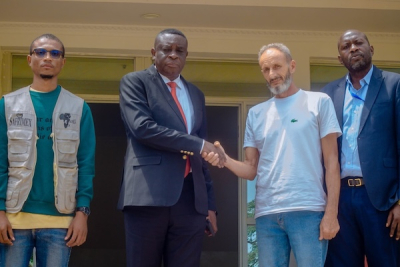

Bobo Makunda Sefekese is the new Deputy Managing Director of Sofibanque, a leading bank in the Democratic Republic of Congo (DRC). The lender announced Sefekese’s appointment on March 4. He holds the same position as Louis-Odilon Alaguillaume, appointed in April 2022.

However, Sefekese will oversee the implementation of the bank’s business continuity plan, approved by its Board of Directors in October 2023, which ensures operational resilience during crises. The plan includes an IT backup strategy to maintain technical and service availability, a critical focus given the DRC’s volatile security and economic landscape.

Sefekese’s appointment aligns with his expertise in risk management and digital transformation. Holding master’s degrees in computer science from the University of Namur and financial risk management from Université Saint-Louis de Bruxelles, he brings over 20 years of experience in banking and insurance, including roles as Director of Information Systems at Equity BCDC and Director of Organization and IT at Banque Commerciale du Congo. His background positions him to address challenges like cybersecurity and fintech integration, areas increasingly vital as digital banking expands in the DRC.

Sefekese will collaborate with Managing Director Henry Yoan Wazne, who has led Sofibanque since 2012. According to the bank’s 2023 report, Deputing MDs help the MD supervise operations, streamline processes, and execute strategic projects. Sofibanque should leverage the expertise of its new Deputy MD to better contribute to the digitization of banking services and fintechs’ emergence in the DRC.

In 2023, Sofibanque was the country’s top sixth bank, with $964 million in total assets. Expanding its management underscores the bank’s commitment to stability and innovation amid regional uncertainties.

This article was initially in French by Boaz Kabeya (intern)

Edited in English by Ola Schad Akinocho