The Kamoa-Kakula mine generated revenues of $973 million in the first quarter of 2025, up 57% year-on-year. Ivanhoe Mines, which runs the mine, released the data on April 30. Kamoa-Kakula is located in the Democratic Republic of Congo (DRC).

Over the period reviewed, the mine’s EBITDA (earnings before interest, taxes, depreciation and amortization) rose from $384 million to $585 million, doubling net income to $266 million. This profit is shared between the mine's various owners: Ivanhoe Mines and the Chinese group Zijin Mining, who respectively hold 39.6% of the shares, the Congolese state with 20%, and Crystal River with 0.8%.

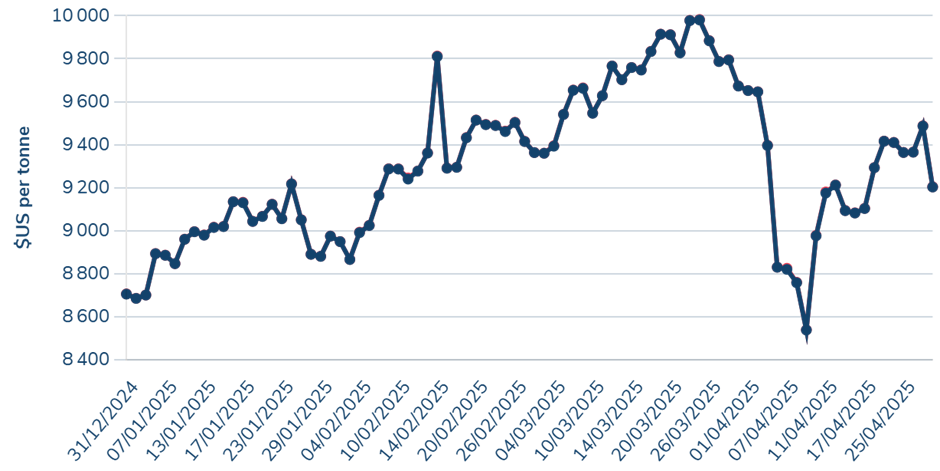

Copper price trends

Between Q1 2024 and Q1 2025, Kamoa-Kakula’s copper output jumped 54% to stand at 133,120 tonnes. Consequently, Ivanhoe sold more copper over the period - 109,963 tonnes in the first quarter of 2025, compared with 85,155 tonnes a year earlier. Also, the metal was sold at a higher average price: $4.19 per pound in Q1 2025, against $3.82 in Q1 2024.

This year, Ivanhoe aims to produce 520,000 to 580,000 tonnes of copper from the mine, and around 600,000 tonnes from 2026 onwards, compared with 437,061 tonnes produced in 2024. However, the level of revenue generated by Kamoa-Kakula will depend on copper price trends.

These prices were greatly impacted by the ongoing US-China trade warn. On the London Metal Exchange, the spot price of copper reached $9,200 per tonne at the end of April, after dropping to $8,500 at the beginning of the month.

This article was initially published in French by Emiliano Tossou

Edited in English by Ola Schad Akinocho