The Democratic Republic of Congo (DRC) has exported 145,452 tonnes of cobalt in the first nine months of 2024, averaging 48,484 tonnes per quarter. The figures were disclosed by the Congolese Ministry of Mines. Annual exports could reach 193,936 tonnes, surpassing last 2023's record of 152,798 tonnes.

According to the data, CMOC, a Chinese firm, has dominated cobalt exports from the DRC over the period reviewed, thanks to its operations at the Kisanfu and Tenke Fungurume (TFM) mines. CMOC exported 50,021 tonnes from the two mines over the period. Glencore followed with around 32,000 tonnes exported from the MUMI and KCC mines. The Swiss firm became the world’s second-largest cobalt exporter in 2023; it was the first before that year.

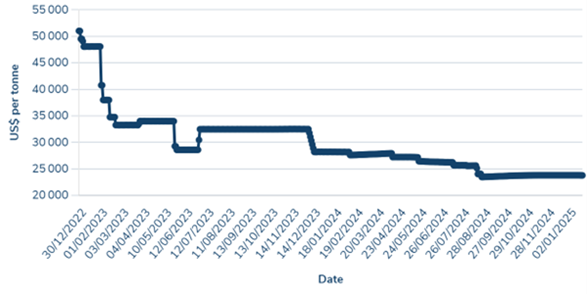

The Ministry of Mines has not disclosed the revenues generated from these record sales, making it difficult to determine whether the increase in export volumes has compensated for declining cobalt prices. The cobalt market has been in surplus for the past three years, leading to a significant price drop. On the London Metal Exchange, cobalt prices fell from around $50,000 per tonne in January 2023 to approximately $24,000 per tonne in January 2025.

Cobalt: Price evolution since 2023

This surplus can be partly attributed to increased Congolese cobalt exports linked to CMOC's expanded production capacity over the past two years. CMOC's cobalt production surged more than fivefold since 2022, reaching 114,165 tonnes in 2024. According to the Cobalt Institute, the DRC is expected to account for 48% of global cobalt supply growth by 2030, compared to 37% for Indonesia.

This article was initially published in French by Emiliano Tossou (Ecofin Agency)

Edited in English by Ola Schad Akinocho