The Financial Action Task Force (FATF) is the international body that evaluates measures against money laundering, terrorist financing, and arms proliferation. In October 2022, the Democratic Republic of Congo (DRC) joined the list, due to weaknesses in its anti-laundering system. Now, the African country wishes to be removed from the list.

The Democratic Republic of Congo wishes to be off the “grey list” of the Financial Action Task Force (FATF) by 2025. Congolese Finance Minister Doudou Fwamba voiced this ambition on Oct.26, 2024, in a meeting with U.S. Treasury Assistant Secretary Scott Rembrandt. The meeting occurred in Washington, D.C, on the sidelines of the International Monetary Fund (IMF) and World Bank Annual Meetings

After a three-day meeting in Paris on October 25, the FATF decided to keep the DRC on its grey list. The Task Force said the DRC must continue working on its action plan to address its weaknesses. This includes creating a risk-based control plan, improving the National Cell for Financial Intelligence (CENAREF) analysis capacity, and enhancing skills for investigating and prosecuting money laundering and terrorist financing. The African country was also asked to effectively implement financial sanctions related to terrorism and arms proliferation before the FATF’s next review session, in October 2025.

Over the past two years, the DRC has taken several steps to be removed from the FATF’s list. For example, it enacted a new AML/CFT law in December 2022. This law extends measures to all financial sectors, bans anonymous accounts, and strengthens the monitoring of politically exposed persons (PEPs). Additionally, a national AML/CFT strategy was approved at the end of 2023, and a National Risk Assessment (NRA) report was created and shared. Authorities for non-financial sectors have also been designated, and investigation capabilities have improved with new hires and training for investigators. Financial sanctions texts were signed on March 21, 2024.

However, experts say an effective AML/CFT system requires financial transactions to go through regulated channels so they can be tracked. In the DRC, many payments are still made in cash. To reduce cash use, authorities have set a limit for cash transactions at $10,000. The government acknowledges challenges with this measure, including a parallel foreign exchange market that supports informal economy networks and limited banking access in remote areas.

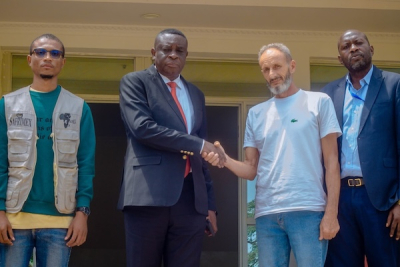

Pierre Mukoko