Copper prices neared $13,000 a tonne on the London Metal Exchange on Monday, climbing as much as 6.6% to $12,960, Bloomberg reported. Prices later steadied around $12,920 in Asian trading.

The metal has gained more than 15% this month, driven by expectations that the United States could impose tariffs on refined copper. Ahead of any such measures, traders have stepped up shipments to the U.S. market, tightening inventories elsewhere. On Comex, U.S. copper futures have been trading at a premium to LME prices.

The rally follows comments earlier this month from analysts at Citigroup, who said copper prices could rise above $13,000 a tonne by the second quarter of 2026. “We remain convinced that copper has upside into 2026 amid several supportive tailwinds, including improving fundamentals and a more favourable macroeconomic environment,” the bank said, forecasting a 2.5% increase in global end-use consumption next year.

Similar views were expressed by Gregory Shearer, head of base and precious metals strategy at J.P. Morgan. “All in all, we think these unique dynamics of disjointed inventory and acute supply disruptions tightening the copper market add up to a bullish set up for copper, and are enough to push prices above $12,000/mt in the first half of 2026,” he said.

Concerns over global copper supply have intensified following several incidents this year. In May, Ivanhoe Mines, which operates one of the world’s largest copper projects in the Democratic Republic of Congo, reported a seismic event that prompted it to cut its production guidance for 2025 and 2026. While the company had initially targeted output of at least 500,000 tonnes in 2025, it now expects production to peak at around 420,000 tonnes, a level also projected for 2026.

Meanwhile, a landslide at Indonesia’s Grasberg mine, the world’s second-largest copper operation, forced Freeport-McMoRan to slash its planned 2026 output by 35%.

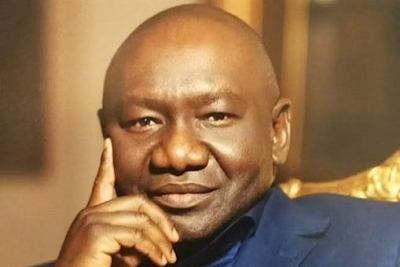

Louis-Nino Kansoun