission and distribution lines, the power station is expected to supply electricity to the towns of Kikwit, Idiofa, and Gungu, as well as to the Catholic missions of Totshi and Aten, and the village of Butshamba, all located within Kwilu province.

Minister Lwamba also announced a forthcoming reform aimed at bolstering the commercial and technical operations of the Grande Centrale de Kakobola. An external entity will be engaged to assist in marketing the electricity produced. The minutes further reveal that an interministerial decree will be enacted to establish a provisional tariff to facilitate this commercialization.

This article was initially published in French by Ronsard Luabeya (intern)

Edited in English by Ola Schad Akinocho

The Congolese Ministry of Tourism and EquityBCDC have signed a Memorandum of Understanding (MoU) to boost tourism in the Democratic Republic of Congo (DRC). The MoU should help structure operators, make them bankable, improve project financing, and digitize tourism services. It also includes training and financial education initiatives, with a particular focus on young people and women.

Commenting on the milestone, Tourism Minister Didier M'Pambia stated: “This collaboration will enable the private sector to boost a sector that has enormous potential, but suffers from underfunding. As public funding alone cannot contribute to the growth of this sector, we have called on a financial institution that already has expertise.”

The partnership comes at a time when the Congolese tourism sector exhibits both development potential and signs of fragility. The low level of financing and limited performance of credits granted to operators highlight structural challenges within the industry.

According to EquityBCDC’s 2023 annual report, the "tourism, hotels and restaurants" sector accounts for just 0.2% of the bank’s overall outstanding loans. This low share reflects limited bank investment in the tourism sector, which records a non-performing loan rate of 34.4%. This is one of the highest in EquityBCDC’s portfolio and up from 31.4% at the end of 2022. This indicates that more than a third of loans granted to tourism players are experiencing repayment difficulties.

Last January, under its financial inclusion strategy, EquityBCDC also launched the “Contribution to Economic Growth (CCE) – for them” project. This initiative provides technical and financial support to businesswomen in Bukavu and Kinshasa.

Boaz Kabeya (intern)

The Radisson Hotel Group will inaugurate two new hotels in the Democratic Republic of Congo (DRC) in 2026 and 2027. The news was disclosed in a press release dated May 15, 2025

The first hotel, a five-star-equivalent Radisson Blu, located in Kinshasa, will be inaugurated by late 2026. The second, a four-star Radisson Hotel, located in Lubumbashi, will be inaugurated by mid-2027.

The Kinshasa building will be located on Boulevard Colonel Tshatshi in the Gombe district—Kinshasa’s main residential and business hub. It will offer 110 rooms, including suites and a presidential suite. Amenities will include a lobby bar, an all-day restaurant, a pool bar, a wellness center with a gym and massage rooms, an outdoor pool with a terrace, and modern meeting and event spaces.

In Lubumbashi, the DRC’s second-largest city and mining industry center, Radisson plans to open a four-star hotel near Lake Kipopo. This hotel will feature 97 rooms, including junior suites and a presidential suite, along with a lobby bar, an all-day restaurant, a rooftop bar & grill, meeting rooms, a modern gym, and a swimming pool.

Radisson’s entry into the Congolese market is part of its broader expansion strategy in West and Central Africa, aiming to increase its hotel portfolio in these regions by 50% by 2030. Ramsay Rankoussi, Vice President of Development for Africa and Turkey, stated that this expansion is designed to consolidate the Group’s presence on the African continent. Besides the DRC, markets such as Tanzania and Guinea-Conakry are also targeted.

Owned since 2018 by the Chinese conglomerate Jin Jiang International Holdings, a state-owned company based in Shanghai, Radisson is capitalizing on local economic opportunities amid significant Chinese investment in the mining and infrastructure sectors.

Radisson operates as a hotel manager, responsible solely for managing properties once they open. Its deployment is conducted in partnership with project promoters, though the Group has not disclosed its partners in the DRC. According to Access HDC, a hotel investment consultancy, the Radisson Blu Hotel Kinshasa is being developed in collaboration with X-Ray Group, an Istanbul-based design firm specializing in architecture, interior design, and hotel project management, which is the main investor.

Ronsard Luabeya (intern)

Assets of FirstBank DRC, a subsidiary of First Bank of Nigeria (FBN Holdings), grew 71% in 2024, reaching 4,476 billion Congolese francs (approximately $1.57 billion). According to the lender’s Pillar III 2024 report, the surge was primarily driven by a major increase in customer deposits and an expanded loan portfolio.

Customer deposits rose sharply by 49.5% to CDF3,317 billion (around $1.16 billion) in 2024, up from CDF2,219 billion the previous year. This significantly boosted the bank’s lending capacity to the Congolese economy.

The loan portfolio stood at CDF1,298.5 billion (about $455.6 million) in 2024, up by 80% year-on-year. Mining captured almost half of the outstanding loans.

Compared to 2023, FirstBank DRC’s revenues jumped 43% in 2024, with net banking income rising to CDF331.3 billion. However, profit growth was modest, increasing only 3% from CDF73.4 billion in 2023 to CDF75.8 billion in 2024. This limited profit growth is mainly attributed to a 36.6% rise in operating expenses and a 46.6% increase in personnel expenses due to salary adjustments.

Looking ahead, the bank plans to strengthen its presence in the Greater Katanga mining region, increase the share of revenues generated from digital products by 30%, and aims to reach 100,000 banking agents by 2029.

Timothée Manoke (intern)

More...

Ivanhoe Mines withdrew its copper production forecasts for the Kamoa-Kakula complex in the Democratic Republic of Congo (DRC). Previously, the firm expected the Congolese complex to deliver between 520,000 and 580,000 tonnes of copper this year, in 2025. Ivanhoe announced the withdrawal on May 26, attributing its decision “to persistent seismic activity in the Kakula mine.”

Initially, Ivanhoe Mines did not revise its production forecasts after the first reports of seismic activity. However, its partner, China's Zijin Mining, stated on May 23 that it expected a “negative impact” on the complex’s production targets for the year. In a corrective statement following Zijin’s announcement, Ivanhoe initially sought to downplay the incident. Now, the company has confirmed that a “revision” of the forecast will soon be made public.

“Seismic activity at the Kakula underground mine has continued intermittently over the past few days [...] Early indications are that seismic activity underground at Kakula could continue for weeks, impeding access to the mine and prolonging the temporary suspension of operations at Kakula,” Ivanhoe explained.

The market reacted sharply to this new information, with Ivanhoe’s share price dropping by 16%. The stock was trading at C$10.76 at 12:37 p.m. local time on the Toronto Stock Exchange.

Kamoa-Kakula is the largest copper mine in the DRC, with the Congolese government holding a 20% stake, and Zijin Mining and Ivanhoe Mines each owning 39.6%.

Emiliano Tossou (Ecofin Agency)

On May 23, 2025, the Democratic Republic of Congo (DRC) signed a memorandum of understanding with Huawei to pilot a smart village model. The project aims to provide high-speed Internet access, digital skills training for young people, and to connect local public services such as the civil registry, health, and education. This initiative is part of the national digital transformation strategy to modernize the State and reduce digital inequalities, particularly in rural areas where Internet access remains limited.

The project aligns with broader continental efforts, supported by the African Development Bank (AfDB) and the World Bank, to leverage digitization for sustainable development and inclusion. Mickael Lukoki Nsimba, the prime minister's chief of staff, highlighted the government’s commitment to ensuring “equaldigitalopportunitiesforruralpopulationsandbuilding a modern, transparent, and connected state.”

As of the end of 2024, only 34.6% of Congolese had access to mobile Internet, and fixed Internet access was extremely limited at 0.02%, underscoring the importance and urgency of such initiatives.

Samira Njoya, We Are Tech

The financial performance and activities of the Fonds pour l'Inclusion Financière (FPM SA) in the Democratic Republic of Congo (DRC) have grown significantly in 2024. FPM SA is majority-owned by the German cooperation fund (KfW) and Belgian BIO Invest.

According to FPM’s Pillar III report, covering the fiscal year 2024, the expansion was driven by initiatives implemented in partnership with the World Bank (WB) and German cooperation.

Established in 2014, FPM is a financial company specializing in refinancing financial institutions and providing portfolio guarantees to facilitate credit access for micro, small, and medium-sized enterprises (MSMEs), as well as low-income populations.

In 2024, FPM raised around $63 million for partial financing guarantees to partner financial institutions, capable of securing up to $200 million in credit for eligible individuals and entities. In detail, $36 million covers 50% of the risks associated with financing granted under the World Bank’s Transforme project, and $26.87 million covers up to 70% of financing extended to women and micro businesses under the Impact project, financed by KfW.

On the lending side, total outstanding loans to FPM customers rose by 53.4% to $50.4 million. Although this growth is substantial, it is more moderate than the 95% increase observed between 2022 and 2023. FPM has adopted a more cautious risk management approach and aims to reach outstanding loans of $81.7 million by 2028.

The institution’s current priority is to enhance services for development finance institutions, particularly those targeting the private sector within the framework of cooperation with the Congolese government. In December 2024, FPM secured a financing line from the Netherlands Development Finance Company (FMO) and is in advanced discussions with the U.S. International Development Finance Corporation (DFC).

FPM also plans to continue improving portfolio quality by collaborating with benchmark institutions. In April 2025, it signed a $3 million agreement with Rawbank to support SME financing.

After returning to profitability in 2024, with net income of $879,000 compared to a loss of $290,000 in 2023, FPM anticipates net income of $3.38 million by 2028. This projection represents an average annual growth rate of 46%, factoring in capitalization effects. The institution is counting on new opportunities in managing guarantee funds and the stability of its equity capital, supported by a $16.5 million credit facility granted by its main shareholder. This credit is convertible into shares at maturity or renewable, enabling FPM to avoid increasing its interest expenses.

Boaz Kabeya (intern)

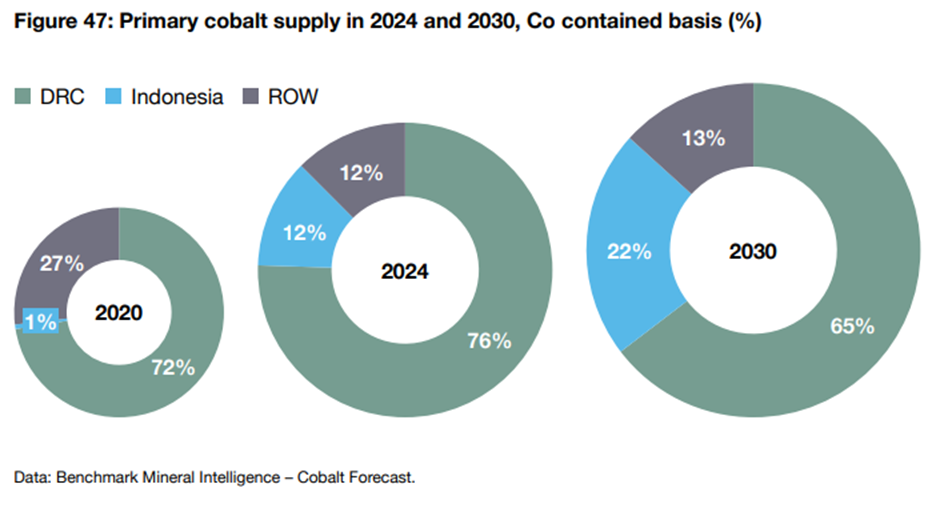

Indonesia could snatch the Democratic Republic of Congo’s (DRC) spot as the world’s leading cobalt producer in the 2040s. The International Energy Agency (IEA) made the forecast in its Global Critical Minerals Outlook 2025 report published on May 21.

According to the Cobalt Institute, the DRC accounted for 76% of global primary cobalt supply in 2024, but the IEA forecasts a 45% decline in Congolese cobalt production during the 2030s “due to declining ore quality”.

In contrast, Indonesia—the world’s leading nickel producer, with cobalt as a by-product—is projected to increase its cobalt output by nearly 80% by 2040, surpassing the DRC. This outlook aligns with the Cobalt Institute’s Cobalt Market Report 2024, which predicts the DRC’s share of global cobalt supply will fall from 76% in 2024 to 65% by 2030, while Indonesia’s share rises from 12% to 22%.

While the projected plunge could reduce the DRC’s influence over the cobalt supply chain, its impact on mining revenues is uncertain. In 2022, cobalt accounted for about 21% of the DRC’s exports, according to the Central Bank of Congo. However, ongoing economic diversification and waning global demand for cobalt could lessen the metal’s importance to the Congolese economy even before it loses its production leadership.

The electric vehicle market—the primary driver of cobalt demand—is showing signs of slowdown. Additionally, energy storage projects increasingly favor lithium-iron-phosphate (LFP) batteries over traditional cobalt- or nickel-based batteries. Martin Jackson, a raw materials consultant at CRU, notes a “monumental drop in the intensity of nickel and cobalt use in battery demand.”

Kinshasa’s response to these shifts remains to be seen. The government is currently focusing on strengthening the country’s position in downstream segments of the value chain, such as refining and battery materials production, as potential buffers against the anticipated shocks.

This article was initially published in French by Aurel Sèdjro Houenou (Ecofin Agency)

Edited in English by Ola Schad Akinocho