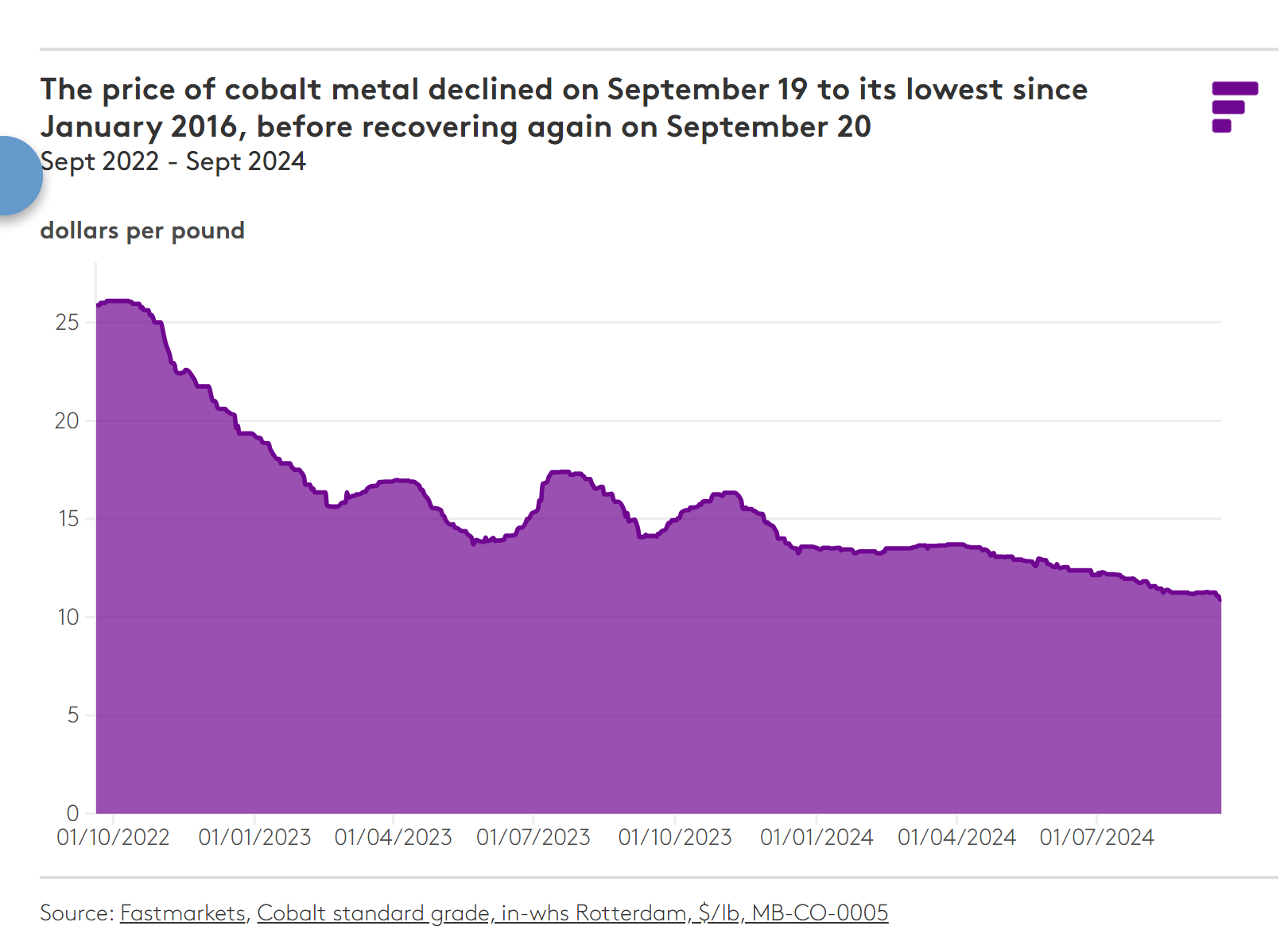

Cobalt prices hit their lowest level since January 2016 last week, according to Fastmarkets. On September 19, 2024, cobalt was trading between $22,046.2 and $26,014.5 per tonne, continuing a downward trend started over two years. This decline is primarily due to an oversupply from the Democratic Republic of Congo (DRC), the world's leading cobalt producer.

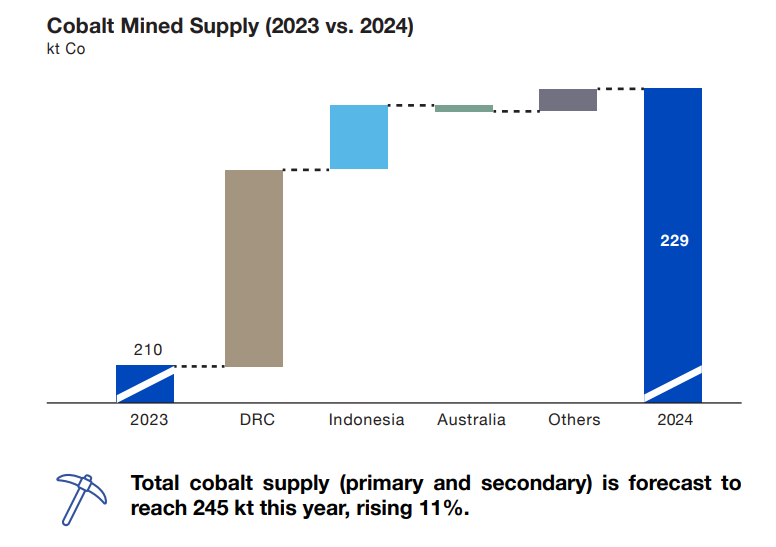

The Cobalt Institute reported that global cobalt supply reached 210,000 tonnes in 2023 and is expected to rise to 245,000 tonnes this year. Congolese production is projected at around 140,000 tonnes in 2023, a 21% increase from the previous year, largely driven by the Chinese company CMOC, which operates the Kisanfu and Tenke Fungurume mines and reported a 178% increase in cobalt production in the first half of 2024.

Global demand for cobalt was 197,000 tonnes last year and is expected to grow to 237,000 tonnes in 2024. No price increases are anticipated in the short term due to demand not exceeding supply. Earlier this year, the DRC considered implementing export quotas to help stabilize prices, as falling cobalt prices directly impact its economy.

In a July 2024 report, the IMF warned that declining cobalt prices "are likely to weigh further on the country's external position" in 2024. This could lower the DRC’s export revenues, reduce foreign currency reserves, and complicate import financing. Current prices, however, remain above the IMF's projected $21,305.4 per tonne for 2024.

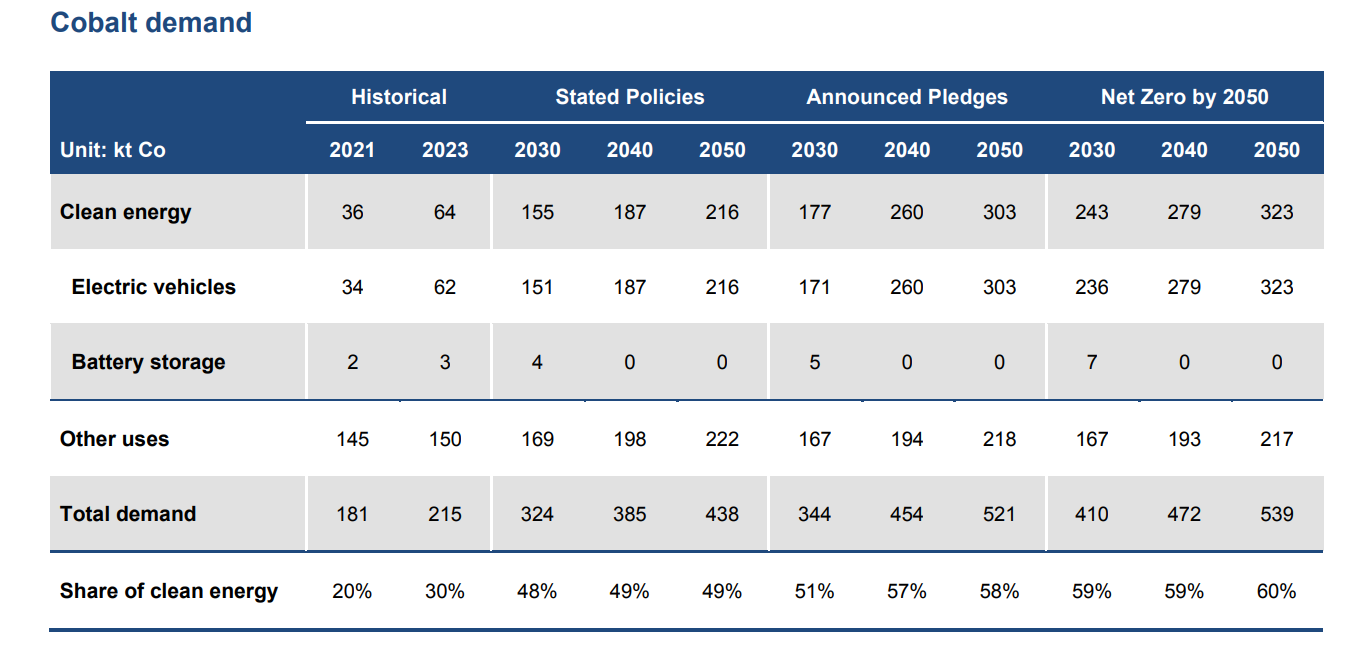

Despite the price drop, the long-term outlook for cobalt is positive due to the global energy transition and expected growth in electric vehicle production. The International Energy Agency predicts that global demand for cobalt will double by 2030, reaching 410,000 tonnes.

Emiliano Tossou, Ecofin Agency