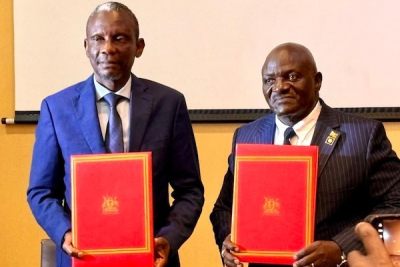

The Democratic Republic of Congo is one of the nine jurisdictions that recently signed the OECD’s Multilateral Convention to Facilitate the Implementation of the Pillar Two Subject to Tax Rule. The DRC became a signatory on September 19, 2024.

According to OECD Secretary-General Mathias Cormann, the agreement enables “developing countries to request the automatic inclusion of the Subject to Tax Rule in bilateral tax treaties with developed country Inclusive Framework members, ensuring that everyone benefits from the consensus-based solutions being developed to make the global tax system fairer and work better.”

Besides the DRC, only two other African countries adopted the inclusive framework: Benin and Cape Verde. Ten (10) more countries, including Senegal, expressed their intent to join the framework.

The Congolese government is yet to explain why it signed the convention. However, the goal could be to improve tax collection on profits made within Congolese borders, across key sectors, like mining. The OECD sees this measure as a way for developing countries like the DRC to increase tax revenue from international transactions.

Some experts and specialized organizations criticize the measure, claiming it is too complex to implement. The rule covers specific income flows between local entities and related foreign entities. It requires a solid understanding of international tax systems. Also, the minimum thresholds of 9% and 10% for bank interest are considered low compared to multinational profits, limiting potential gains for developing countries.

Specific skills needed

For the DRC to benefit from the new OECD tax rule, it must identify tax opportunities effectively. In mining, 63% of investments come from Mauritius, while many companies are based in countries like Canada or China. Beneficial owners often reside in tax havens. The Congolese tax administration will need skills to analyze foreign tax systems and identify payments that could generate additional taxes.

Customs and tax authorities must also identify entities linked to multinationals in the DRC and assess potential additional taxes under the new OECD commitment. This will require investment in tax infrastructure and training on international rules.

In the short term, the mining sector may face higher taxes, particularly on dividends. The current rate is 10%, set under the 2002 mining code and kept under the 2018 code. In Mauritius, effective rates on dividends can be as low as 3%, which could benefit the DRC. However, for interest payments, Mauritius has a rate of 15%, exceeding OECD thresholds of 9% and 10%.

Georges Auréole Bamba