MINING (179)

For the first time in its mining history, copper exports from the Democratic Republic of Congo (DRC) reached an impressive 3.1 million tonnes in 2024, according to a report released by the Congolese Ministry of Mines on March 6.

This marks a 13% increase from the previous year, largely driven by strong performances from the country's largest copper mines. The Chinese group CMOC, which operates the Tenke Fungurume and Kisanfu mining sites, reported a total production of 650,161 tonnes. Ivanhoe Mines, which runs the Kamoa-Kakula copper mine, achieved an annual output of 437,061 tonnes—up 12% from 2023.

This year, copper exports from the DRC could grow even more, fueled by a 3.7% increase in global demand, anticipated by Commodity Insights. Also, according to the British price analysis firm CRU Group, the DRC should produce 8% copper this year, compared to 2024. These developments solidify the DRC's position as the world's second-largest copper producer, a title it snatched from Peru in 2023. Last year, Peru’s copper output stood at 2.73 million tonnes, slumping by 0.7% year-on-year.

However, challenges persist. Congolese authorities have raised concerns that production from the Kamoa-Kakula mine is being sold at below-market prices, which could deprive the state of vital mining revenues. Moreover, the DRC must remain cautious about an economic slowdown in China—its top copper buyer—as this could impact export levels. During the first two months of 2025, imports of Congolese copper into China fell by 7.2%.

This article was initially published in French by Emiliano Tossou (Ecofin Agency)

Edited in English by Ola Schad Akinocho

The majority shareholders of the Kamoa-Kakula copper complex have committed $200 million to modernize and stabilize the power grid in the southern part of the Democratic Republic of Congo (DRC). According to official documents reviewed by Bankable, the modernization project began in late 2024.

The project focuses on boosting the transmission capacity between the Inga II hydroelectric power station and Kolwezi, Lualaba province’s mining hub. Key upgrades include installing a harmonic filter at the Inga converter station and a static compensator at Kolwezi’s substation.

Additional measures involve replacing aging power cables, repairing direct current (DC) infrastructure, and establishing maintenance contracts with SNEL (Société Nationale d’Électricité), the DRC’s state-owned electricity operator. These efforts are being spearheaded by Ivanhoe Mines Energy DRC, under the financing of Kamoa Holding a joint venture between Ivanhoe Mines and Zijin Mining.

Stable power is a critical performance factor for mining operations, particularly for Kamoa-Kakula, which is ramping up its Phase 3 operations. The project plans to commission a third smelter powered primarily by renewable energy, reducing production costs while increasing refined copper output.

178 MW more incoming

However, these benefits depend on the commissioning of Inga II’s fifth turbine, which was installed in 2024 and is expected to add 178 MW of hydropower capacity. Starting in mid-2025, Kamoa-Kakula will receive an initial 70 MW of this capacity, gradually increasing to 178 MW by 2026. Until then, the mine will continue relying on imported electricity and diesel generators.

Kamoa-Kakula is not alone in addressing DRC’s energy challenges. Chinese mining giant CMOC, which operates the Tenke Fungurume and Kinsfu Mining projects, announced plans in 2024 to generate at least 600 MW of solar power to support its operations.

This article was initially published in French by Georges Auréoles Bamba

Edited by Ola Schad Akinocho

The price of cobalt oxide on the Shanghai Metals Exchange rose to €16,640 per tonne (excluding tax) on February 28, 2025, up 1.46% over five days. The dynamic, reviewed by Bankable, was also observed on the London Metal Exchange, where April 2026 cobalt oxide contracts climbed 5%, trading at $22,246.19 per tonne, up from the current $21,153.

This surge follows the Democratic Republic of Congo's (DRC) announcement on February 22 of a four-month suspension of cobalt exports, a move aimed at addressing oversupply and stabilizing prices.

The DRC, which supplies 75% of the world’s cobalt oxide, has triggered market uncertainty with this decision, as buyers anticipate tighter supply amid growing demand. Analysts at the Shanghai Metals Exchange attribute the price acceleration to reactions from cobalt processing industries, which temporarily halted refined cobalt bids to assess raw ore availability. S&P Global had already forecasted a reduction in surplus cobalt stocks for 2025, but the Congolese export suspension has amplified this upward price correction.

No Supply Deficit before 2030?

The recent suspension is part of broader efforts by the Congolese Regulator of Strategic Minerals Markets, ARECOMS, to influence global supply-demand dynamics. The watchdog plans to assess the measure’s impact in three months to determine whether to maintain, adjust, or lift it. Meanwhile, observers anticipate the reaction of major producers like China’s CMOC, whose investments in the Kisanfu mine have contributed significantly to the global oversupply of copper.

The DRC earns a lot from selling its minerals and taxes and royalties from its mining assets. Therefore, higher cobalt prices are critical for meeting the country’s budgetary revenue targets and financing development ambitions.

However, at the end of 2024, some observers had projected that it would take some time for prices to rise sustainably. They said there should be no supply deficit before 2030. Last December, Joel Crane of S&P Global, predicted that while electric vehicle demand will drive an 11% annual increase in cobalt consumption through 2030, supply growth will lag at just 4% annually due to limited new exploration projects in the DRC. “Although the DRC has added 60,000 tonnes of cobalt since 2022, its contribution is expected to gradually decline,” Crane noted. Nick Burroughs, Sales Director at Benchmark Mineral Intelligence, shares this view.

EGC Steps Up

While the impact of the recent forecasts on prices in the market for direct cobalt purchases, especially artisanal mining, this sector could face supply chain-related challenges. Artisanal mining contributes 15-30% of the DRC’s cobalt production.

According to several media outlets, the ARECOMS has recently clarified that even after the export suspension is lifted, artisanal cobalt can only be sold to Entreprise Générale de Cobalt (EGC), a state-owned subsidiary of Gécamines. With this in mind, EGC’s managing director Éric Kalala, quoted by Bloomberg, said the firm plans to purchase artisanal cobalt during the suspension to support miners and strengthen EGC’s role as an exclusive buyer. At the same time, the state-owned entity is committed to fostering a fairer supply chain while boosting its revenues. However, questions remain about whether EGC has the resources and capacity to manage these operations effectively in a market that demands immediacy. Indeed, artisanal miners often want to quickly sell and regularly request advances to finance their activities.

This article was initially published in French by Georges Auréole Bamba

Edited in English by Ola Schad Akinocho

On February 24, 2025, Ivanhoe Mines announced a $50 million investment in exploration activities at its Western Forelands copper project in the Democratic Republic of Congo (DRC). This is about two-thirds of the company's total exploration budget of $75 million for 2025.

This year, Ivanhoe plans to implement an ambitious program that includes 102,000 meters of diamond drilling and 18,000 meters of reverse circulation drilling at Western Forelands. The project will build on last year’s progress, including the expansion of the mineralized zone of the Makoko deposit and the discovery of the Makoko West zone.

The company is also set to update its mineral resource estimate for Makoko in the second quarter of 2025. This update should include initial resource estimates for Makoko West and Kitoko, a high-grade copper zone discovered in 2023.

The first estimate for the deposits that currently comprise Western Forelands Kiala and Makoko revealed that the project contains 21 million tonnes of indicated mineral resources with a copper grade exceeding 3%. Encouraging drilling results position Ivanhoe Mines to potentially develop its second copper mine in the DRC. A few kilometers away, Ivanhoe operates Kamoa-Kakula, the country’s largest copper mine.

While 2025 could be a pivotal year for Western Forelands, significant challenges remain before construction begins. Among others, Ivanhoe must confirm the project's mineral resources and conduct comprehensive studies to assess its economic viability. Only after these steps will the company consider raising funds for eventual mine development.

The positive outlook for copper demand and prices may help attract investors as Ivanhoe advances its exploration efforts in this promising region.

This article was initially published in French by Emiliano Tossou

Edited in English by Ola Schad Akinocho

Mining companies invested $130.7 million in exploration activities in the Democratic Republic of Congo (DRC) in 2024. S&P Global Market Intelligence disclosed the figure in a report issued on February 21, 2025. Over the year reviewed, $1.3 billion was invested in Africa, and the DRC was the leader in mining exploration investment.

The investments in the DRC were predominantly focused on copper, with $71.5 million allocated to this sector. This strong performance propelled the DRC to ninth place globally, just ahead of Zambia, Africa's second-largest copper producer, which attracted $65.5 million in 2024.

In the cobalt sector, exploration spending in the DRC reached $8.3 million, securing the country's position as the second-largest recipient of cobalt exploration funding worldwide, behind Australia, which received $15.2 million.

The report does not provide the amount invested in gold, coltan, tin, and zinc, despite the country having significant reserves. The DR Congo hosts one of the largest gold mines in Africa, the Kibali mine.

The DRC's dominance in copper and cobalt exploration is likely driven by its vast mineral reserves. The country holds approximately 50% of the world's cobalt reserves and accounts for over 70% of global cobalt production. It is also the world's second-largest copper producer, responsible for 65% of newly announced copper reserves globally in 2023. Both metals are crucial for the energy transition, with copper demand projected to reach 50 million tonnes by 2050, up from 32 million tonnes now.

Chinese companies currently dominate the mining sector in the DRC, in the copper and cobalt sub-sectors especially. They control about 80% of the country's mines. To change this dynamic, Kinshasa has been seeking new partnerships with countries like Saudi Arabia and the United States.

This article was initially published in French by Emiliano Tossou

Edited in English by Ola Schad Akinocho

On February 24, 2025, the European Union's Foreign Affairs Council announced a review of its Memorandum of Understanding (MoU) with Rwanda on strategic minerals, signed in February 2024. This decision, communicated by EU High Representative Kaja Kallas, is part of broader efforts to pressure Rwanda to respect the territorial integrity of the Democratic Republic of Congo (DRC).

"Consultations on defense issues with Rwanda have been suspended. There is also a political decision to apply sanctions, depending on developments on the ground. We have asked Rwanda to withdraw its troops from DRC territory. Finally, the memorandum of understanding with Rwanda on critical raw materials will be re-examined," said Kallas, Vice-President of the European Commission.

The move follows a surge in violence in eastern DRC, where M23 rebels and Rwandan troops have been advancing since January, occupying key cities like Goma and Bukavu. On February 24, Congolese Prime Minister Judith Suminwa Tuluka reported that the conflict has claimed over 7,000 lives since the start of the year.

Supply Chains Contaminated

The EU-Rwanda MoU aims to “foster sustainable and resilient value chains for critical raw materials”, and secure the EU’s supply of strategic minerals such as coltan, essential for sustainable development and the energy transition. It also highlights both parties’ commitment to promoting responsible mining practices and building local capacity in Rwanda.

However, UN experts have revealed that Rwanda is mixing minerals from M23-controlled areas with its resources, leading to “the largest contamination of mineral supply chains in the Great Lakes region.” The DR Congo government has criticized this partnership, arguing it facilitates Rwanda’s plundering of Congolese resources.

On February 12, 2025, the DRC declared all mining sites in the Masisi and Kalehe territories "red," prohibiting exploitation in coltan and tin ore areas. The measure concerns 38 mining concessions, notably in the Rubaya and Nyabibwe sectors, rich in coltan and cassiterite (tin ore).

According to data gathered by the Ecofin Agency, Rwanda's coltan exports surpassed those of the DRC in 2023, with Rwanda exporting 2,070 tonnes, a 50% increase, compared to the DRC's 1,918 tonnes.

This article was initially published in French by Ronsard Luabeya (intern)

Edited in English by Ola Schad Akinocho

The projected value of measured copper and copper reserves of the Mutanda mine in the Democratic Republic of Congo (DRC) is $72 billion. Glencore, the Anglo-Swiss multinational commodity trading and mining company, recently disclosed the estimate in its 2024 reserves and resources report.

Based on estimated potential, mineral deposits fall under three classifications: measured reserves, which offer high reliability; indicated reserves, which are reliable but require further confirmation; and inferred reserves, which are less certain.

According to Glencore's latest report, Mutanda boasts measured reserves of 197 million tonnes of ore with a copper grade of 1.94%, yielding a total of 3.8 million tonnes of copper. The cobalt grade in this category is 0.61%, translating to approximately 1.2 million tonnes. By applying the market value of mineral contracts deliverable in one year (February 2026) to these measured reserves, Glencore estimates $41 billion for copper and $31 billion for cobalt, totaling $72 billion.

These projections could change, based on factors like actual resource extraction, complex financial modeling, and the terms of sales contracts over time.

The Mutanda mine is 40 km from Kolwezi, the capital city of Lualaba Province in the southern part of the DRC. Glencore owns 95% of the asset, against 70% of the Kamoto project. The Anglo-Swiss firm has secured two permits valid until 2037 for Mutanda, with the mine's lifespan potentially extending to 20 years pending further investment.

In contrast, the latest report from Kamoto does not mention measured resources but reveals indicated resources that still require further study estimated at 10.4 million tonnes of copper and 1.5 million tonnes of cobalt suggesting a potential mining life of around 15 years.

The figures could spark local stakeholders’ interest, including the Congolese government, which collects taxes and royalties on industrial mines. After smelling opportunity, subcontractors and suppliers linked to Glencore's regional operations could also flock to the project.

This article was initially published in French by Georges Auréole Bamba

Edited in English by Ola Schad Akinocho

The Democratic Republic of Congo (DRC) exported 6,642 tons of zinc between January and September 2024. Over the same period the year before, the country had exported 10.336 tons or 35.74% more, according to the Ministry of Mines.

So far, Congolese authorities have not officially explained what drove the drop. However, the trend could reverse this year, spurred by the ramp-up of the Kipushi mine, operated by Ivanhoe Mines.

Commissioned in July 2024, Kipushi delivered 50,307 tonnes of zinc concentrate during the year, achieving a monthly record of 14,900 tonnes in December, though still shy of its maximum capacity.

The outlook for 2025 is more optimistic. This year, Ivanhoe Mines expects the asset to produce between 180,000 and 240,000 tonnes of zinc concentrate. The burst should significantly boost the DRC’s exports and bolster its mining revenues.

This article was initially published in French by Olivier de Souza

Edited in English by Ola Schad Akinocho

Mining sites in Masisi and Kalehe, respectively in North and South Kivu, have been classified as "red" zones, according to an order signed by Mines Minister Kizito Pakabomba on February 12, 2025. This designation affects 38 mining concessions, particularly in the Rubaya and Nyabibwe sectors, where coltan and tin ore (cassiterite) are extracted.

"The exploitation and illicit trade in minerals organized by the aggressors establish an illegal supply chain," Pakabomba stated. "Considering that these illegal supply chains constitute the main source of financing for this war of aggression, it is necessary for the government of the Democratic Republic of Congo to reconsider the status of certain miners."

Through the move, the Congolese government likely hopes to cut off funding sources for the M23 rebels and their Rwandan supporters. The new decree forbids mining in these "red" zones. This means minerals mined in these areas can no longer be sold legally.

The "red" designation will remain in effect for six months, during which the affected sites may undergo independent audits initiated by the Ministry of Mines or international organizations such as the UN or OECD.

M3 Rebels Gain Territory

Since M3 rebels and their Rwandan allies launched their assault in the eastern Democratic Republic of Congo (DRC) on January 23, the Congolese side has reported over 3,000 casualties (and as many injured). The rebels already took over Goma and Bukavu, the respective capitals of North and South Kivu.

Last December, the United Nations (UN) published a report revealing that M23 rebels have been controlling the DRC’s Rubaya mine since late April 2024. The mine is "the largest coltan mine in the Great Lakes region," accounting for approximately 15% of global coltan production.

According to the UN report, at least 150 tons of coltan were smuggled each month from Rubaya to Rwanda, where it is mixed with local production, “leading to the most significant contamination of mineral supply chains across the Great Lakes region”.

This article was initially published in French by Emiliano Tossou

Edited in English by Ola Schad Akinocho

The Kibali gold mine in the Democratic Republic of Congo (DRC) produced 686,000 ounces in 2024, down from 763,000 ounces in 2023, thus down 10% year-on-year. Barrick Gold, the Canadian from which co-owns the mine, disclosed the figure on February 12, 2025.

Kibali thus fell short of the forecast of its owners for 2024. Indeed, Barrick Gold and its main partner, AngloGold Ashanti, had projected the mine’s output at 711,000 to 800,000 ounces. Barrick’s expectations were based on a 4% increase in the first half of 2024.

However, in H2 2024, the mine’s output dropped by 21% year-on-year. While Barrick has not officially explained this underperformance, AngloGold Ashanti attributed the third-quarter drop to lower gold grades in the processed ore.

This year, Barrick expects its attributable gold production to stand between 310,000 and 340,000 ounces, against 320,000 to 360,000 ounces anticipated in 2024. Bankable estimates that Kibali will produce between 688,000 and 755,000 ounces in 2025, down from its output in 2023.

Barrick and AngloGold each hold a 45% stake in Kibali.

Emiliano Tossou

More...

On January 24, 2025, Ivanhoe Mines, a major mining operator in the Democratic Republic of Congo (DRC), successfully raised $750 million on international markets, exceeding its initial $600 million target. The funds come as Rwanda-backed M23 rebels escalate hostilities in eastern DRC.

The funds are repayable over five years at a 7.875% interest rate. Though steep compared to global benchmarks, this rate undercuts borrowing costs for many Africa-focused firms. Investors could have been deterred by the ongoing security crisis in the East, especially since the recent operation is partly guaranteed by Kipushi Holdings, one of Ivanhoe’s subsidiaries in DRC.

Several factors could explain the successful fundraising, including the strong demand for zinc and copper, which Ivanhoe extracts in DRC. Also, Copper futures on the London Metal Exchange (LME) have climbed steadily, reflecting tightening global supply chains. Another reason is that Ivanhoe and its subsidiaries have a good borrowing track record.

The funds raised will primarily fuel Ivanhoe’s ambitious expansion at its Kamoa-Kakula copper complex, where 2025 investments are projected between $1.42 billion and $1.67 billion. By contrast, the Kipushi zinc mine—now operational after a $185 million overhaul—is forecast to receive only $25 million for capacity upgrades.

This marks Ivanhoe’s latest in a series of strategic financings. In 2023, Rawbank extended an $80 million loan (since repaid), while FirstBank’s Congolese unit provided $50 million due in May 2025. Last summer, Trafigura Asie and CITIC Group (Ivanhoe’s largest shareholder, with a 22% stake) contributed $60 million via prepayment deals tied to future mineral output.

It remains to be seen what will happen to the value of the shares in the recent $750 million loan, listed on several European and American stock exchanges. In early January, Ivanhoe tempered shareholder enthusiasm by announcing lower-than-expected copper production forecasts, while raising its capital expenditure forecasts compared with estimates made three months earlier. Its communication to investors, scheduled for the close of trading on February 19, will hence be closely scrutinized.

This article was initially published in French by Georges Auréole Bamba

Edited in English by Ola Schad Akinocho

The M23 rebel group is consolidating its control over several mining towns in the eastern Democratic Republic of Congo (DRC). After taking over Rubaya in North Kivu, the rebels have also seized Lumbishi, a mining town in South Kivu, according to reports from residents and the territory's administrator. Rubaya hosts an artisanal coltan mine, which accounts for up to 15% of global production. Lumbishi is located in a resource-rich area abundant in coltan, gold, tourmaline, and cassiterite.

"This military advance is accompanied by efforts to establish a parallel civilian administration in M23-controlled areas, as well as an intensification of mining," notes the Washington-based Africa Center for Strategic Studies (ACSS). Several experts, including UN experts, warn that the M3 group is exacerbating the illicit mineral trade in the DRC, further hindering efforts to formalize artisanal mining practices in the country.

Another driver

To ensure responsible artisanal mining of gold in the country, the DRC government set up a company to buy, sell, and export this gold. Formerly Primera Gold, the firm was rebranded as DRC Gold Trading SA after coming under public control. In 2023, it operated solely in South Kivu, collecting up to 5.07 tonnes of gold and boosting the country's artisanal exports by an astonishing 12,000% year-on-year. However, the M23's increasing presence in this province is likely to disrupt the company’s activities.

The DRC’s vast wealth in critical minerals is one of the drivers of the conflict, and, according to a note from the Center for Strategic Studies of Africa published on January 29, it“will need to be addressed if a comprehensive peace is to be achieved”. “Rwanda, in particular, is alleged to be facilitating the illicit mining and trafficking of these minerals. The market value for these minerals is likely to exceed over $1 billion,” the note adds.

Depuis @MiningIndaba à Cape Town, nous dénonçons avec force le pillage de nos ressources minérales par le Rwanda, qui mène une agression inacceptable contre notre pays🇨🇩 @MinMinesRDC pic.twitter.com/hKTlElABiG

— Kizito Pakabomba (@kizpaka) February 2, 2025

Cited by Reuters, Jason Stearns, a political scientist at Simon Fraser University and former UN investigator, highlighted that Rwanda's mineral exports now exceed $1 billion annually—roughly double what they were two years ago—with a significant portion believed to originate from the DRC. The Congolese government firmly asserts Rwanda's involvement in the plundering of its resources. Kisiti Pakabomba, Minister of Mines, reiterated this point at the Mining Indaba forum currently taking place in South Africa.

In February 2024, Rwanda and the European Union signed a memorandum of understanding aimed at ensuring a "sustainable supply of raw materials" for the EU in exchange for funding to develop Rwanda's mining supply chains and infrastructure. This agreement has since been criticized by the DRC and some Members of the European Parliament (MEPs), who view it as complicit with ongoing resource exploitation in the region.

This article was initially published in French by Pierre Mukoko

Edited in English by Ola Schad Akinocho

The Democratic Republic of Congo (DRC) has exported 145,452 tonnes of cobalt in the first nine months of 2024, averaging 48,484 tonnes per quarter. The figures were disclosed by the Congolese Ministry of Mines. Annual exports could reach 193,936 tonnes, surpassing last 2023's record of 152,798 tonnes.

According to the data, CMOC, a Chinese firm, has dominated cobalt exports from the DRC over the period reviewed, thanks to its operations at the Kisanfu and Tenke Fungurume (TFM) mines. CMOC exported 50,021 tonnes from the two mines over the period. Glencore followed with around 32,000 tonnes exported from the MUMI and KCC mines. The Swiss firm became the world’s second-largest cobalt exporter in 2023; it was the first before that year.

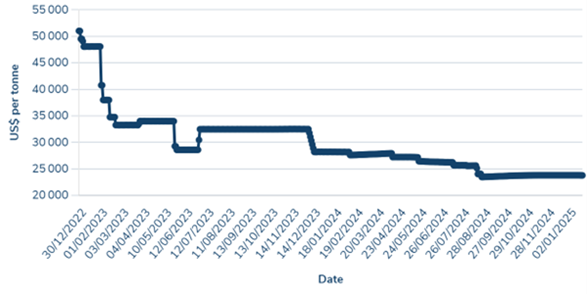

The Ministry of Mines has not disclosed the revenues generated from these record sales, making it difficult to determine whether the increase in export volumes has compensated for declining cobalt prices. The cobalt market has been in surplus for the past three years, leading to a significant price drop. On the London Metal Exchange, cobalt prices fell from around $50,000 per tonne in January 2023 to approximately $24,000 per tonne in January 2025.

Cobalt: Price evolution since 2023

This surplus can be partly attributed to increased Congolese cobalt exports linked to CMOC's expanded production capacity over the past two years. CMOC's cobalt production surged more than fivefold since 2022, reaching 114,165 tonnes in 2024. According to the Cobalt Institute, the DRC is expected to account for 48% of global cobalt supply growth by 2030, compared to 37% for Indonesia.

This article was initially published in French by Emiliano Tossou (Ecofin Agency)

Edited in English by Ola Schad Akinocho

On January 15, 2025, the International Monetary Fund (IMF) Executive Board approved a new program with the Democratic Republic of Congo (DRC), following a service-level agreement reached in November.

The 38-month program has two main components: the Extended Credit Facility (ECF) worth $1.729 billion and the Resilience and Sustainability Facility (RSF) with $1.038 billion. Although these amounts are slightly lower than initially announced, the program’s goals have not changed: enhancing the country's macroeconomic stability, improving governance, and increasing resilience to climate challenges.

The ECF is designed to stabilize the economy, improve governance, and promote inclusive growth. Meanwhile, the RSF will support the DRC’s climate adaptation efforts, helping the country reduce its greenhouse gas emissions by 21% by 2030.

In 2024, the DRC achieved solid economic performance, with GDP growth projected at 6%, a significant drop in inflation, and reduced budget deficits, despite exceptional expenditures related to security and the fight against the Mpox epidemic.

The Central African nation also faced major climate-related disasters, including devastating floods that affected over 300,000 households, destroyed buildings, and killed 300 people. The crisis has exacerbated health risks and affected agricultural production. It called for urgent humanitarian responses and more funds to boost climate resilience.

According to IMF Deputy Managing Director, Kenji Okamura, while the DRC has shown resilience in the face of crises, sustained efforts are crucial to consolidate economic and social gains, combat corruption, and address climate challenges.

The previous IMF program concluded in 2021 helped strengthen foreign exchange reserves and boost growth, but structural and climatic challenges persist.

Under the ECF, the IMF champions reforms to help the DRC increase tax revenue, improve public financial management, and depend less on mining revenues. As for the RSF, it focuses on achieving climate objectives, such as forest preservation and sustainable natural resource management.

Despite risks from ongoing conflicts and health crises, the IMF’s outlook for 2025 remains positive, with growth forecast at 5.1% and inflation projected at 7%.

This article was initially published in French by Charlène N’dimon

Edited in English by Ola Schad Akinocho