The Democratic Republic of the Congo has retired 2,000 eligible civil servants as part of a plan to streamline its public administration, the ministry in charge of the civil service said.

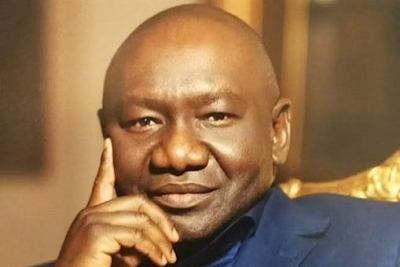

Public Service Minister Jean-Pierre Lihau announced the move in a statement dated Dec. 18, saying the retirements affected all government departments, job categories and provinces to ensure balance and fairness.

Those retired include 58 senior officials, comprising secretaries-general, inspectors-general and senior medical officers, as well as 232 directors, 285 division heads, 106 office heads, 716 first-class administrative staff and 603 lower-grade execution staff.

Lihau said the government was adopting a gradual approach in line with available financial resources. The aim, he said, was to restore civil servants’ right to a dignified retirement, turning it into a legitimate period of rest after long service rather than a source of hardship, as had often been the case in the past.

He said retirement notices and end-of-career allowance payments were already being processed and that the entire operation must be completed by Dec. 31, 2025. He added that withholding salaries or benefits before official notification by his ministry was strictly prohibited.

On the management of vacant posts, Lihau said they would not be opened to external recruitment. He also barred interim appointments by retired staff and prohibited the hiring of individuals without an official registration number or those who are not career civil servants, in accordance with existing law.

Beyond this initial phase, the minister said that from January 2026 the government plans to retire at least 30,000 civil servants each year. As of July 2025, around 314,000 state employees met the legal criteria for retirement, according to official figures.

In response, the government has adopted a ten-year retirement plan covering the period from 2025 to 2035. The plan includes a proposed partnership with commercial banks, presented as an innovative mechanism to speed up the process.

Under the proposal, banks would advance end-of-career allowances to retirees, while the state would repay the amounts gradually through monthly instalments equivalent to the former salaries.

The scheme remains subject to the signing of a memorandum of understanding between the state and participating banks, which must set out the operational details of the arrangement.

Timothée Manoke