- NIU Invest granted Critical Metals a £2.1 million ($2.84 million) convertible loan.

- The funding will support operations at the Molulu copper-cobalt project in the DRC.

- Critical Metals targets first mineral sales from Molulu by mid-2026.

NIU Invest SE, the majority shareholder of Critical Metals, has granted the company a loan of £2.1 million, equivalent to about $2.84 million, to finance its activities, notably at the Molulu copper and cobalt project in the Haut-Katanga province of the Democratic Republic of Congo.

The company announced the financing on December 31, 2025. The loan has an 18-month maturity and carries an annual interest rate of 10%, payable at the end of the term.

According to the disclosed terms, the loan takes the form of a convertible bond. This structure allows NIU Invest SE to convert the loan into equity in Critical Metals at any time and under certain conditions.

NIU Invest has used similar instruments to gradually increase its stake in the company. Its participation has now reached 69.62%, giving it effective control over Critical Metals.

The financing provides short-term relief for Critical Metals, whose Molulu project—70% owned by the company—has yet to generate commercial sales. The company remains loss-making.

For the financial year ended June 30, 2025, Critical Metals reported losses of about £2.4 million. This marked a reduction of roughly 13% compared with the previous financial year, when losses stood near £2.8 million.

According to the financial report, the improvement primarily reflects a reduction of about 25% in salary expenses. The company also implemented significant workforce cuts in the Democratic Republic of Congo, particularly among technical staff.

Cost-cutting measures extended to senior management. Since January 1, 2025, remuneration for the chief executive position has been reduced by as much as 30%.

First Sales Expected in 2026

Alongside its financial restructuring, Critical Metals has undergone several leadership changes. Russell Fryer stepped down as chief executive on September 4, 2025, and Ali Farid Khwaja replaced him. Khwaja subsequently resigned on December 16, 2025.

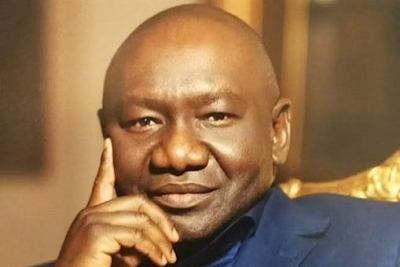

Since then, Danilo Lange has served as interim chief executive.

In its announcement, the company described Lange as an internationally experienced executive with more than 25 years of experience across the mining, consumer goods and marketing sectors. He previously held senior roles at companies including Yahoo and Red Bull and served as chief executive of Auriant Mining AB, a Swedish mining company listed on Nasdaq in the United States.

Critical Metals said his profile suits the company’s transition phase, as the board continues its search for a permanent chief executive.

The loan from NIU Invest again signals the majority shareholder’s confidence in the Molulu project, despite the company’s continued financial losses since launch.

The funding secures short-term operational financing while the company prepares for a ramp-up in activity.

According to Critical Metals’ most recent report, the first mineral sales from the Molulu mine are now expected by mid-2026.

This article was initially published in French by Timothée Manoke

Adapted in English by Ange Jason Quenum