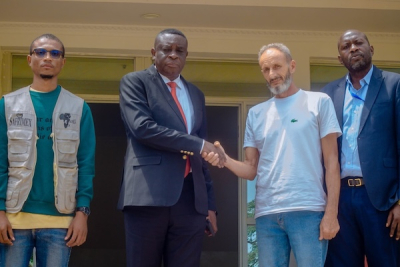

Malick Fall has represented the International Finance Corporation (IFC) in Burundi, the Democratic Republic of Congo (DRC), and the Republic of Congo since 2022. The Senegalese is also the Corporation’s resident representative in the DRC since 2021. On the sidelines of IFC Day Congo, on January 14, Bankable interviewed Fall who discussed the institution’s projects in Congo and the DRC, and their financing issues.

Bankable: Over the past year and a half, the International Finance Corporation (IFC) has strengthened its presence in Congo-Brazzaville by opening a dedicated office there. However, its current portfolio in the country only includes an investment of around $10 million. What are your goals relating to financing this country?

Malick Fall: As you said, last year, we invested $10 million, but we have also been preparing many projects in sectors that are key for the Congo.

At IFC Day, we highlighted our actions in the energy sector, intending to reduce the energy deficit and support the development of the electricity sector. A public-private partnership (PPP) project is also in the pipeline in the water sector, and it should improve supply and distribution nationwide.

With the World Bank, the IFC is also collaborating on a new program to attract more private investment in agriculture. It aims to boost local production and reduce reliance on imports.

We also work with banks and digital companies to develop new services that foster SMEs’ financial inclusion.

Bankable: With these projects, how much could the IFC inject into the Congolese private sector? And over what timeframe?

MF: It's difficult to give an amount at this stage, as many of these projects are being prepared. Infrastructure projects, as you know, require a fairly high level of preparation.

At the IFC, we have an approach called Upstream, which enables us to prepare projects for financing. The IFC works within this framework in Congo to identify opportunities, structure, and finance them, while mobilizing funds from other financial partners to meet the country's needs.

Thanks to all these initiatives, we hope to quickly and significantly increase our investment portfolio in Congo. But at the moment, it's too early to give a precise figure for the projects in the pipeline.

Bankable: As a regional representative, do you have any financing ambition for the Congo?

MF: The IFC's role is to finance, but we measure our goals based on their impact. Today, we're not interested in financing per se. Financing is a means to an end.What matters to us is how many people will have access to energy, how many will benefit from the products of our agricultural projects, or how many SMEs will have access to financing thanks to the initiatives and services we develop with our partners.

We are a development institution, and our priority is impact. Financing, on the other hand, is merely a lever for achieving these objectives.

Bankable: So do you have quantifiable objectives? How many people do you want to connect to electricity, for example? What are your goals in the area of agricultural production?

MF: We draw a country strategy to guide our actions in every country we support. This strategy is based on the government's priorities. In the Congo, for example, our strategy is based on the National Development Plan and the partnership framework established with the World Bank. This information has enabled us to define key areas where the IFC should be positioned.

In Congo, we have four strategic axes. The first is financial inclusion. SMEs are the main contributors to job creation. By meeting their financing needs, we also contribute to job creation.

The second priority is the development of basic infrastructures, notably energy, water, and telecoms. Energy, for example, is essential to the country’s industrialization. No energy, no industry. And no industry means job creation targets can be compromised.

While we don't yet have any players in these markets, our work also involves identifying potential partners in our customer network, and we encourage them to invest in the Congo.

Our third goal is to develop a real industry. By real industry, we mean everything related to industry and agriculture. The Congo has immense agricultural potential, with vast arable lands that must be exploited to meet the needs of the country and the sub-region. The Congo borders large countries such as the DRC and Cameroon, potentially important markets.

Next, we identify potential partners that can help us achieve these goals. However, if the conditions are not in place, we take the necessary steps to create them.

If reforms are needed, we develop them with the World Bank, other partners, and the government. While we don't yet have any players in these markets, our work also involves identifying potential partners in our customer network, and we encourage them to invest in the Congo.

Bankable: Earlier, you mentioned one of Congo-Brazzaville's big neighbors: the DRC. You are also IFC's country representative in that big country (over 2 million km², more than 100 million inhabitants), which faces major challenges in transport, housing, and energy... What are your priorities for the DRC?

MF: In the DRC, since 2021 we have accelerated our activities with investments in the financial sector, providing funds to banks so they can lend more to SMEs.

We have also invested heavily in telecoms infrastructure. There was a huge backlog of investment in this sector, which now accounts for a significant proportion of our commitments in the DRC in recent years.

We are working on all these fronts to create the right conditions for property developers to set up in the country so that they can carry out large-scale projects and help reduce the housing deficit, estimated at around 4 million units according to a study we carried out.

Of course, we are also present in the energy sector. The country has a very low rate of access to electricity, around 19% or 20%, and our ambition is to provide solutions, some of them innovative, to reduce this energy deficit.

In this respect, we are currently working on some projects in the energy sector, which, I hope, will help us rapidly boost this low electrification rate.

Bankable: In 2024, you estimated that an investment of $132 billion was needed over the next 16 years to reduce the housing deficit in the DRC. You mentioned having a project in this sector. How far along are you?

MF: Housing is a major issue in the DRC. To give you an idea, the population of a city like Kinshasa is set to double over the next 30 years. It currently houses 15 to 20 million people, depending on the source, and soon it will be one of Africa's largest megalopolises.

However, not enough housing is being built each year to meet this demand, particularly in the middle-class segment. In this context, we have identified an opportunity to massively increase investment in this sector and are working on the reforms needed to attract this investment.

Several challenges need to be overcome: land tenure issues, difficulties in establishing title deeds, as well as a still insufficient mortgage market. We are working on all these fronts to create the right conditions for real estate developers to set up in the country, launch large-scale projects, and help reduce the housing deficit, which is estimated at around 4 million units according to a study we carried out.

It's a long-term project, but the stakes are high since our goal is to provide decent but affordable housing to every Congolese citizen.

Bankable: For many, securing long-term loans is a hassle in the DRC. Do you have any specific actions to enable banks to grant long-term credit?

MF: The IFC can make long-term resources available to local banks, especially to develop the mortgage market. When a Congolese person wants to buy a house, if he or she is offered a 10-year loan, this allows him or her to qualify for certain housing.

However, providing long-term credit is not enough to solve the problem. We also need to create the conditions necessary to produce quality housing. These two actions must be implemented simultaneously.

Since 2021, we have invested just over $550 million, cumulatively, in the DRC, in the various sectors I mentioned earlier. However, the IFC does not just invest in the DRC.

We cannot solve the supply problem without considering demand, and conversely, if we solve the demand aspect without addressing supply, the market will remain unbalanced.

So we're working on both fronts. On the one hand, we can make long-term credit available, thus allowing many more Congolese to access housing. Besides this, however, we need to attract solid real estate developers with the experience and capacity to build housing en masse in the DRC.

Bankable: What is the current size of the IFC's portfolio in that country?

MF: Since 2021, we have invested just over $550 million, cumulatively, in the DRC, in the various sectors I mentioned earlier. However, the IFC does not just invest in the DRC. We also provide advisory support to help the country tackle several challenges.

For example, we are working closely with the Central Bank to improve the financial infrastructure. One of our current projects is to set up a credit bureau that provides banks with better information on borrowers, enabling them to lend more safely. Ultimately, this could increase the rate of credit to the private sector.

We have also worked with the Ministry of Finance to revise the leasing law, to make it more attractive and give banks a tool widely used in other countries, particularly by SMEs.

Interview by Aboudi Ottou